The stock market is fueled by how investors feel about it...

The stock market is fueled by how investors feel about it...

This is why we frequently talk about investor sentiment during our Monday macroeconomic insights – think correlations and active investor allocations.

These metrics are so important because human sentiment tends to flip quickly. That's why the field of behavioral economics exists... Financial markets are just an aggregation of humans (and machines designed by humans), so human nature naturally affects financial markets.

Human nature tells us collective investor sentiment can change in only a matter of weeks. Investors can go from bullish levels, to bearish levels, and back to bullish again before analysts can react.

So when everyone gets bullish, it may be a sign to sell. When investors start to panic, like they did in back in March, it may be time to buy.

This is what we call a "contrarian indicator."

However, the past few months have made it difficult to be a contrarian...

Throughout most of the coronavirus pandemic, nearly all investor sentiment indicators have been positive. Right now, investor expectations are incredibly bullish. Folks expect the market to go higher, gross domestic product ("GDP") to rise, and unemployment to decrease.

The market is also bullish on global earnings and believes high-yield debt will outperform investment-grade debt.

Normally, all these positive signals might indicate the market is overheating and needs a sell-off. This could be especially true as the calendar has just turned. Considering how strong the rally was in November and December, it's reasonable to be concerned that the market pulled potential profits for this year into 2020.

However, there's a reason that we don't just look at investor sentiment signals... It's not a complete picture. As we often mention, we need to look at the data as a mosaic to understand the market's valuation.

If investors are looking for a reason that sentiment could remain bullish, they need not look further than management's outlook for earnings growth...

If investors are looking for a reason that sentiment could remain bullish, they need not look further than management's outlook for earnings growth...

Earnings are the fundamental driver of valuations, and they're primed to accelerate. When earnings grow, upside will follow.

To get insight into the probability of earnings expansion, we can look at management sentiment. While investor sentiment is important, management sentiment may be even more insightful. These are the people driving corporations, and they understand their companies better than anyone.

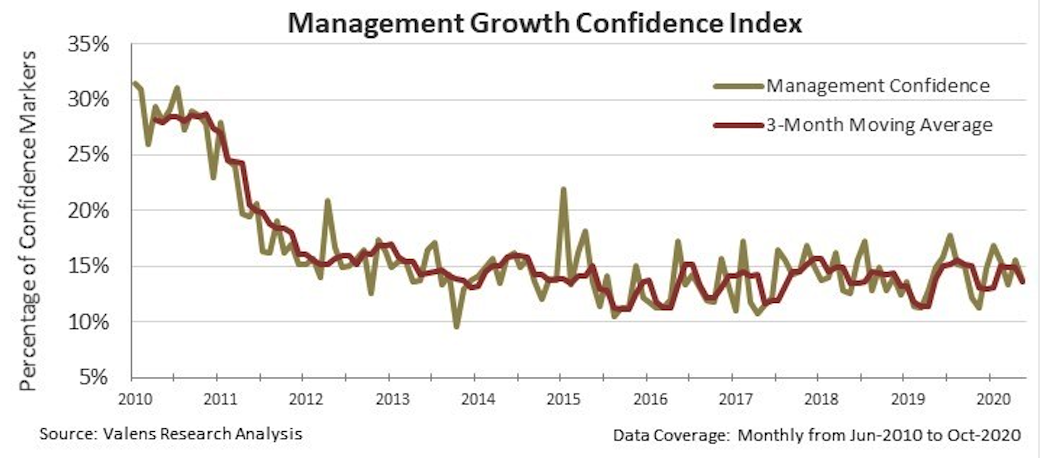

To understand manager sentiment, we can use our aggregate management growth confidence index. This is based on our Earnings Call Forensics ("ECF") technology.

Our ECF data show us when management teams are highly questionable, questionable, highly confident, or excited.

Highly questionable markers signal management teams may be holding back significantly on communicating what they're really thinking about a subject. Questionable markers indicate a lower degree of management teams withholding their true feelings.

On the other hand, highly confident markers signal that executives have conviction in what they're talking about. Excited markers, which are exceedingly rare, highlight giddiness from management on a subject.

Aggregating our ECF data for the companies we run across in the market allows us to identify trends in management conviction and excitement. In turn, this tells us when management is confident about growth opportunities.

After a dip in April and May, the aggregate growth confidence index has recovered and held steady at better-than-average levels. Even with concerns about the pandemic, election, and stimulus, the index stayed near or above averages.

Management teams see the current environment as a growth opportunity. They're ready to invest in capital expenditures ("capex") as well as research and development (R&D) to grow their businesses in this economy.

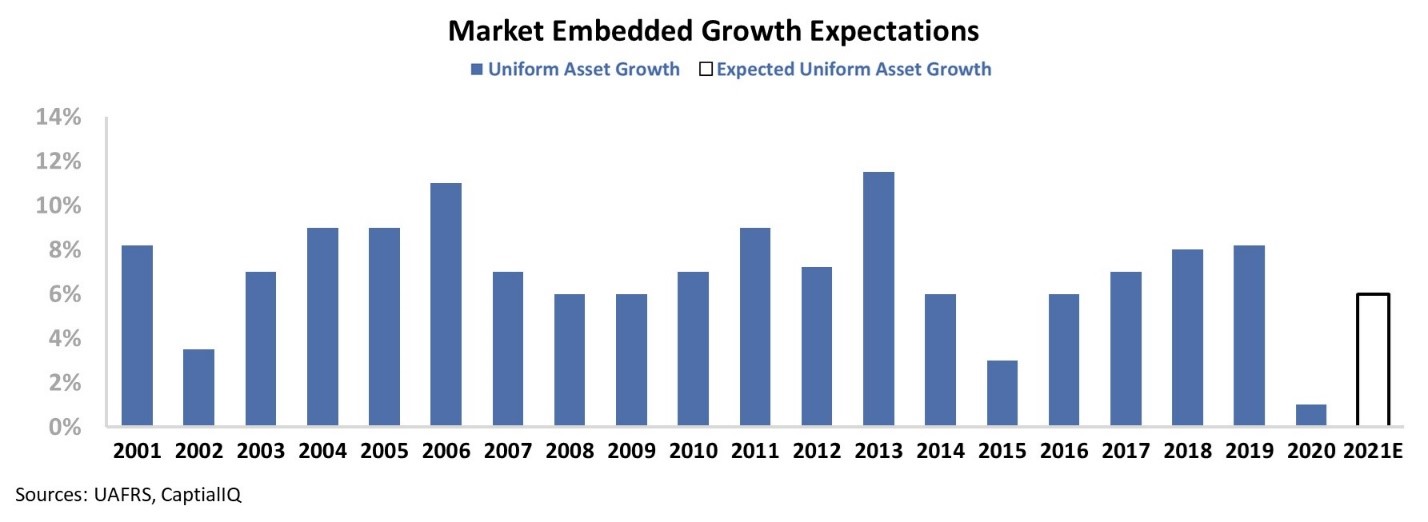

Meanwhile, the market doesn't have the same aggressive expectations for growth. Due to the pandemic, companies didn't have many opportunities to grow their business last year – leading to Uniform Asset growth of only 1% for the broad market.

With management showing significant confidence and vaccine distribution potentially starting to alleviate the pandemic overhang later this year, capex spending looks bullish for 2021 and beyond. Despite this, the market is only pricing in 6% Uniform asset growth this year... which is below averages seen over the past two decades.

This conservative forecast could be a sign for continued investor bullishness. If companies grow at a rate closer to 8% – as they did in 2018 and 2019 – markets may be in for a positive surprise.

It's understandable for investors to be cautious about 2021. The market was able to eke out a 16% gain in 2020 even with grave economic uncertainty, and that looks hard to reproduce on first blush. However, looking at bullish management and low expectations, there may be room to grow.

Regards,

Joel Litman

January 11, 2021

P.S. We're always open to new ideas... What market indicators are you following? Let us know at [email protected] and we might take a look in an upcoming Monday edition of Altimetry Daily Authority.

The stock market is fueled by how investors feel about it...

The stock market is fueled by how investors feel about it...