Low interest rates are great for borrowers, but they can send lenders into uncharted territory...

Low interest rates are great for borrowers, but they can send lenders into uncharted territory...

In late September, we highlighted the low yields in the credit markets and how this meant companies and individuals could easily refinance their debt.

You don't see severe bear markets or recessions when yields are this low. When it's easy to refinance debts, debtors don't default... and without credit destruction, you don't see recessions.

That's great for debtors and the economy, but it's less great for credit investors. The other side of the coin of the low cost of borrowing is that investors end up heading to truly obscure parts of the credit markets to find yield...

Earlier this week, Bloomberg highlighted how high-net-worth ("HNW") individuals are jumping into the esoteric lending market in a desperate attempt to chase high yields.

For now, this type of lending to marginal borrowers who wouldn't otherwise be able to access capital is likely to continue fueling economic growth. However, when the music stops and the "Minsky Moment" from all this speculative activity arrives, these are the type of loans that will come under pressure.

We'll continue monitoring the credit markets and fundamentals, just as we have for the past 10-plus years... and we'll let you know when that moment comes.

It's one of the popular trends this year...

It's one of the popular trends this year...

Meat alternatives have been a big topic in 2019... And Beyond Meat (BYND) is the poster child.

In October, I was teaching a graduate class on valuation at Northeastern University when Beyond Meat came up. During a discussion, one of my students asked me to apply the valuation concepts we were looking at to Beyond Meat.

To facilitate discussion, I looked at the company on the Valens database that powers our research here at Altimetry. However, before starting my example, we noticed that the stock price was off. The Valens database is updated every Monday, and during the week, BYND shares had already fallen 25%.

You might assume that with the stock having dropped so far in a week, our insight on whether it was too expensive or not had changed. However, our view on the company remained much the same, and still remains the same right now.

Since its initial public offering ("IPO"), BYND shares have been highly volatile. The massive moves higher and lower remind us of the dot-com bubble IPOs. Stocks that move that much end up in the news – especially when they're also helping popularize a market, like meatless meat. Because of that, we often get questions about those companies.

And it's not just our students who ask... Since starting Altimetry Daily Authority, we've received questions from subscribers about Beyond Meat. Some readers want to know if the stock will be able to bounce back to its previous highs, while others wish to know how low it can fall. With such a recent IPO, many investors have differing opinions on the company.

In the investing world, an IPO generates a lot of buzz. Currently, investors are on the hunt for what the venture capital industry calls a "unicorn." Unicorns are privately held startup companies with a value of more than $1 billion. (One of the first unicorns was Google in the 1990s.)

This is one reason why the Beyond Meat IPO interested investors. With an initial price of $25 per share, the implied market valuation of the firm on May 1 was $1.46 billion. With a business model that targets the rising demographic segment of vegetarians and vegans, excitement built after Beyond Meat's IPO on May 2.

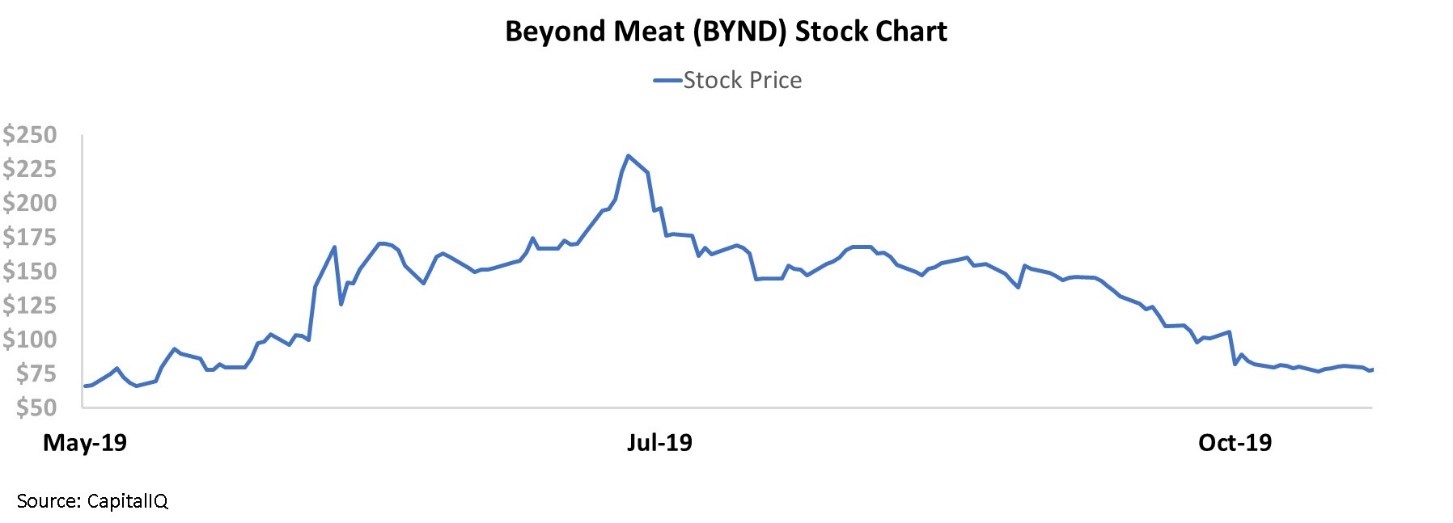

By Friday, May 3, the stock was trading near $66 per share... and rose steadily over the next three months to a high of $235. However, since July, Beyond Meat has steadily fallen to current levels near $75 per share.

Despite the excitement surrounding an IPO, many investors choose to wait before investing. This follows the first step to investing we follow here at Altimetry – understanding what the market is thinking.

As you know, our Uniform Accounting removes the noise inherent in GAAP and IFRS reporting. By removing as-reported accounting distortions around goodwill, operating leases, and other items, we're able to understand the true underlying metrics of a company.

Once we make our Uniform Accounting adjustments, we can use this clean data to create a model that projects the market expectations for any company. At any stock price, the market has an expectation that the business will achieve a certain return to warrant that valuation.

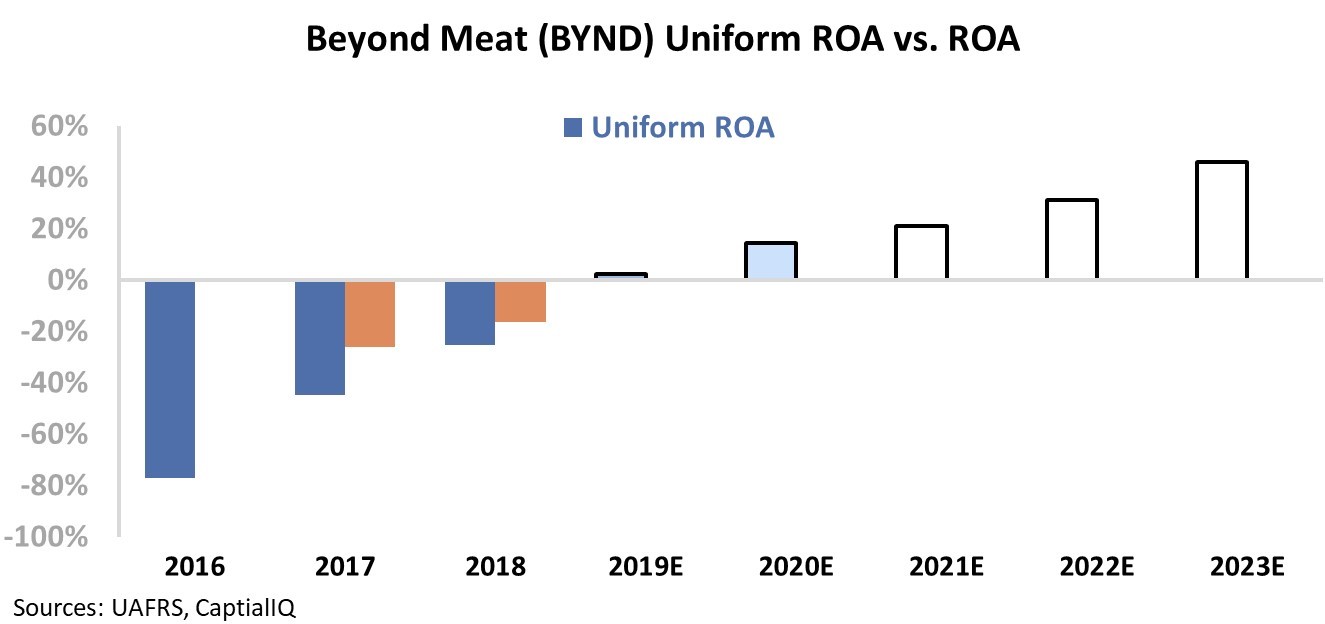

The chart below explains Beyond Meat's Uniform historical corporate performance levels in terms of returns on assets ("ROA") and asset growth (dark blue bars) versus what sell-side analysts think the company is going to do this full year and next year (light blue bars). The white bars show what returns the market expects Beyond Meat to reach over the next few years to warrant its current stock price. Take a look...

As you can see, the market expectations are very high. To justify the current stock price of $75, Beyond Meat needs to improve its ROA from negative 25% in 2018 all the way to 46% by 2023.

Food-manufacturing companies have historically seen muted returns, as they sell commodity products with thin margins. Just look at McDonald's (MCD), which we covered in October... the company has seen impressive performance over the past 20 years, but currently only has a Uniform ROA of 15%.

As competitors continue to muscle in on the plant-based burger space, it will be hard for Beyond Meat to charge large premiums for its products... which the company will need to do to justify its current valuations.

Despite Beyond Meat's long fall, using Uniform Accounting we can understand that there is still room for market expectations to be tempered further.

Regards,

Joel Litman

December 12, 2019

Low interest rates are great for borrowers, but they can send lenders into uncharted territory...

Low interest rates are great for borrowers, but they can send lenders into uncharted territory...