Another platform company is coming to the market...

Another platform company is coming to the market...

In mid-January, we devoted an entire week to the platform companies that show how just being a marketplace doesn't guarantee riches for these businesses and their investors.

We discussed how Uber's (UBER) ride-hailing business model has lit investors' capital on fire in a failed rush for market share. We also highlighted how food-delivery service Grubhub (GRUB) – another platform with no competitive moats – started out strong... but has recently come under significant pressure from competitors.

Just last week, one of those competitors announced plans to file for an initial public offering ("IPO"). Valued at $13 billion, DoorDash surpassed Grubhub in size in 2019. Its operating trends are positive... and investors are excited.

But if it was that easy for DoorDash to overtake Grubhub – which had a dominant position in the market as recently as 2018 – what makes anyone think the same couldn't happen to DoorDash? Also, more and more regulatory overhang is coming into the delivery and transportation world – which could further disrupt the business.

Let others chase this fad... Smart investors are better off staying on the sidelines.

It's too soon to know the overall economic impact of the coronavirus outbreak...

It's too soon to know the overall economic impact of the coronavirus outbreak...

With the disease taking a number of twists and turns over the past few weeks, it's no surprise that the markets have been volatile.

Even though we have a general sense of how public health epidemics impact the global economy, new developments can have unexpected consequences.

For instance, while it's clear that the travel industry will take a big hit, we've also seen the market react when the virus spreads to new countries that were previously uninfected.

Also, the scope at which some activities have been halted is bigger than most people expected. We were surprised to see just how much some of the biggest cities in the world have been impacted.

For example, Hong Kong saw its average visitor arrivals plummet from 200,000 per day in February 2019 to just 3,000 last month – much lower than during the SARS outbreak in 2002 and 2003.

And the drop is much more extreme when considering how much China has developed in recent years...

In 2003, China represented 5.3% of world trade. At the time, travel to Hong Kong dropped significantly, which was a good proxy for the impact on the global economy.

Sadly, nearly 800 people passed away globally from the SARS outbreak... and it was the first time in modern history there was a real concern about an epidemic. But while SARS caused travel and trade to fade quickly, they returned to normal almost as fast.

Today, China represents 12.8% of global trade, and the country has a much larger presence in the travel industry... so it's safe to say that we've yet to see the full economic impact of the coronavirus outbreak.

Not only has travel to many parts of continental Asia come to a virtual standstill, but trade has suffered – especially between the U.S. and China. Factories all across China have been shut down for much of this year, which ripples through to U.S. consumption.

There's likely one thing in common between the coronavirus and SARS outbreaks: the economic impacts will be strong, but short-term.

As such, investors currently have a great buying opportunity for companies whose stocks are suffering due to the outbreak... but are likely to rebound quickly if the global economy doesn't see any structural disruption.

Considering the slowdown of goods flowing to the U.S., many package delivery companies have cut their expectations this quarter due to fewer overall deliveries.

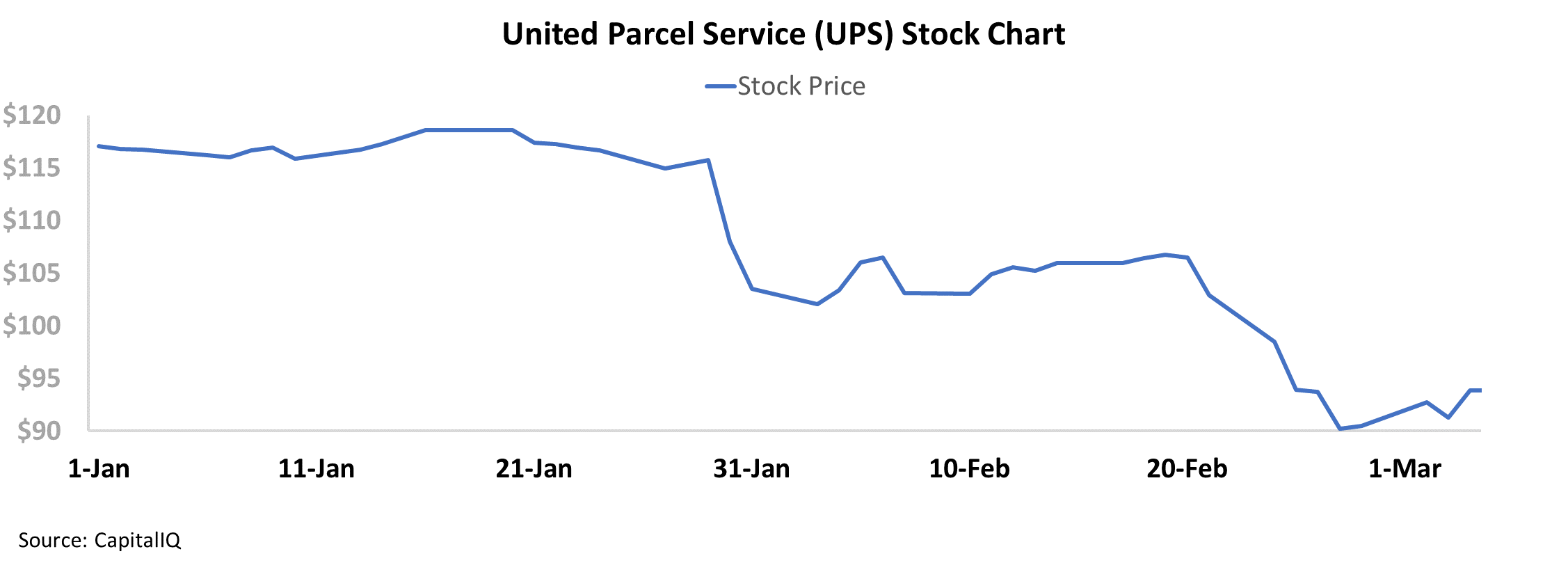

Just look at one of the most well-known package delivery companies in the U.S. – United Parcel Service (UPS). Since the beginning of the year, the company's stock has struggled in the midst of the outbreak.

However, even if UPS struggles for a quarter or two, this isn't indicative of the company's fundamentals...

As soon as fears around the coronavirus fade, the stock is likely to return to levels that reflect the company's fundamental performance.

Looking at current valuations, UPS appears to be trading at a discount. Its price-to-earnings ("P/E") ratio is currently 15, well below corporate averages near 20. This looks like a potential buying opportunity – as soon as investors overcome current volatility, valuations should normalize towards corporate averages.

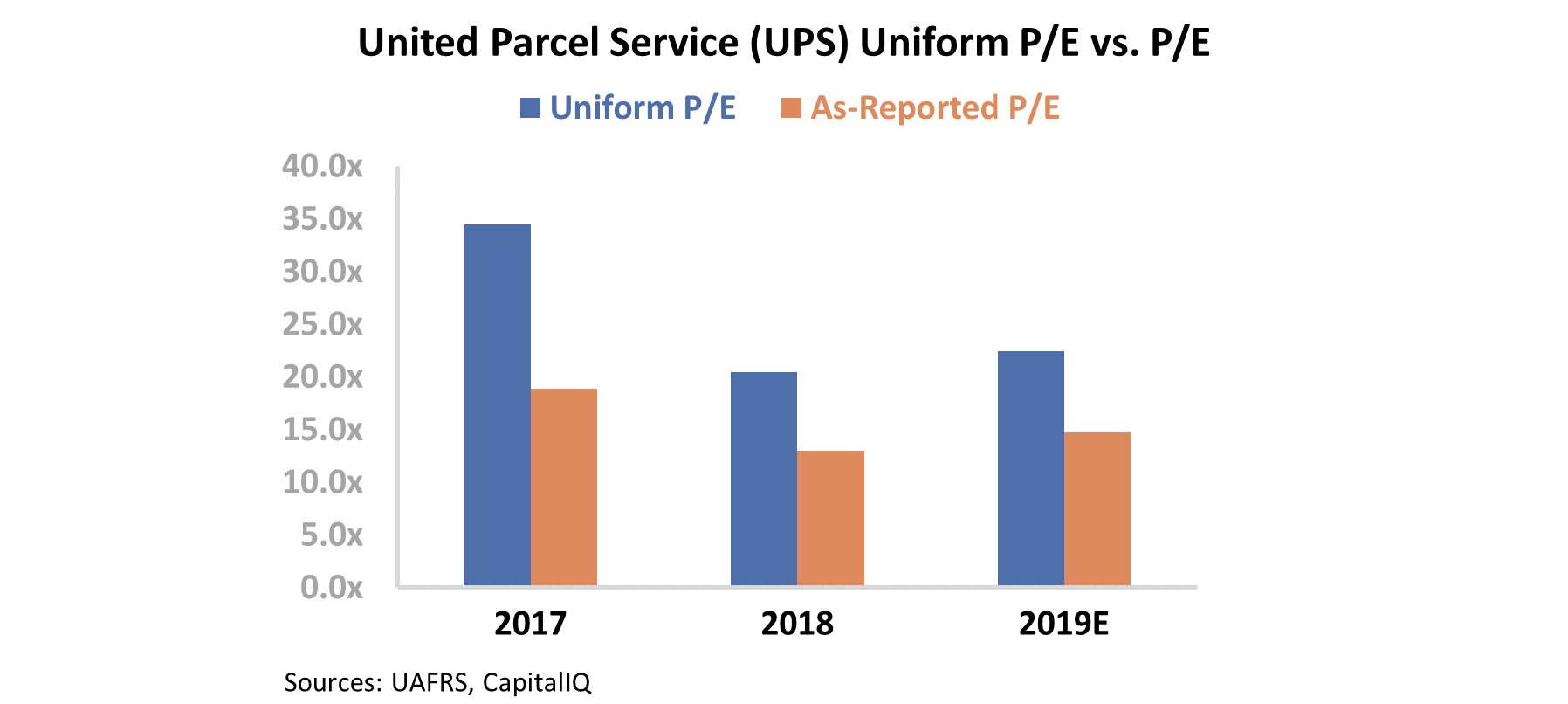

That said, UPS may not be as undervalued as you might think...

Once we apply our Uniform Accounting metrics, we can see UPS's real valuation. We adjust for misleading accounting practices like the treatment of operating leases, non-cash stock option expenses, and goodwill. After making these adjustments, UPS doesn't look nearly as attractive...

Rather than trading at a discount to the market, UPS actually trades for a P/E ratio of 23 – slightly above market averages.

This means the market may already see through the panic around the coronavirus outbreak. Investors might think UPS is a value opportunity based on the as-reported numbers... but Uniform Accounting tells us the real story.

Regards,

Joel Litman

March 6, 2020

Another platform company is coming to the market...

Another platform company is coming to the market...