There's not a lot to be excited about in today's market...

There's not a lot to be excited about in today's market...

Inflation isn't coming down as fast as the Federal Reserve hoped. The labor market is still incredibly tight. Credit continues to tighten, too. And the earnings outlook for this year is pretty bleak.

As if that weren't enough, the cryptocurrency industry collapsed... the banking sector has faced its toughest conditions in years... and investors are growing more concerned about commercial real estate and the new mania in private credit.

And yet, if you only looked at stocks, you wouldn't know any of that was going on.

The S&P 500 has rallied more than 20% since its October low. And one trend has driven almost all of that gain... artificial intelligence ("AI").

Chipmaker and S&P 500 constituent Nvidia (NVDA) is one of the hottest stocks of the year. Its chips are at the heart of the AI industry. The stock is up roughly 180% since January.

Software giant Microsoft (MSFT) is a major investor in OpenAI, the company that owns ChatGPT. That alone has pushed the stock 40% higher year to date.

The majority of the rally since last October has been driven by the seven largest tech companies in the world – the two listed earlier, plus Google parent Alphabet (GOOGL), Amazon (AMZN), Apple (AAPL), Facebook owner Meta Platforms (META), and Tesla (TSLA).

These seven companies have added about $3.4 trillion in market cap since then... and the entire S&P 500 has added $6.5 trillion.

It's an impressive rally, that's for sure. But as we'll explain today, it's also getting ahead of itself.

The market might be jumping the gun...

The market might be jumping the gun...

Last month, a report from management consulting firm McKinsey speculated that the global AI industry might add between $2.6 trillion and $4.4 trillion to the world's gross domestic product in the next few years.

Mind you, that's not how much profit these seven companies could generate over the next few years. That's how much value AI can create across the entire economy. It includes improving worker efficiency, which shouldn't show up in these companies' calculations.

Investors have effectively attributed all that potential value creation to these companies... lifting up valuations for the entire market.

It seems like investors haven't gotten the memo. AI can do a lot... But it hasn't figured out a way to prevent our economy from entering a recession.

It hasn't figured out a way to separate credit cycles – the lifeblood of every economy – from recessions and economic booms. And it hasn't figured out a way to solve the worrying signs in the current credit cycle.

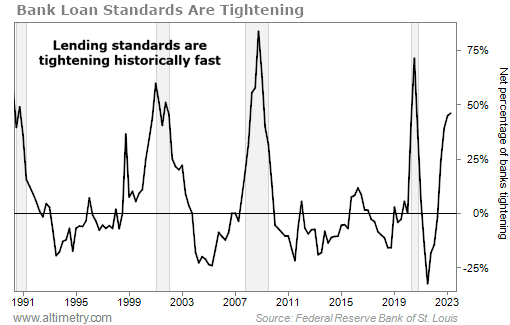

The credit market is still tight. And it's getting tighter. Just look at the Senior Loan Officer Opinion Survey ("SLOOS")...

The SLOOS is a poll conducted every quarter by Federal Reserve regulators. It asks loan officers if their lending standards have tightened, loosened, or stayed the same over the past three months.

Said another way, it tells us how willing banks are to make loans... and how easy or difficult it is for corporations and consumers to access credit.

The chart below shows the percentage of domestic banks that tightened standards for commercial and industrial (C&I) loans to large- and middle-market firms. As you can see, banks are still tightening lending standards faster than any time since 1990 – not counting the past four recessions.

We're technically in a bull market today. But underlying economic growth isn't showing it... because banks aren't financing growth.

They understand that corporate and consumer delinquencies are on the rise... meaning the Fed's interest-rate hikes are starting to take effect in the economy.

Almost every other credit metric we look at is worrying. The yield curve is still inverted, and it's getting more inverted. Corporate borrowing costs are going up, making it more expensive to finance growth. And bankruptcies are starting to rise.

These are all signs that everything is not fine...

These are all signs that everything is not fine...

Industry folks often say that bond investors are smarter than stock pickers. They have a better nose for when risk is unsustainable... and that's exactly what we're seeing today. The equity market just can't wrap its head around the economic reality.

AI could have real long-term benefits for the global economy. But the current mania is unlikely to last. Tightening credit standards are hurting corporate investment... which, by the way, will be essential to fuel AI growth in the short term.

The Fed, banks, and markets are being much more cautious with their money. We recommend you do the same. Remain tactical with your investments, even as the market keeps rallying.

Regards,

Rob Spivey

July 5, 2023

There's not a lot to be excited about in today's market...

There's not a lot to be excited about in today's market...