Late 2022 and early 2023 were the 'ice age' and 'deep freeze' of the venture capital ('VC') world...

Late 2022 and early 2023 were the 'ice age' and 'deep freeze' of the venture capital ('VC') world...

As the Federal Reserve began hiking interest rates, VC-backed companies that feasted on cheap debt were forced to make tough decisions.

Many had to slash their workforces. Tech companies laid off more than 93,000 employees in 2022 alone.

And as funding became harder to come by, these companies had to accept that they were losing value. At the time, 8% of VC-backed companies had a "down" fundraising round – meaning they raised money at a lower valuation.

Last year was supposed to be the year of AI... a catalyst that, along with a halt in rate hikes, would reverse this trend and make it easier to access credit.

Yet as we discussed yesterday, the latest survey from Masayoshi Son's SoftBank Vision Fund tells a different story about recent AI trends. While most folks expected AI investment to rise, it's actually staying about the same for many companies this year.

But the Vision Fund didn't stop at AI. It also offers key insights about the world of VC... and the pain that's brewing for the broader U.S. economy.

The availability of capital is one of the most important ways to assess the economy's health...

The availability of capital is one of the most important ways to assess the economy's health...

Regular readers know the Senior Loan Officer Opinion Survey ("SLOOS") is one of our favorite ways to track credit standards.

The SLOOS is a quarterly survey from the Federal Reserve. It gathers information about lending practices in the U.S. by asking loan officers if their lending rules have tightened, eased, or remained unchanged in the past three months.

It's a great way to understand if banks are making it easier or harder to access credit. (And if you've been following along, you know it's been getting harder for years.)

But the SLOOS doesn't measure debt already in the markets, private credit, financing from going public, or VC and private-equity investments.

VC firms are like the heartbeat of the economy. Their ability to raise funds and invest in new ventures reflects the economy's overall health... and investor confidence in its future.

And given their appetite for risk, these companies are constantly losing money. That means they cannot exist without access to debt.

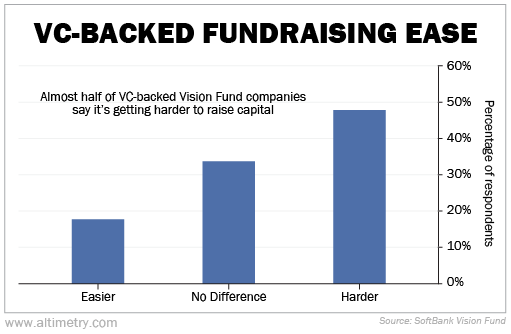

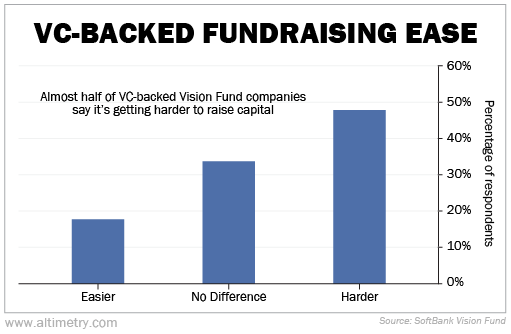

This is where we again turn to the SoftBank Vision Fund. Every year, the Vision Fund asks the companies in its VC portfolio how difficult it has been to raise funds.

According to the survey, 48% of VC-backed companies found it tougher to get funding now than a year ago. About 34% feel the situation hasn't changed... and only 18% believe it's easier.

Take a look...

As much as people talk about how the economy has "turned a corner," the numbers say otherwise.

For most companies, it's harder than ever to access VC-backed capital...

For most companies, it's harder than ever to access VC-backed capital...

VC firms can't afford to spend because they're having their own problems raising money. Fundraising by U.S. VC firms hit a six-year low in 2023. Their investors have pulled back due to rising interest rates.

Several VC leaders, like Insight Partners and Tiger Global, even reduced their fundraising goals in 2023. It remains to be seen how they'll approach this year's goals.

Many startups – particularly those backed by VC – find themselves struggling to survive. These "zombies" can't afford to pay off their debt obligations. Or they're close to running out of money as venture funding remains closed.

The days of free cash are over. Many companies are struggling to hang on.

Make sure to tune back in tomorrow, when we'll look at yet another concerning issue for Vision Fund companies... volatility.

For now, brace yourself for more bankruptcies. The worst is yet to come for the U.S. economy.

Regards,

Rob Spivey

February 7, 2024

Late 2022 and early 2023 were the 'ice age' and 'deep freeze' of the venture capital ('VC') world...

Late 2022 and early 2023 were the 'ice age' and 'deep freeze' of the venture capital ('VC') world...