If it were up to Bill Dudley, the Fed would've cut rates already...

If it were up to Bill Dudley, the Fed would've cut rates already...

Dudley is a former president of the Federal Reserve Bank of New York. And for the better part of a decade, he was a key voice in the "higher for longer" camp.

So he made waves in late July, when he published an opinion piece in Bloomberg... calling for rate cuts as soon as possible.

While Dudley was all for a cut that month, he wasn't surprised the Fed held off. He believed the central bank wanted to avoid spooking the market with any sudden announcements.

And with the economy more or less chugging along, the Fed didn't think the situation was urgent.

Of course, that didn't last long... A few weeks after Dudley made his comments, the market took a nosedive. As we'll discuss today, the Fed is out of excuses now.

A rate cut is coming... and it's sorely needed.

According to Dudley, the Fed wanted to be absolutely sure it was ready to cut rates...

According to Dudley, the Fed wanted to be absolutely sure it was ready to cut rates...

For one thing, the central bank didn't want to be misled by a temporary slowdown in inflation. That's what happened in late 2023... And the lower rates go, the harder it becomes to fight an overheated economy.

For another, the Fed has been signaling rate cuts in September for months. That's what the market expected.

Any earlier cuts could've caused investors to panic about a potential recession.

And even though unemployment seemed close to breaching the Sahm Rule – a recession indicator with an impressive track record – Dudley said Fed officials didn't seem concerned.

The central bank was too scared of upsetting the apple cart to roll out rate cuts sooner than September. Dudley argued that it might already be too late to fend off a recession...

And the longer we wait, the riskier it gets.

Dudley was proved right about needing a rate cut in no time flat...

Dudley was proved right about needing a rate cut in no time flat...

The latest unemployment data sent the three-month rolling average too far above the one-year low. Said another way, the economy breached the Sahm Rule.

The market panicked. The S&P 500 fell 7% over a few days in early August. The Nasdaq and the Russell 2000 dropped roughly 10% apiece.

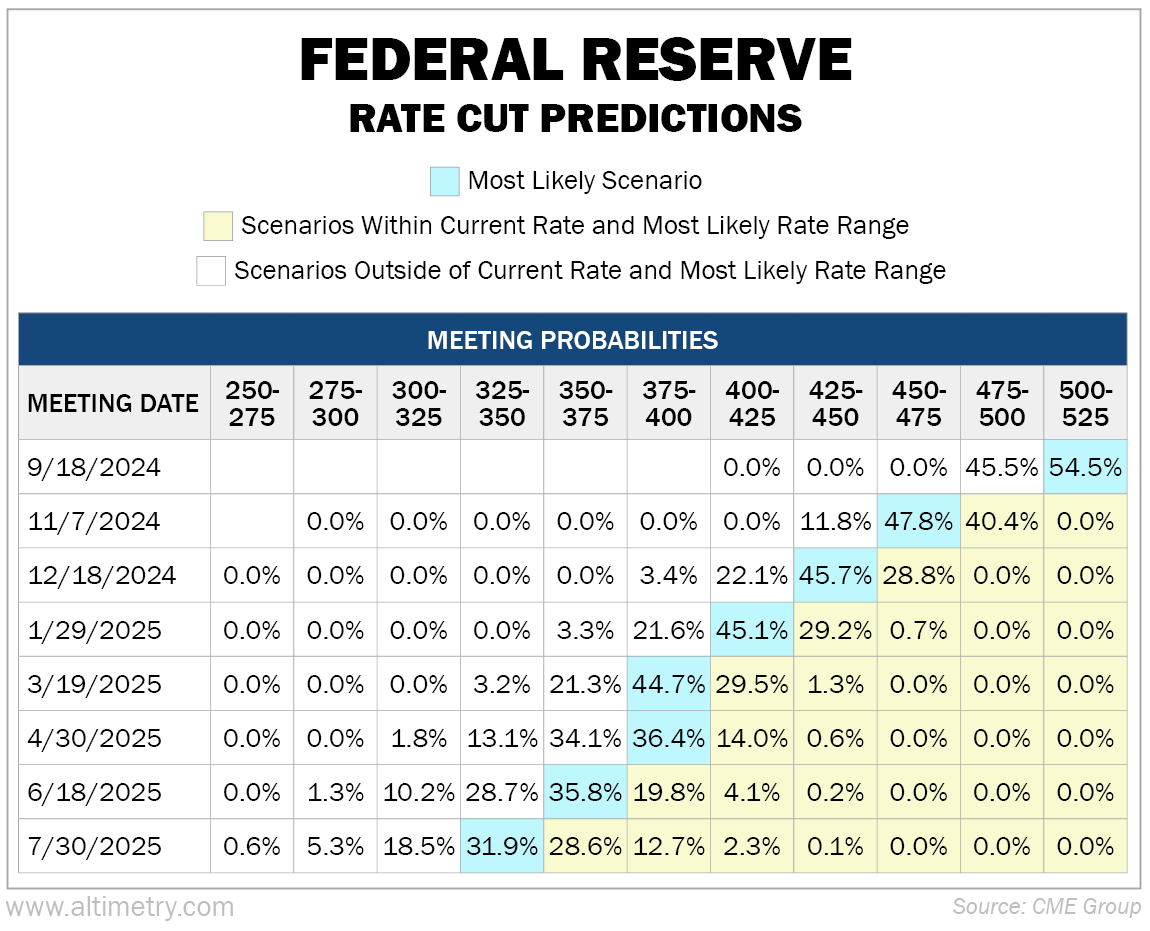

Investors now think there's a 100% chance of a rate cut in September. We can see this through the CME FedWatch Tool, which tracks sentiment in the futures market.

Take a look...

As you can see, investors think there's a roughly 46% chance of that cut being 50 basis points ("bps"), with a 55% chance of it being 25 bps. Either way, they expect rates to come down.

Fed Chair Jerome Powell doesn't want anybody to be surprised by the first cut. The Fed now has a clear signal (or several).

That's also why we likely won't get an emergency Fed meeting before September, despite what the rumors say...

That's also why we likely won't get an emergency Fed meeting before September, despite what the rumors say...

It would signal recession risk to investors – and would probably cause more harm than good.

While the Fed is being cautious, make no mistake... Interest-rate cuts are almost certainly on the way. The recent negative unemployment data only makes it more likely.

The central bank doesn't have much wiggle room left. If it keeps waiting, the market could get antsy. Unless something major changes, we need a rate cut come September.

Bill Dudley knows it. Investors know it. The Fed knows it, too.

Regards,

Joel Litman

August 13, 2024

If it were up to Bill Dudley, the Fed would've cut rates already...

If it were up to Bill Dudley, the Fed would've cut rates already...