Quantitative easing was never the boogeyman, some thought...

Quantitative easing was never the boogeyman, some thought...

Concerns over rapid inflation aren't a new phenomenon.

From the dot-com bubble burst of the early 2000s to the collapse of the financial markets in 2008, central banks have used several tools to help get the economy back on track.

One of the most controversial tools the Federal Reserve uses is quantitative easing.

Quantitative easing was introduced back in the Great Recession in 2008 as an unconventional way to inject liquidity into the economy by directly purchasing assets.

Since then, people have been ringing the bell of imminent inflation for more than a decade.

Some say that a rapid injection of cash into the economy can cause rampant inflation and debase the currency.

With hyperinflation ruining economies like Germany's in the early 1900s and Zimbabwe's in 2007, folks are always hesitant to introduce too much cash into the economy at once.

However, reality differs from many pundits' worst fears. Quantitative easing didn't cause inflation after its 2008 implementation.

Now, we are in the middle of massive fiscal stimulus being injected into the economy to help kickstart growth after the pandemic... but this action is causing hyperinflation fears to come back...

More money doesn't always mean more problems...

More money doesn't always mean more problems...

Many people believe higher stimulus must mean equally higher inflation, as more money is pumped into the system.

But this conclusion is missing a key component of the equation, as we discussed in November 2021. Inflation doesn't strike every industry equally. Inflation is also driven by demand, not just the supply of money.

In 2021 and 2022, inflation has been driven by a focus away from spending from services, which don't require a constant stream of supplies, to tangible goods.

Tangible goods require getting manufacturing facilities up and running and supply chains to deliver the product.

Supply chains and jumping prices, therefore, become key characters in the story of explaining today's inflation levels.

Tangible shifts in consumer preferences due to the coronavirus pandemic have made it hard for supply chains to handle surging demand.

And as economic theory states, when supply can't keep up with demand, prices will rise. We talked about this as the source of inflation in our January 24 article on "Why It Costs More to Shop These Days."

Unlike the case studies of Germany or Zimbabwe, federal monetary policy isn't the cause of this inflation.

That's why we still think that once supply chains can "catch up" with demand, this inflation won't become endemic.

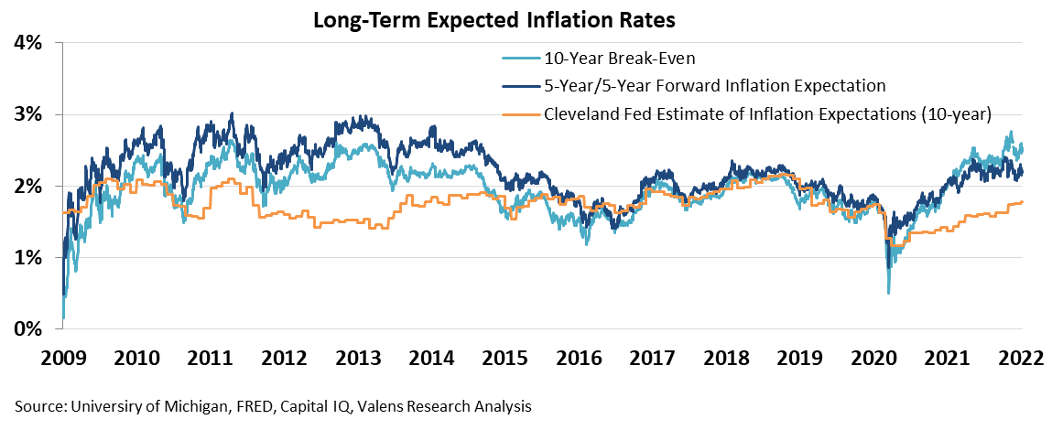

While the expected inflation rate for both 10 years and five years has climbed, it is still less than 4%, the rate at which inflation begins to eat into equity returns and become a drag on the economy.

It's easy to look at the current number and worry these high rates will be here to stay and drag down the recovery over the next few years. But higher prices are due to a mismatch of supply and demand, not flawed monetary policy.

As supply chains reestablish and critical shortages in products such as microchips normalize, supply will increase. In turn, this means even if demand stays high over the next few years, prices should come down, not continue to climb.

What is the long-term situation?

What is the long-term situation?

Inflation numbers have risen significantly in the past couple of years, with particularly sharp rates seen in the past year – increasing by 4.9% from a year ago.

While the media may focus on the fiscal stimuli as a cause for concern, the long-term outlook is a much rosier picture.

Inflation expectations remain low going forward as the economy continues to reopen and consumers go back to a pre-pandemic mix of goods and services spending.

Until then, the current inflation numbers should have little bearing on your long-term inflation strategy.

Regards,

Joel Litman

January 31, 2022

P.S. It didn't matter if the country is experiencing Fed hikes, inflation, or even the swine flu – there are a handful of small companies that continue to rise to new heights year after year. And these companies make their investors rich in the process.

In a recent presentation that I put together, I'll walk you through how these select companies achieve this success... and I'll even give you one stock pick (for free) following this playbook. Click here to learn more.

Quantitative easing was never the boogeyman, some thought...

Quantitative easing was never the boogeyman, some thought...