How serious of a risk is the oil sell-off for U.S. high-yield debt?

How serious of a risk is the oil sell-off for U.S. high-yield debt?

On Tuesday, as we discussed why investors shouldn't panic in the current market environment, we mentioned a Valens Research piece we wrote in 2015 about why low oil prices aren't actually a sign of an imminent recession... Instead, they're bullish for the economy.

Of course, regular Altimetry Daily Authority readers know one of the big indicators we pay attention to is the credit market.

While the drop in oil price is good for the global and U.S. economies, it certainly isn't good for energy companies... And a lot of them have high-yield debt.

After oil prices collapsed on Sunday night and Monday, energy bond yields rocketed higher, as investors started pricing these companies for significantly higher risk of bankruptcy. As Barron's highlighted on Monday, some analysts were even calling for 15% default rates in the oil and gas sector in 2020 with this drop.

But another important detail stands out to us in that Barron's article... Despite the calls for a 15% default rate, only about 7% of the energy bonds in a common high-yield benchmark – the ICE BofA US High Yield Index – will mature between now and the end of 2021.

As we said in the September 9 Daily Authority, debt maturity schedules offer a powerful window into credit risk. Most of the time, companies don't go bankrupt because they can't service interest expense... They go bankrupt because they can't refinance debt coming due.

If only 7% of energy bonds are coming due over the next two years, expecting 15% default rates sounds overly pessimistic. It's the exact kind of extreme reaction that causes investors to panic.

It's not going to be pretty in the energy patch over the coming months, especially for highly levered companies. We would not recommend investors try to "buy the dip" with these equities. Many of them just don't need to exist... So it's why we're likely to see significant consolidation in the space in the next year.

But without debt maturities coming due, the risk of mass defaults and credit destruction is much lower than many analysts are calling for. It reminds us of early 2015, when a similar breakdown in oil prices and energy credit presented a fascinating opportunity for bond investors who were doing good research.

To be clear, companies did end up going bankrupt in that cycle... But it wasn't the apocalypse that the market initially priced for the entire industry. And unlike many people expected, it didn't pull the entire U.S. into a recession – mainly because debt maturities weren't massively stacked in the short term.

That's worth remembering as exploration and production companies – the ones most at risk – are a significantly smaller part of the high-yield market today than they were in 2015. Back then, these businesses made up roughly 8% of the high-yield market. Today, this number is down to less than 6%.

But just as in 2015, the financial-news media makes it sound like the apocalypse is imminent. This is yet another example of why it's important to follow the data... and not the hysteria in the financial news at times like this.

Many companies rely on scale to succeed...

Many companies rely on scale to succeed...

One of the key parts of running a business is competing for market share. A company can have the best product on the market, but it doesn't matter if that product fails to attract customers.

This is why marketing and advertising are so important – it's critical to get the product in front of customers. Billboards, TV advertisements, sale promotions, and even product design can help companies steal market share from the competition.

Tech giant Apple (AAPL) did a great job of this in the early 2000s. Think back to the uniform aesthetic between all of Apple's marketing efforts...

Its popular "Mac versus PC" ads were set on a plain white background, which complemented the simple and clean design of its products.

These were certainly high-quality products, but customers may not have known that without Apple's product redesign and ad campaigns.

In some markets, the best way to gain market share is through price.

For customers who may not care about quality – or for a product that doesn't have much variance in quality, like table salt or tissue paper – market share is dictated by which company can offer the lowest price.

Some particularly shrewd corporations have been able to use this type of market to their advantage.

Walmart (WMT) is one of the most famous examples of the "scale at any cost" strategy that so many companies are employing today... It dominated the retail market by offering lower prices than anybody else.

This wasn't very profitable in the short-term. Initially, the company's margins were beyond razor thin.

However, Walmart had more scale than any of its competitors, which meant two things...

- The company had "economies of scale" – meaning it was able to spread its fixed costs over a wider base.

- Walmart was also hyper-focused on optimizing its supply chain to maximize the speed between when the company paid for a product to when its customers purchased that product.

By maximizing working capital management, Walmart was able to have thin margins... But because it had such high sales volumes, it still had high final returns on the business.

Walmart's success has had a significant impact on other retailers. Smaller businesses were forced to shut down when Walmart moved to the neighborhood.

We talked about a number of marketplace companies trying to achieve the same strategy in the January 14 Daily Authority...

As we explained, Companies like Uber (UBER) and Grubhub (GRUB) are taking huge losses on their transactions in an effort to win business from their competition. Unfortunately, the competition is doing the exact same thing... and this has led to a stalemate.

These marketplace companies don't have strong competitive moats, which makes it tough to keep competitors from stealing back market share.

That said, one food distributor has been building the "Walmart strategy" to massive success...

Sysco (SYY) is one of the largest food-service corporations in the world. It distributes all kinds of food products to restaurants, hospitals, hotels, and other clients.

The company has used its scale in a similar manner to Walmart. It offers just about the lowest prices in the industry to dominate market share.

It was so successful at gaining market share that the government had to block its attempted acquisition of a competitor, US Foods (USFD), due to anti-competition concerns.

This hasn't stopped Sysco from growing its scale further. In 2016, the company used the money it had planned on using for the US Foods takeover to buy Brake Bros, a food distributor in the U.K.

Sysco's goal was to establish its scale internationally and continue following the Walmart model, but this appears to be a misstep when looking at the company's recent financials.

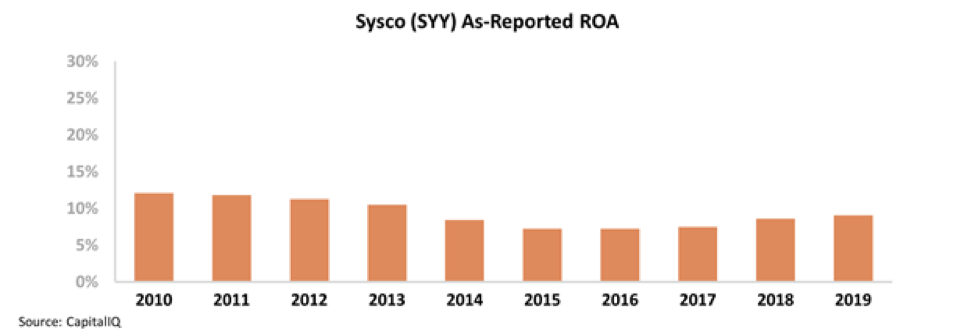

Over the past decade, Sysco's as-reported return on assets ("ROA") has come under pressure – declining from a peak of 12% in 2010 to just 7% in 2015.

And the company's Brake Bros acquisition doesn't appear to be helping much. Sysco's as-reported ROA has only rebounded to 9% in 2019 – still well below prior levels.

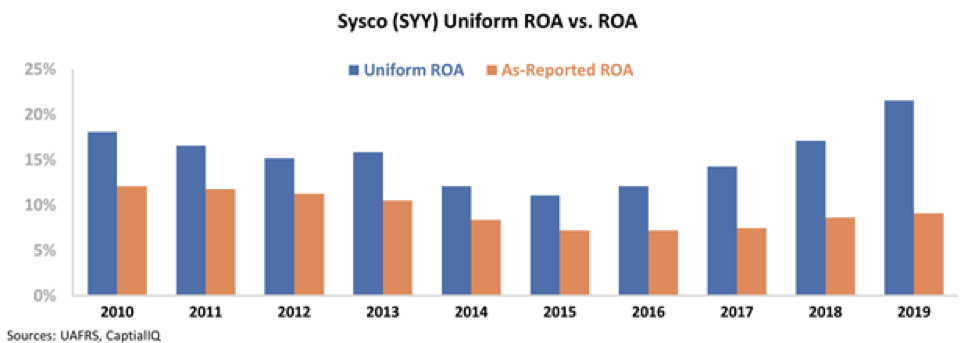

That said, the as-reported metrics utilize a number of misleading accounting practices that make it difficult to properly assess Sysco's profitability...

For example, GAAP accounting mistreats items like goodwill, capital leases, and non-cash stock option expenses – all of which can lead to distorted ROAs.

Once we've made the proper adjustments to Sysco's balance sheet and income statement, we can see how the Brake Bros acquisition has actually impacted the company's profitability.

On a Uniform basis, Sysco's ROA has improved from lows of 11% to a new high of 22% in 2019.

Not only has the acquisition helped Sysco return to normal profitability, it has also helped the company accelerate returns to 10-year highs.

Tying this back to the Walmart strategy, Sysco has been able to continue building its economies of scale by driving down costs and eliminating competition along the way.

These types of signals may not come through so clearly when looking at as-reported metrics. Make sure you're always seeing the most accurate picture possible with Uniform Accounting.

Regards,

Joel Litman

March 12, 2020

How serious of a risk is the oil sell-off for U.S. high-yield debt?

How serious of a risk is the oil sell-off for U.S. high-yield debt?