President Joe Biden celebrates infrastructure week...

President Joe Biden celebrates infrastructure week...

We have been pounding the drum for quite some time about the upcoming capital expenditure ("capex") cycle in the U.S.

The country's aging public infrastructure has long been a concern among voters and politicians. Yet little seemed to ever come about from discussions on what to spend on repairs.

That all changed just a few weeks ago when one of the crown jewels of President Biden's economic agenda finally made it through Congress.

The $1.2 trillion – or $600 billion, depending on how you count already approved spending – infrastructure bill has finally become law...

The infrastructure bill should provide big tailwinds for public and private investment across the U.S. economy.

The money will be spent in areas ranging from electric-vehicle charging stations and broadband expansion to more traditional infrastructure like roads and bridges.

At $1.2 trillion in spending, the bill amounts to an equivalent percentage of gross domestic product ("GDP") that the U.S. spent rebuilding Europe after World War II under the Marshall Plan.

Only by comparing the current infrastructure plan to the Marshall Plan, can investors see how big of a catalyst infrastructure spending could be in the years ahead...

More spending looks set to bolster an already strong economic recovery...

More spending looks set to bolster an already strong economic recovery...

It's quite telling that spending on infrastructure will be bolstered by a strong economy in terms of production.

Volumes for construction materials have been on a rapid rise as the economic recovery powers ahead.

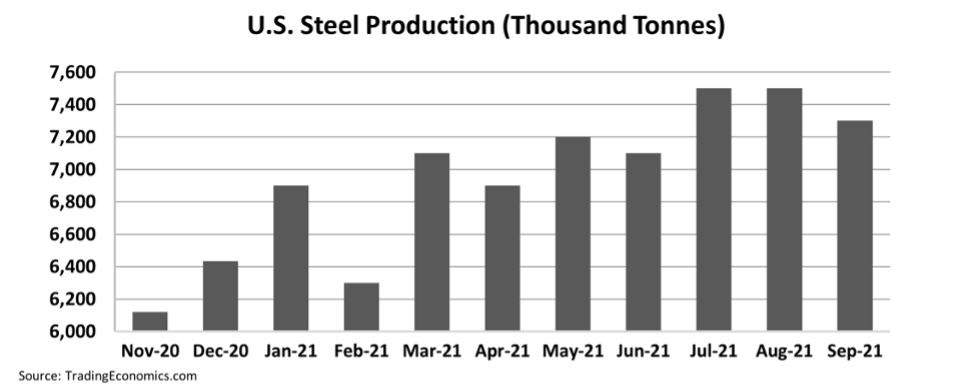

Steel production, for example, had already bounced back from the slump of the pandemic and is back at volumes last seen between 2018 and 2019 when the economy was humming.

See for yourself below...

Now the economy is positioned to pick up even more speed as demand for raw materials pushes even higher.

This is a dream scenario for many basic materials companies.

These firms process naturally occurring substances like the oil used to power machines or the stone used to produce cement and gravel.

High infrastructure spending is also a great scenario for the industrial companies that take raw materials and turn them into valuable products.

The big names in steel and aluminum production and the companies that refine copper products into wire and cable are in this category.

The market for these products is currently characterized by rising demand and constrained supply. In other words, a recipe for higher prices.

Firms with the pricing power to pass on any input cost pressures will inevitably see their margins and profitability expand.

Names to look for in the current environment...

Names to look for in the current environment...

The financial press has been shouting from the rooftops about the 30-year-high inflation information that the U.S. Bureau of Labor Statistics released last month.

As we've previously discussed, we still don't think inflation is going to derail the market.

However, we believe that the coming capex cycle has the potential to be a major tailwind for many companies. It's a bonus that many benefit from prices staying higher for a bit longer than expected.

Our High Alpha subscribers know that we just published a brand-new recommendation last week on one of the companies we think is positioned to take off as capex spending comes into focus.

For the Altimetry's High Alpha service, our team scours the entire universe of U.S. stocks using our brand of forensic accounting to identify stocks that are primed to take off... the average return for our portfolio of open recommendations is 43%, with some gains as high as 203%!

With High Alpha, you'll receive our monthly newsletter with insights and stock ideas you won't find anywhere else – learn more by clicking here.

Regards,

Joel Litman

November 22, 2021

President Joe Biden celebrates infrastructure week...

President Joe Biden celebrates infrastructure week...