The stock market can be a cruel mistress...

The stock market can be a cruel mistress...

There's a saying on Wall Street that the market will inflict the most pain it can on the most people it can. And at the start of the year, this saying couldn't have been more true.

Folks were still plenty worried about a looming recession. Inflation was still high, at more than 6%. And the Federal Reserve still showed no signs of slowing down its interest-rate hikes.

Most investors expected companies to suffer in this macroeconomic environment. They expected the market to fall. Overall exposure to U.S. equity markets fell below average.

In short, investors didn't trust the market. And since the market likes to be cruel, of course it rallied... hard.

The S&P 500 Index has climbed more than 17% this year. This is in stark contrast to the predictions of many analysts who expected a subdued year for stocks.

Investors have started to come around to the market's unexpected rise. Unfortunately for them, the market is still cruel.

As we'll explain today, we're now seeing a setup in the opposite direction... and the same folks are in danger of missing the boat yet again.

Investors are letting their guard down...

Investors are letting their guard down...

We proved this last week through the National Association of Active Investment Managers ("NAAIM") Exposure Index. Equity exposure steadily increased from below-average levels at the start of the year to above 100% at the end of July... near an all-time high

As a reminder, that means investors are more than 100% exposed to the market. It's only possible because they can use leverage to increase exposure beyond 100%.

This is a clear sign of excessive optimism in the market. And it's not the only sign that investors have completely forgotten about downside risk...

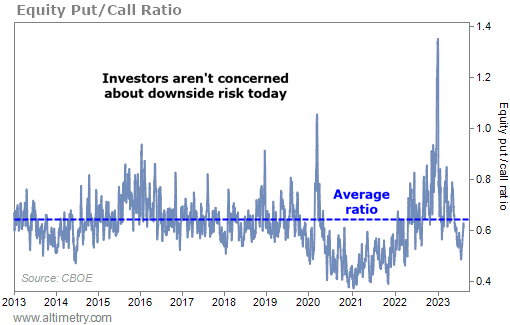

The NAAIM Exposure Index is one of our favorite ways to measure sentiment. Another of our favorites is called the "put/call ratio."

The put/call ratio divides the number of put options being traded by the number of call options being traded.

When the ratio is higher, investors are buying more puts... and are more bearish about the future. When the ratio falls, it can be another sign of excessive optimism. Investors are less focused on the downside.

At the start of the year, the put/call ratio was above 1.3 times, meaning investors were buying 1.3 times more puts than calls. That's extremely high, considering the 10-year average is only 0.64 times.

As the market rallied, investors were less worried about downside risk... and stopped buying so many puts. The ratio fell below 0.5 times in July. It's still only around 0.6 times today.

Take a look...

Folks realized stocks were rallying. They didn't want to get left behind. They stopped worrying about the market and went "all in."

And you know what the market likes to do when that happens...

We're not the only ones worried about today's overheated sentiment...

We're not the only ones worried about today's overheated sentiment...

Hedge funds have started to sniff out the same problem.

While retail investors and the market as a whole are bullish on the U.S., hedge funds have been quietly cutting their bets – and leaning into Europe instead.

According to prime brokerage data from Goldman Sachs, hedge funds have reduced their holdings of U.S. stocks to the lowest level since 2013. At the same time, their exposure to European stocks hit the highest level ever recorded.

The U.S. market has been on a tear. But these funds have growing doubts about the market's ability to maintain this momentum. The "smart money" knows we're due for a new dose of maximum pain from Mr. Market.

Unfortunately, there are still plenty of investors who let their guards down. They've forgotten that with stocks, pain tends to follow optimism.

The put/call ratio is yet another warning sign that valuations could drop in short order.

Regards,

Joel Litman

August 10, 2023

The stock market can be a cruel mistress...

The stock market can be a cruel mistress...