Our Director of Research attended his first concert since the coronavirus pandemic started...

Our Director of Research attended his first concert since the coronavirus pandemic started...

And he didn't even have to leave his couch! He streamed the whole thing.

For performing artists, tours make up the largest portion of their income. In this streaming age, with song plays on streaming services making a fraction of a cent for the recording artist, album sales aren't the moneymaker they once were. Earlier this year, Forbes reported that around 75% of an artist's income comes from ticket sales and the merchandise sold at the concert venue.

However, over the past few months, artists have needed to figure out another way to bring in income. Stadiums and concert venues were some of the first businesses to close and will be some of the last to reopen. This means that many artists have turned to virtual concerts – performers live stream to an exclusive group of paying fans.

Starting in April, musicians began to stream their concerts online. Popular bands like Radiohead, The National, and Grateful Dead as well as solo acts such as Phoebe Bridgers and Rhett Miller all streamed their shows to eager fans.

Electronic group 100 Gecs even took this a step further – organizing a music festival with other musicians to play their sets within the popular video game Minecraft. Fans could log into a public server to listen to music played by their favorite artists in the digital world.

For many artists, the economics of this model are powerful. As Bloomberg reported in early August, the New York Metropolitan Opera is currently curating a service where subscribers can stream their favorite operas.

We could see virtual concerts sticking around even after the pandemic recedes, due to their ability to reach inaccessible audiences and put more funds in the hands of the artists. This is another example of how the "At-Home Revolution" has caused lasting change... and possibly for the better for fans and artists.

By the way... for those who are wondering, the concert Rob attended was for two bands he listened to in college: Cursive and Thursday. If you go check them out, be prepared... Some people still ask the question his father had when he first heard one of those bands: "You call this music?"

Have any of you attended a virtual concert since the pandemic started? If so, let us know... we might mention it in a future Altimetry Daily Authority issue. Send an e-mail to [email protected].

Software giant Oracle (ORCL) has made a fortune helping companies understand their own operations...

Software giant Oracle (ORCL) has made a fortune helping companies understand their own operations...

Oracle provides a range of products – from database software to enterprise resource planning ("ERP") – that allow businesses to track fundamental progress and financials. The company also provides reporting and business intelligence platforms, which allow management teams to make better strategic decisions.

This means Oracle essentially enables companies to run better and more efficient operations.

Businesses generally don't have a core competency in creating and managing the massive databases – as well as developing the complex software – needed to be able to track their operational performance. This is why they turn to Oracle.

Similarly, Paychex (PAYX) is a provider of human resource, payroll, and benefits services for small to medium-sized businesses. Human capital is an essential part of any modern company... but dealing with payroll taxes, benefits, and everything else that comes with it is a headache for most companies.

Along with its competitors, Paychex has turned being able to help companies deal with this issue into a cash-flow machine.

Like Oracle, it provides services and products that allow companies to improve their own businesses. Most firms also don't have core competencies in the payroll segment, so they choose to outsource.

Both of these end markets have been hugely successful, and these providers' solutions have become integral parts of many businesses. That means if a firm could do both of these things, it would go without saying that it would be expected to be hugely profitable.

Its customers would have a one-stop solution for understanding how their business and people inside it operate. It could provide support for everything from strategic planning all the way down to the more mundane payroll processing.

That's exactly what Workday (WDAY) does.

The company provides cloud-based financial management as well as human capital management. Workday combines the strategic planning capabilities of Oracle's offerings with the day-to-day management of payroll and human resources of Paychex's.

Instead of using multiple vendors for these different services, Workday provides the complete one-stop shop for businesses. The company is the clear leader in this combined financial and human capital management software field.

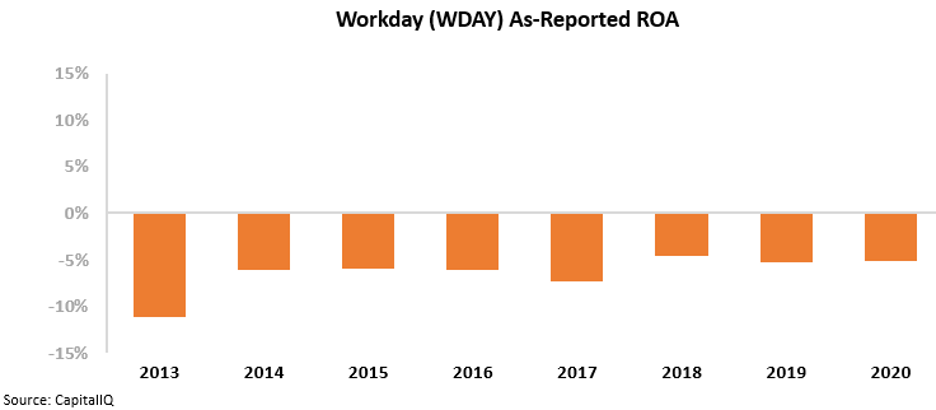

But despite its dominant market position, Workday's as-reported metrics paint the picture of a company failing to execute on its strategy.

Workday's as-reported return on assets ("ROA") has been negative every year since the company went public in 2012. Some investors believe Workday's dual focus strategy means that the company isn't focusing on efficiency or profitability for either segment – thus hampering returns and preventing it from turning a profit.

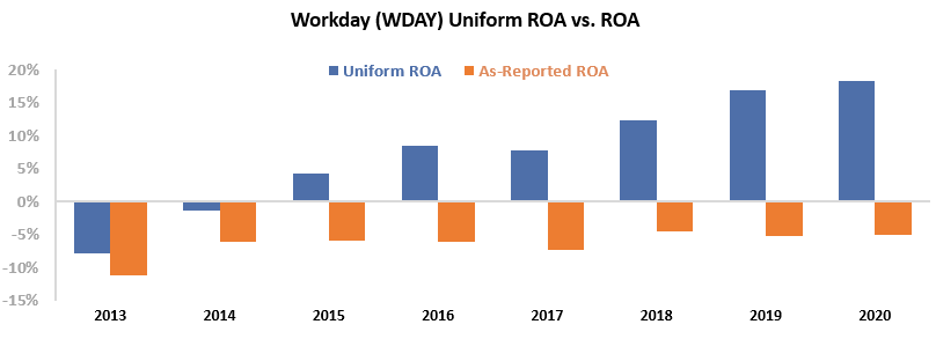

However, this picture of Workday's performance is inaccurate. Due to the GAAP treatment of goodwill and stock-option expense, among other distortions, as-reported accounting is deceiving investors.

Workday has managed to successfully create an essential service for thousands of entities in a massive market... and is profiting from it with great success.

In reality, Workday's Uniform ROA has been positive and improving steadily since the company's IPO. This metric currently sits at 18% – well above the as-reported figures of negative 5%...

Workday isn't a negative-return business that's failing to execute... It's a company with robust, improving returns. By excelling at tasks that businesses don't have the capability or interest in doing, Workday can create sustained value.

That said, strong profitability historically isn't what a company needs to justify equity upside. This is about what the company can do in the future, versus what the market expects it to do.

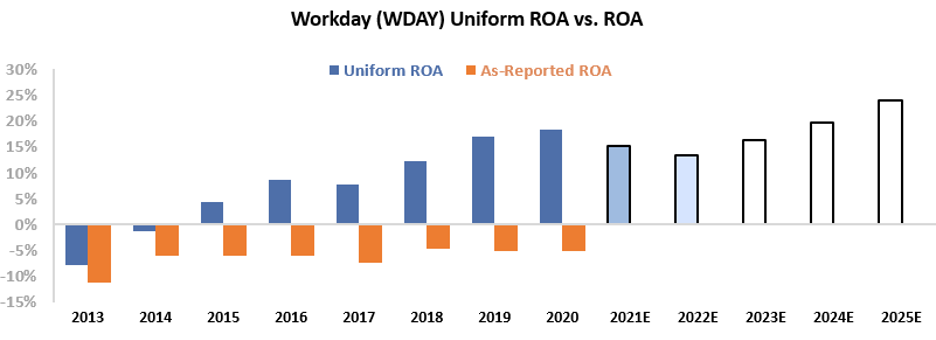

So to understand if the market thinks Workday can continue to create value, we can use the Embedded Expectations Framework to easily understand valuations.

The chart below explains the company's historical corporate performance levels, in terms of ROA (dark blue bars) versus what sell-side analysts think the company is going to do in the next two years (light blue bars) and what the market is pricing in at current valuations (white bars).

While analysts forecast Workday's returns to slip over the next two years, the market is pricing returns to continue growing well beyond current levels. This is despite the current economic uncertainty and cost rationalization caused by the pandemic.

The market appears to recognize that businesses still see Workday as an essential service, and so it believes returns will to continue on their upward trajectory...

Whether those high expectations will prove justified – or if Workday will exceed market expectations for returns, thus priming the stock to move higher – isn't completely clear. However, it's certainly clear that investors looking at the as-reported metrics wouldn't even understand why the market was so bullish.

Uniform Accounting shows the true strength of Workday's business... and the company's steady improvement historically helps explain the market's bullish outlook for the company.

Without Uniform Accounting, investors would miss this high-return company that's considered essential by its vendors... and would be thus left scratching their heads as to why valuations are so positive.

Regards,

Joel Litman

August 27, 2020

Our Director of Research attended his first concert since the coronavirus pandemic started...

Our Director of Research attended his first concert since the coronavirus pandemic started...