Many of Altimetry's U.S. employees, including our Director of Research, come from Northeastern University...

Many of Altimetry's U.S. employees, including our Director of Research, come from Northeastern University...

Northeastern's "hybrid" work/study model is unique in the world of higher education. Students typically complete two to three "co-ops" – six-month internships – while at the school. These programs give students the opportunity to spend extended periods of time gaining real-world experience.

Here at Altimetry, we just completed the latest round of interviews for our co-ops last Friday, and we're excited about the group we have joining us.

We know the value of a younger perspective in our business, so it made a lot of sense why our friends at MBO Partners recently acquired MindSumo.

MindSumo is a platform that connects thousands of college-aged problem solvers with businesses looking for solutions – including big firms such as Microsoft (MSFT), Disney (DIS), and Johnson & Johnson (JNJ). MindSumo takes clients' business problems and creates what it calls "challenges," which are then outsourced to groups within the company's network of problem solvers. These younger folks are submitting solutions to win money as well as recognition.

MindSumo takes advantage of a concept called "the wisdom of the crowd." This is the idea that large groups are collectively smarter than individual experts when it comes to solving problems.

By tapping into a large network of students, companies can benefit from the wisdom of the crowd. They also get perspective from younger consumers who might not be part of their normal resource pool, but are directly affecting demand for their products and the vision for the economy in the future.

For MBO, it's a logical extension to innovation around this type of consulting and staffing platform – the idea of bringing in "insight" as a service, just like employment as a service.

Like MindSumo's problem solvers, students choose Northeastern's co-op program to gain experience and improve their resumes...

Like MindSumo's problem solvers, students choose Northeastern's co-op program to gain experience and improve their resumes...

Northeastern students can graduate college with up to 18 months of work experience in their chosen field. And in an increasingly competitive labor market, this can help differentiate candidates.

Another firm spending time thinking about how to bridge the experience gap is Strategic Education (STRA). It's an education services holding company with multiple for-profit universities and academies that was formed in 2018 from a merger between Capella Education and Strayer Education.

Strategic has more than 100,000 students, most of whom are working adults looking for a flexible and cheap online university.

Strayer also owns the Jack Welch Management Institute, an online Master of Business Administration ("MBA") program. It was formed in conjunction with Jack Welch, the famous former CEO of General Electric (GE). Welch's legacy in the business world gives this online university a branding boost, which helps differentiate it from other online universities.

Strategic was well-prepared for the coronavirus pandemic, as more than 95% of classes were already taught online. The company was able to seamlessly convert the remaining classes to the online model without missing a step.

New enrollments are primarily driven by corporate partnerships, where employers bear the brunt of payments. This creates a more stable revenue stream, as larger corporations tend to have higher liquidity than the average American.

This means that investors would likely expect a stronger-branded and more stable employer-driven business model to lead to high returns.

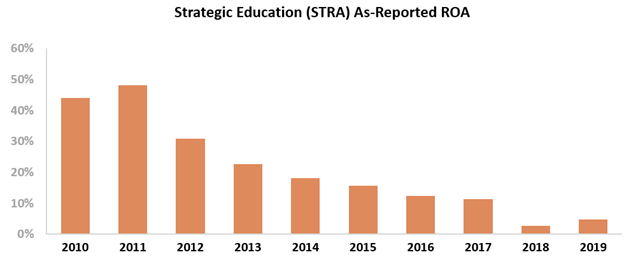

However, looking at the as-reported accounting, it appears that Strategic's acquisitions and focus on branding haven't helped its profitability. The company's as-reported return on assets ("ROA") has fallen from 44% in 2010 to 5% last year.

These returns would imply partnerships and branding have been unsuccessful in differentiating Strategic from competitors. Furthermore, it appears as though the 2018 merger with Capella has been value-destroying. Take a look at the drop...

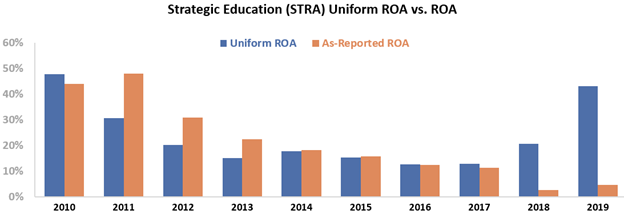

But due to distortions in as-reported accounting – including the treatment of goodwill – this picture of Strategic's profitability is inaccurate. The market is missing the full story...

Strategic's Uniform returns were similar to as-reported metrics until the Capella merger – the company's Uniform ROA rose from 13% in 2017 to a massive 43% last year. Strategic has clearly been able to consolidate the industry and integrate the new schools seamlessly onto its platform.

However, understanding the strength of historical returns doesn't tell us if STRA shares are undervalued or overvalued.

To find out if Strategic can continue to create value for shareholders, we can use the Embedded Expectations Framework...

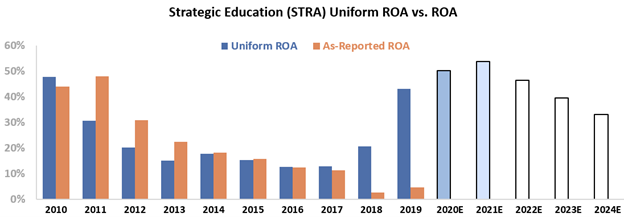

The next chart breaks down Strategic's historical corporate performance levels, in terms of ROA (dark blue bars) versus what sell-side analysts think the company is going to do in the next two years (light blue bars) and what the market is pricing in at current valuations (white bars).

As you can see below, analysts expect the company's returns to rise to 54%, while the market is pricing in returns to fall to 33% by 2024.

If Strategic can take advantage of tailwinds associated with the shift to online learning and continue to make beneficial acquisitions such as Capella, these expectations may be too pessimistic.

Many students are experiencing online education for the first time, thus creating an opportunity for Strategic to reach a larger segment of the population that may be seeking more affordable school.

Without Uniform Accounting, investors wouldn't have seen the true strength of Strategic's returns... instead seeing below-average, declining profitability.

Furthermore, the market is pricing in Strategic's returns to fall from their recent highs. And if the company can continue to capitalize on the growth of online education, these expectations may be far too low. This means STRA shares could be poised to move higher.

Regards,

Joel Litman

October 15, 2020

Many of Altimetry's U.S. employees, including our Director of Research, come from Northeastern University...

Many of Altimetry's U.S. employees, including our Director of Research, come from Northeastern University...