The world runs on America's currency...

The world runs on America's currency...

It's been that way since the end of World War II and the signing of the Bretton Woods Agreement.

As of 2023, central banks across the globe held around 60% of their foreign exchange reserves in U.S. dollars... three times as much as the closest competitor, the euro.

The dollar is also the most widely used currency in international trade and financial transactions... involved in nearly 90% of all foreign exchange market transactions.

Its widespread use and the strength of the U.S. economy are why people consider it a "safe haven" in times of economic crises.

Despite all that, there have been rumors of the greenback's potential downfall...

Not long ago, China tried to promote the yuan as a global trade currency that could shake the dollar from its throne.

Recently, there has also been talk about BRICS – an intergovernmental organization formed by Brazil, Russia, India, China, and South Africa – trying to come up with its own currency to replace the dollar.

However, as we'll discuss today, a recent report from the International Monetary Fund ("IMF") on global capital flows shows that the dollar isn't going anywhere... In fact, the dollar and the U.S. economy are ripe for further investment.

According to the IMF, one-third of the world's capital has flowed into the U.S. since the pandemic...

According to the IMF, one-third of the world's capital has flowed into the U.S. since the pandemic...

Pre-pandemic, that number was just 18%.

In other words, the U.S. is growing its position as the leading destination for foreign investments.

And more foreign investment and capital inflows translates into more trust in the U.S. economy and its currency.

China – the U.S.'s biggest competitor – on the other hand, is hurting from a lack of investment... Over the same period, China's share of global capital inflows fell from 7% to 3%.

One of the drivers behind the increase in capital flowing to the U.S. – and away from China – is interest rates.

U.S. interest rates are at their highest level in the past two decades. China, on the other hand, has been actively lowering its interest rates in an effort to revive the country's economy.

Its one-year loan prime rate – the benchmark for corporate and consumer loans – is just 3.45%... down from above 4% pre-pandemic.

The U.S. government is still considered one of the safest investments in the world. So if investors can get a higher yield from a safer investment, that's what they're going to do.

Not to mention, investors know that U.S. corporations are still among the best in the world...

Not to mention, investors know that U.S. corporations are still among the best in the world...

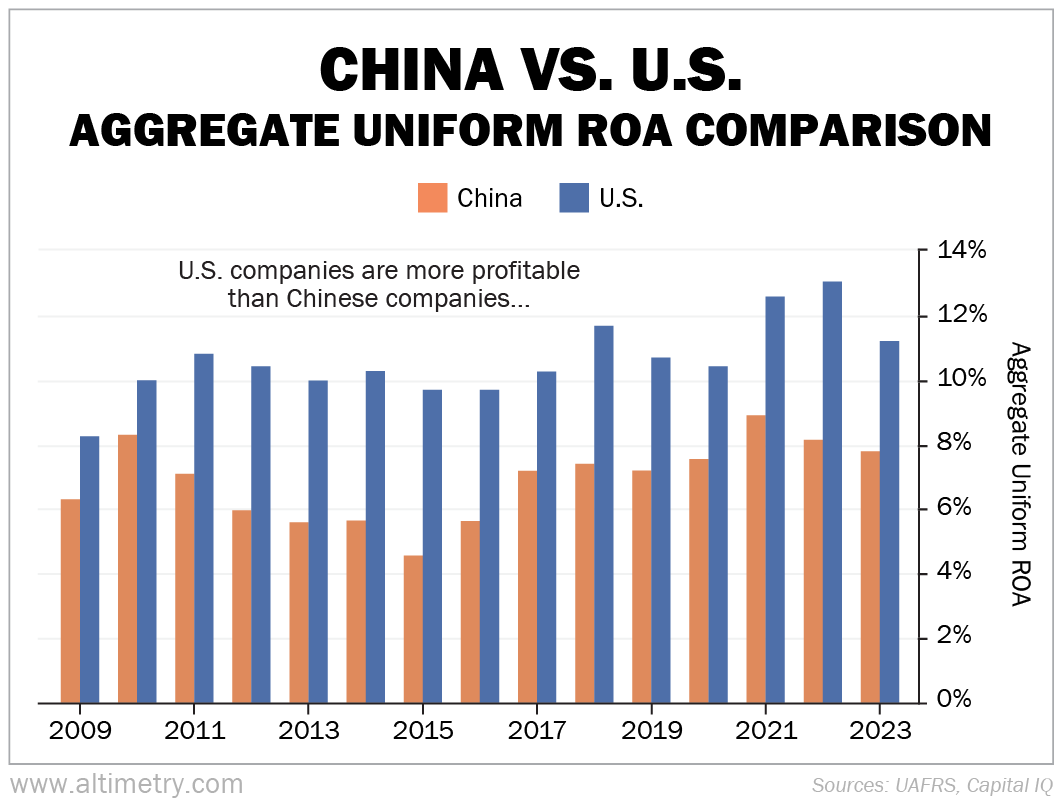

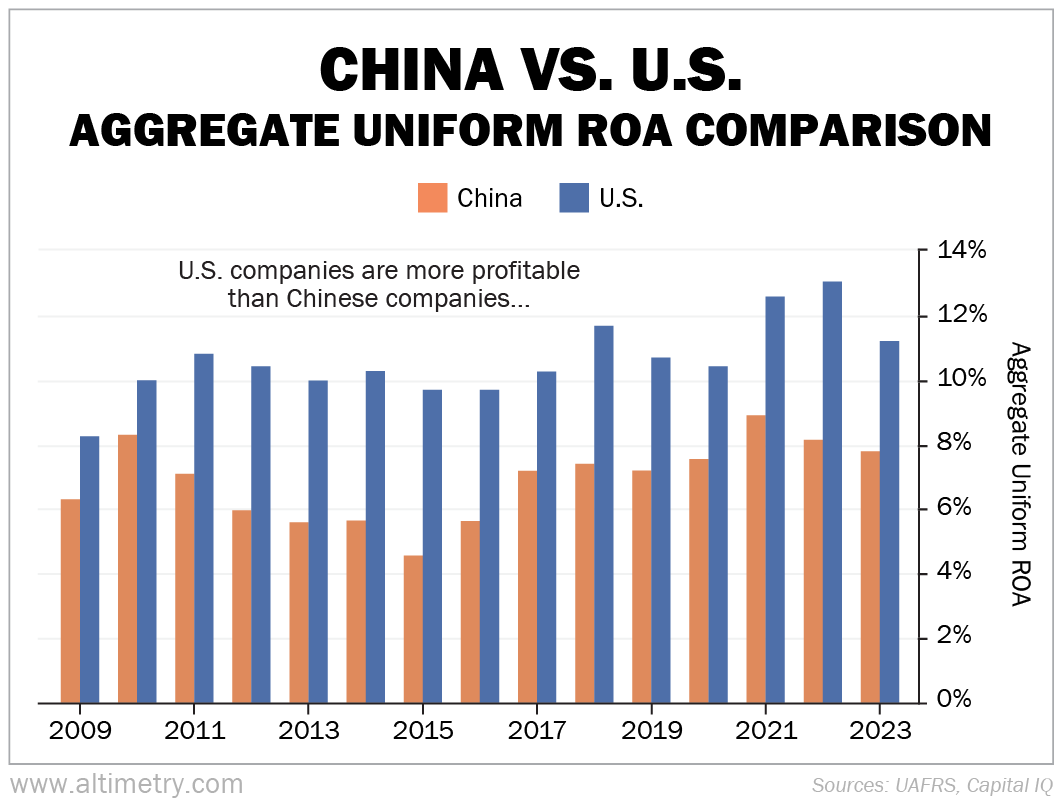

We can see this by looking at U.S. companies in aggregate versus Chinese companies.

Rather than looking at an individual company's Uniform return on assets ("ROA") like we normally do, we can combine the assets and returns of all public companies in a country to get a sense of how profitable the overall economy is.

Since 2009, aggregate Uniform ROA for U.S. companies has been higher than for China's companies.

Take a look...

The U.S. has been more profitable than China for 15 straight years... And it's not slowing down anytime soon.

It has had some of its most profitable years ever since 2021 – and it's easy to see why...

It has had some of its most profitable years ever since 2021 – and it's easy to see why...

For starters, the U.S. leads the world in oil and gas production. And more and more countries are relying on our energy industry as geopolitical tensions ramp up.

In addition to America's energy dominance, it also heavily invests in its supply-chain infrastructure. U.S. companies are bringing their supply chains closer to home – in what we call the "supply-chain supercycle" – and it's creating countless investment opportunities in the space.

Moreover, the U.S. is the world's front-runner in artificial intelligence ("AI") investments. In 2023, U.S. private investment in AI was roughly $68 billion... more than double that of the rest of the world's investments combined.

AI in particular is a way for the American economy to stay on top... especially with companies like U.S. chip giant Nvidia (NVDA), which managed to become the largest company on Earth last month.

Plus, the U.S. is still investing in AI. We're spending billions of dollars on semiconductor plants... more data centers... and everything else that will continue to drive the AI boom.

All of this should bring even more investment to the U.S. dollar... not less.

Regards,

Joel Litman

July 15, 2024

Editor's note: This Thursday, July 18, at 1 p.m. Eastern time, Altimetry founder Joel Litman is stepping forward to reveal an AI story nobody is talking about.

In short, Joel believes that coming news from Silicon Valley will kick off a $10 trillion move... starting in a matter of days. It's likely to have a dramatic impact on your money – whether you own AI stocks or not. To learn more – and reserve your free seat to Joel's "AI Panic Summit" – click here.

The world runs on America's currency...

The world runs on America's currency...