America fails to make the infrastructure grade...

America fails to make the infrastructure grade...

A few weeks ago, one of Wall Street's darling economists went onto Bloomberg News to talk about the current state of infrastructure in the U.S.

Abby Joseph Cohen was the chief investment strategist at Goldman Sachs (GS) before retiring in 2008, although she still serves as an economic advisor to the firm.

Throughout the course of the interview, she explained how U.S. infrastructure spending is at all-time lows when compared against GDP. Across the country, we can already see the effects of this...

- A recent crack in a Mississippi River bridge that passed inspection, which then held up the river's traffic for days, highlights doubts about the health of aging construction.

- Colonial Pipeline – the largest pipeline in the U.S. for refined oil products – suffered a ransomware attack and was forced to go offline to address the issue.

- Texas' winter storm earlier this year crippled the entire power grid, which points to other problems in both state and federal budgeting.

The American Society of Civil Engineers ("ASCE") gives the U.S. a yearly grade for its infrastructure, with the country receiving a "C-" on its 2021 report card. The ASCE forecasts a required cost of more than $2 trillion to make America's infrastructure reflect its needs.

Cohen highlights that investors should be aware of the need for infrastructure over the next few years and prepare their portfolios accordingly.

More important, as she said in her Bloomberg interview, one of the big issues with an infrastructure recovery isn't necessarily government spending... It's corporate spending.

Management teams are now reluctant to invest...

Management teams are now reluctant to invest...

Cohen highlights a key issue building in the economy we have brought up before here at Altimetry Daily Authority.

Recently, total U.S. private sector investment isn't keeping pace with cash flows. That means management teams aren't investing as much to maintain their company's earning power.

As we move further into 2021, counterintuitively, management teams have less confidence in future demand. This means they're less willing to invest their money now into the future.

Without growth in investment accelerating, earnings growth is capped. Management is sacrificing future earnings to conserve resources now.

To understand why management teams are easing up on the gas pedal, we can turn to two of our tools to gauge management sentiment...

To understand why management teams are easing up on the gas pedal, we can turn to two of our tools to gauge management sentiment...

Here at Altimetry, one way we get insight into what management teams across the market are really thinking is by leveraging our Earnings Call Forensics framework and tracking overall management confidence and concerns.

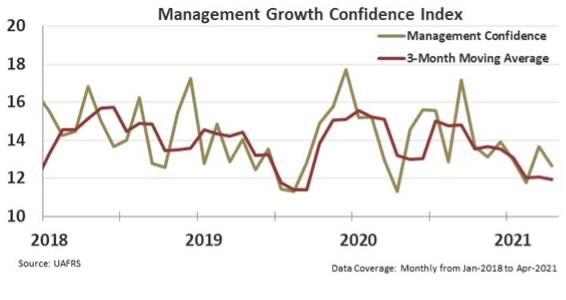

By gauging "confident" and "concerned" statements against each other, we can compile a Management Growth Confidence Index. We can track when management teams have confidence. This sentiment generates highly confident ("HC") and excited ("EXC") markers. When management teams are more concerned and holding back on their outlook, it generates highly questionable ("HQ") markers.

We combine all those signals together into this one ratio. When the olive one-month ratio line and the maroon line, which is the three-month average of this ratio, are lower, it signals management teams are less confident about their outlook. When these are higher, it means management is getting more bullish about the opportunities they see.

If management teams are more confident, they're more likely to commit to investing in growth. This means they'll have more HC and EXC markers compared to HQ markers during calls.

As you can see below, management sentiment fell below late 2020 highs, when companies had easy access to stimulus cash and were excited about growth opportunities. This growing negativity translates into the unwillingness to put money to work that Cohen discussed.

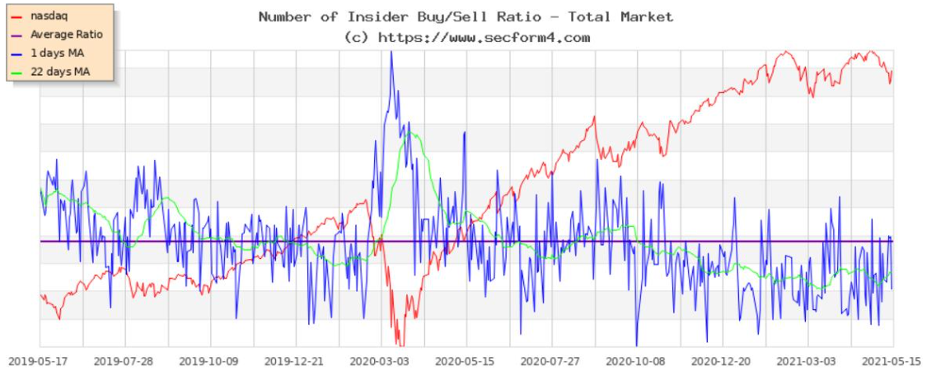

Another tool we can use to measure management sentiment is insider buying levels.

By looking at a combination of insiders' buying versus selling of stocks for a wide swath of U.S. corporations, we can understand not just how management teams are thinking about their corporate outlook... We can also understand how they're voting with their wallets.

Take a look at the chart below from SecForm4.com. Insider buying to selling (the green line) has trended well below average levels over the past few months, as management teams are waiting out the current market rally for a more opportune time to invest.

These two metrics together give us the context to see that management teams aren't as confident about the future as they were during the initial recovery from the coronavirus pandemic.

As we have talked about over the past few weeks, this market exuberance isn't a reason to panic and sell your stock... But it is a reason to expect that the market isn't going to keep on marching higher, as it has the past 15 months.

Investors should be ready for volatility in the short term, similar to 2015 and 2018.

If you're looking for monthly insights pulling together the facts of the market – and exactly how you should be adjusting your investment strategy – our Altimeter service has the answers...

Along with giving access to the Uniform Accounting data for more than 4,000 companies, we break down important economic trends in our monthly Timetable Investor feature for Altimeter subscribers. This tells you exactly how to navigate concerns like government spending and stimulus, management sentiment, and more. Get the details about The Altimeter right here.

Regards,

Joel Litman

June 7, 2021

America fails to make the infrastructure grade...

America fails to make the infrastructure grade...