Folks just don't want to work in person anymore...

Folks just don't want to work in person anymore...

For months, we've been warning that office real estate is in a pickle. Major metropolitan areas like New York City and San Francisco are struggling to fill office space. Vacancy rates in these cities climbed to 22% and 24%, respectively, in the fourth quarter of 2022.

Many employees have balked at being asked back to the office. They've invested in better work-from-home setups and have even increased their Internet speeds to boost productivity. And they're reluctant to part with the added time they save from not having to commute every day.

In short, the typical in-person workweek looks a lot different from four years ago...

According to software reviewer GetApp, 78% of employees still work remotely some of the time. Most workers commute on Tuesdays, Wednesdays, and Thursdays.

That's not just hurting office real estate... It's crushing all the businesses that cater to the in-person work crowd.

An uptick in remote work means less money spent on train tickets and subway rides, gas at the pump, parking costs, lunch bills, and even shopping after work.

Bloomberg recently reported that in Manhattan alone, workers are spending $12 billion less per year due to fewer days in the office.

The in-person workweek seems to have settled at three days per week – and it's likely to remain that way. Companies focused on the office crowd will have to make some changes... or get left behind.

Today, we'll take a look at one coffee giant that has passed the pandemic test. At first glance, as-reported numbers make it look like it's struggling. But it has actually used COVID-19 to become stronger. That could make it a great opportunity for investors.

Starbucks (SBUX) makes a good deal of its money from office workers...

Starbucks (SBUX) makes a good deal of its money from office workers...

With the in-person workweek shrinking from five days to three, that means Starbucks should lose about 40% of its commuter revenue.

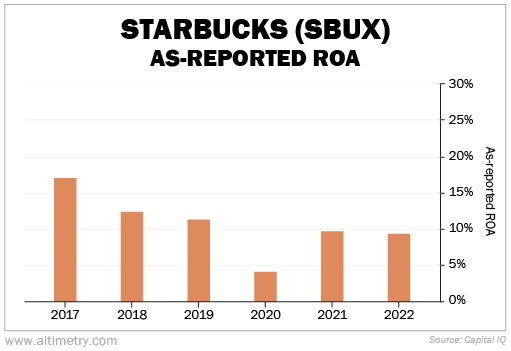

And if you look at the as-reported numbers, that appears to be the case...

Starbucks' as-reported return on assets ("ROA") has been steadily declining. It fell from roughly 16% in 2017 to 4% in 2020. It has recovered a bit since then, to just below 10% last year. But that's still low compared to historical levels.

Take a look...

Even though as-reported ROA is down, the company is still growing. In 2018, Starbucks had just over 29,000 locations worldwide. As of 2022, that was up to almost 36,000.

That sounds like bad management. Starbucks is growing while its sales opportunities are dwindling... or so it seems.

In reality, that couldn't be further from the truth.

The past two years were actually Starbucks' best ever...

The past two years were actually Starbucks' best ever...

Revenue was $27 billion in 2019. And while it fell to $24 billion in 2020, it surged past $32 billion last year.

The reason is simple... Starbucks changed its strategy.

Rather than building big stores in city centers, the company started opening small locations that can fulfill more to-go and drive-thru orders. That actually makes the stores more efficient. By mid-2021, drive-thru sales were more than half of total revenue, and mobile orders were over a quarter. Those were record highs for both sales channels.

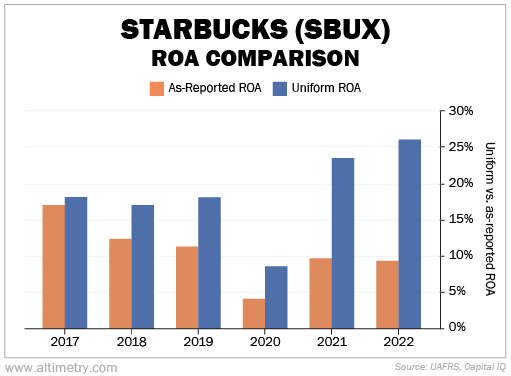

The Uniform data shows us how this translated to performance. Starbucks' Uniform ROA was around 18% per year before the pandemic. That's slightly above the 12% corporate average.

Of course, that number fell in 2020. The world was locked down and folks were no longer grabbing coffee on the way to the office. Uniform ROA plunged to 9%.

But it didn't stay down for long... Profitability surged right after the pandemic. That's the opposite of what we saw with as-reported data.

Starbucks' Uniform ROA jumped from 9% in 2020 to 24% in 2021 and 26% in 2022. Those are historically high levels for the company. Check it out...

This is a company that knew it had to change its strategy. Employees are switching to "hybrid" work models. Starbucks is beefing up its to-go offerings accordingly.

Starbucks is proof that you shouldn't write off every company that caters to the office crowd...

Starbucks is proof that you shouldn't write off every company that caters to the office crowd...

The coffee giant seems to be a valuable exception to the rule. Many companies are still struggling to cope with the three-day in-person workweek. But others have met the challenge head-on...

Before you write off every company that caters to the working crowd, make sure you take a look under the hood. Some companies are adapting well to the new workweek.

The changes to Starbucks' business strategy allow it to meet the needs of post-pandemic workers. It's only a matter of time before the market rewards its efforts.

Regards,

Rob Spivey

February 28, 2023

Folks just don't want to work in person anymore...

Folks just don't want to work in person anymore...