We've covered the tug of war between employers and employees extensively this year...

We've covered the tug of war between employers and employees extensively this year...

In short, as we put the COVID-19 pandemic behind us, most bosses want their workers back in the office. And most workers want to keep doing their jobs from home.

We've discussed this back-and-forth struggle many times so far in 2022 (like here, here, and here). Specifically, in those essays, we looked at how the "future of work" is critical for various real estate owners.

The future of work looks much different depending on where you live...

Companies in big cities like San Francisco and New York dominate the finance and tech industries. In those places, the return to work has been a huge challenge...

According to research from real estate company CBRE, the office vacancy rate in San Francisco climbed to 24.2% in the second quarter. And in Manhattan, the vacancy rate reached an all-time high of 15.2% that quarter.

However, outside of the major cities, the return-to-office battle doesn't exist.

That's right... In the more rural parts of the U.S., the debate is already over. Most people are back at their offices.

The return to the office happened without much buzz in many cities. People are happy to return to the office in places where the commutes were never that bad in the first place.

In cities with populations of less than 300,000, the share of full days worked from home dropped from 42% in October 2020 to 27% this past spring. However, in the largest 10 U.S. cities, the share of full days worked from home increased from 38% to 50%.

The different mindsets about returning to the office are clear. It's all about location.

This disparity creates unequal opportunities in different regions...

This disparity creates unequal opportunities in different regions...

Real estate investment trusts ("REITs") benefit from employees returning to their offices.

But as I said, demand for office space isn't the same in all parts of the U.S. right now. And that's creating a divergence in investment opportunities with REITs...

It's easy to focus on the "flashiest" players in the REIT space. By that, I'm talking about the companies with the most glamorous real estate...

Boston Properties (BXP) is a great example. It's the largest publicly traded owner of "Class A" office properties in the U.S. It owns high-profile buildings in major cities like New York, San Francisco, Los Angeles, and Washington, D.C.

But the reality is that smaller REITs like Highwoods Properties (HIW) are in better locations today...

Highwoods Properties focuses on secondary markets like Richmond, Pittsburgh, and Orlando. And as I alluded to earlier, demand for office space is much higher in those markets right now.

Employers are getting workers back into the office in smaller cities due to huge demand for jobs. New York and San Francisco are being left behind in job growth by places like Austin, Nashville, and Raleigh.

But of course, the most important thing is what Mr. Market thinks...

But of course, the most important thing is what Mr. Market thinks...

Investing without knowing what Mr. Market thinks is no better than going to Las Vegas and gambling. You're totally in the dark without knowing what's already priced in.

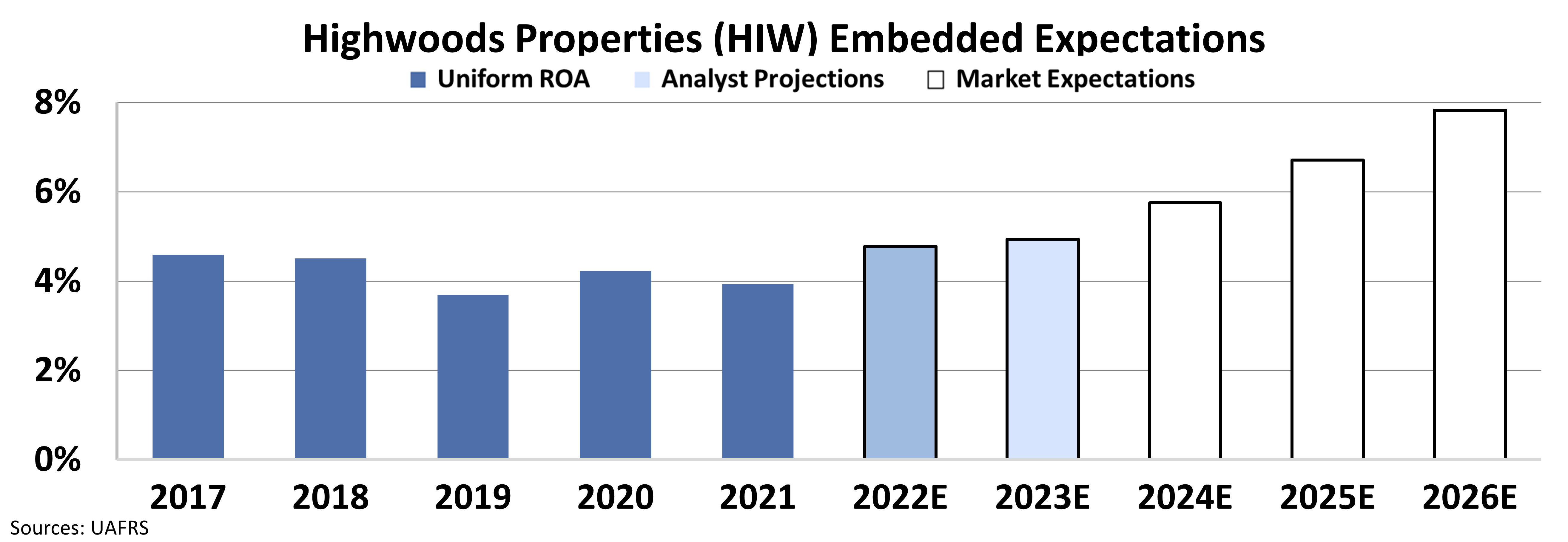

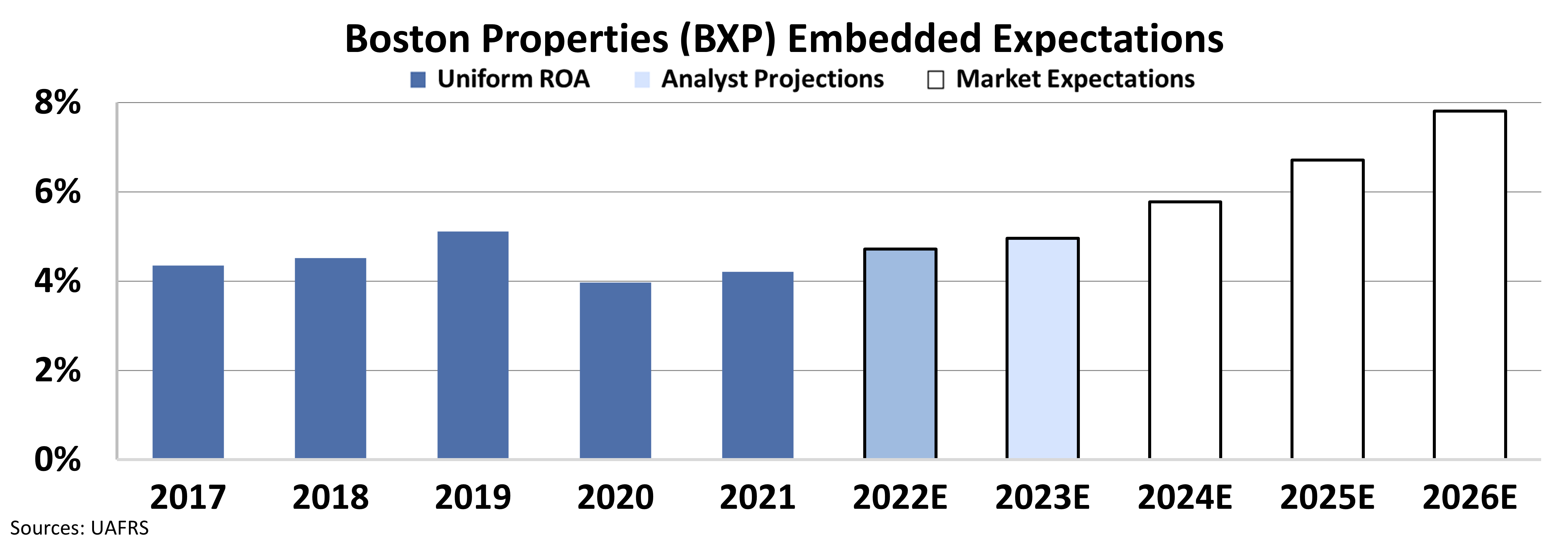

By using our Embedded Expectations Analysis ("EEA") framework, we can see what investors expect these companies to do at their current stock prices...

Stock valuations are typically determined using a discounted cash flow ("DCF") model. The DCF model makes assumptions about a company's future and produces the "intrinsic value" of a stock.

But here at Altimetry, we know models with assumptions based on distorted metrics from generally accepted accounting principles ("GAAP") only come out as garbage. Therefore, instead of relying on GAAP, we use the current stock price with our EEA to determine what returns the market expects.

And in short, our EEA shows that the market expects a similar recovery for both Boston Properties and Highwoods Properties at current valuations. Take a look...

As you can see, the market currently expects both companies' Uniform return on assets ("ROA") to climb to close to 8% over the next four years.

In other words, many investors could be making a costly mistake...

With news of folks returning to offices, investors have been piling into REITs no matter where their office space is. But as we've discussed, not all REITs are equal right now...

Highwoods Properties' real estate portfolio is perfectly positioned in smaller regions of the U.S., where demand for office space is much higher. That's why it has a better chance of turning the market's high expectations into a reality over the next four years.

Meanwhile, Boston Properties focuses on large cities. And if employees continue to battle their bosses about returning to offices, the company's stock could disappoint investors.

Regards,

Rob Spivey

August 11, 2022

We've covered the tug of war between employers and employees extensively this year...

We've covered the tug of war between employers and employees extensively this year...