More than 38 million people caught on to the 'EQ hazards' of The Social Dilemma documentary...

More than 38 million people caught on to the 'EQ hazards' of The Social Dilemma documentary...

My coaching comments for our global team often revolve around the subject of "EQ," or the emotional quotient (more commonly known as "emotional intelligence").

From Benjamin Franklin to Carl Sagan to Warren Buffett, folks have emphasized how temperance and emotional control are critical to an individual's success. Failure to have emotional control leads to terrible decisions, both in investing and in general.

I recently watched a great in-depth conversation between podcaster Joe Rogan and Tristan Harris, one of the key players in the Netflix (NFLX) documentary The Social Dilemma. The documentary examines how the algorithms of popular platforms such as Facebook (FB), Twitter (TWTR), and Instagram turn many people into social media addicts.

In the interview, Harris discussed some details about how the social media algorithms work. These massive artificial intelligence ("AI") engines are designed to get people to spend more time and attention on a social media platform – primarily to induce ad sales.

By hijacking your EQ – an "amygdala hijack" – the algorithms can make people stop thinking rationally and devote inordinate amounts of time and attention to things that make them emotional.

The more compelling the media topic, the more likely it is that people will drop everything and become fixated... Those people then spend more time on the platform, which is great for ad sales.

So, somewhat inadvertently, the massive engines of social media are playing on our emotional weaknesses. They then exacerbate that weakness – essentially making people less emotionally intelligent.

The amygdala hijack happens in the part of the brain that powers strong emotions, including "fight, flight, or freeze." In almost all cases, unless you're literally running from a bear or hunting wild boar, this triggers a much larger emotional reaction than is warranted.

We're innately hardwired to respond that way. It helped the human race rise to conquer the globe.

However, with stronger EQ, we can recognize emotional manipulation. We can take a few deep, slow breaths to reset our vagus nerve. Then we can ignore the often-inflammatory nature of what shows up in the right-hand selections of "up next" on YouTube or that next post on Facebook.

For those with higher EQ, the algorithms will learn and push less divisive content. By learning to block out the amygdala hijack, social media search engines can better serve the purposes for which you really want to use them.

But Facebook and Twitter aren't the only companies relying on algorithms...

But Facebook and Twitter aren't the only companies relying on algorithms...

Other social media platforms like online dating sites and apps benefit as well.

Just consider Match Group (MTCH) – the dominant player in the online dating space.

The company owns popular brands like Tinder, Match.com, PlentyofFish, and OkCupid. It benefits from the "illusion of choice" – a powerful phenomenon we've discussed numerous times here at Altimetry Daily Authority. Consumers believe they have a variety of different brands to choose from. In reality, five out of the top seven online dating brands by size fall under the Match umbrella.

Match uses algorithms in all of its brands to bring users together. Ultimately, people come to online dating for its convenience, efficiency, and large pool of candidates.

Optimized for each user based on individual preference, the algorithms are what make the dating app world work... and what make people come back for more.

Each brand has unique features that tailor how the algorithm pairs users together. Hinge focuses on liking prompts on other users' profiles. Tinder is known for its famous "swipe right" feature.

Match makes most of its money through a "freemium model." Users get access to a certain number of features for free and have the option of upgrading to a premium paying experience.

The company also benefits from the "network effect." The more people using a service, the more value each user gets out of the platform. And Match's network effect is strong, with 47% of singles between ages 18 to 24 using a dating app today – up from only 16% in 2012.

As more people join the apps, the value increases due to the greater pool of potential candidates. It also normalizes the process of online dating, driving more people to Match's products.

Tinder is the best example of this, considering that it's far and away the largest platform for online dating. Consumers are essentially forced to use the app because of the sheer size of the user base at around 8 million people. This increases the value of the network and creates a virtuous cycle for Match.

Match dominates this fast-growing market...

Match dominates this fast-growing market...

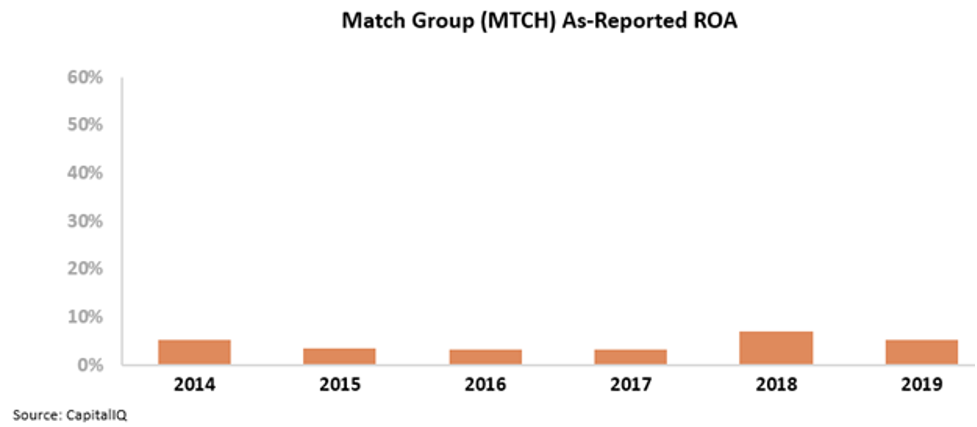

Therefore, investors would expect its profitability to be high. And yet, looking at the as-reported metrics, it appears Match has cost-of-capital returns at best – with an as-reported return on assets ("ROA") of 5% last year. The company appears to be unable to capitalize on its dominant market position.

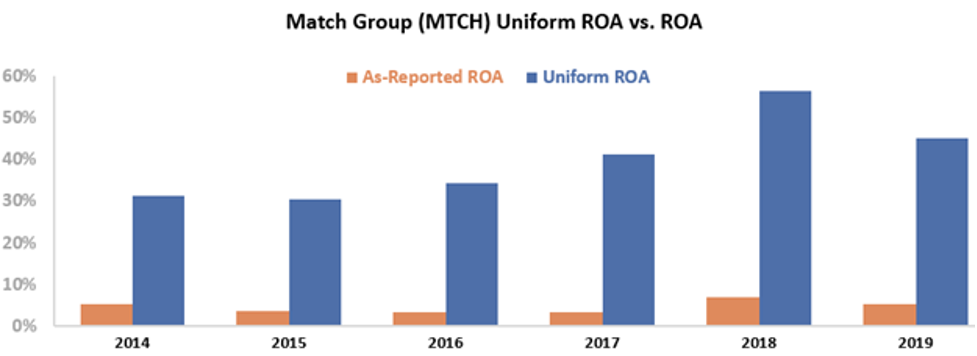

But this picture of Match's performance is inaccurate... and it's because of the distortions in as-reported accounting.

Due to GAAP's treatment of excess cash and stock option expense – among other distortions – Wall Street has missed the mark on Match's profitability.

The company's real returns have been nearly five times the as-reported numbers since 2014. Just last year, its Uniform ROA was 45% – far higher than the 5% as-reported figure. Take a look...

A 40% ROA is impressively profitable and indicates the power of Match's algorithms to figure out what people want and keep them coming back to the company's platforms.

Without Uniform Accounting, investors might view Match as a company with cost-of-capital returns... But once we make adjustments to the distorted GAAP numbers, we can see how Match is capitalizing off its market position to print money.

Regards,

Joel Litman

November 20, 2020

P.S. Match has benefited greatly since people have been stuck at home during quarantine, and the stock has responded – up more than 175% since March. But it's not the only one...

In our Altimetry's Hidden Alpha newsletter, we've found the best ways to play the massive trend of folks spending more time – and money – at home. With any great economic shift comes opportunity for anyone who spots it quickly enough... Click here to learn more.

More than 38 million people caught on to the 'EQ hazards' of The Social Dilemma documentary...

More than 38 million people caught on to the 'EQ hazards' of The Social Dilemma documentary...