How is the alcohol industry holding up?

How is the alcohol industry holding up?

In yesterday's Altimetry Daily Authority, we highlighted a company that has done a great job collecting a group of affordable alcohol brands to build a strong return-on-assets ("ROA") business.

Constellation Brands (STZ) – which owns popular brands like Kim Crawford wine, Svedka vodka, and Ballast Point craft beer – has spent decades acquiring brands with mass appeal.

But one aspect we didn't discuss yesterday is how the pandemic is affecting the company's business. We have to consider a few conflicting trends...

First, bars, restaurants, and entertainment venues around the country are shut down. That's a huge loss for alcohol manufacturers, who distribute a substantial portion of their product for "on premise" consumption. That means that for many producers, a huge chunk of their sales have dropped off almost overnight.

Second, offsetting the first, more Americans – and people across the globe – are buying larger volumes of alcohol for home consumption. A recent report from data-measurement firm Nielsen highlights that in-store alcohol sales for home consumption has grown 21% during the pandemic compared to the prior year, while online sales have grown more than 230%.

Furthermore, consumers are turning towards volume over quality. This could actually be a saving grace for Constellation, which is benefitting from the ironic boom in sales for its Corona brand beer.

As we covered yesterday, Constellation owns the U.S. distribution rights for Corona, Modelo, and Pacifico – all of which have performed relatively well since mid-March.

The at-home strength hasn't been enough to completely offset the weakness for Constellation's main customers, though... so the markets are bearish towards the company's stock.

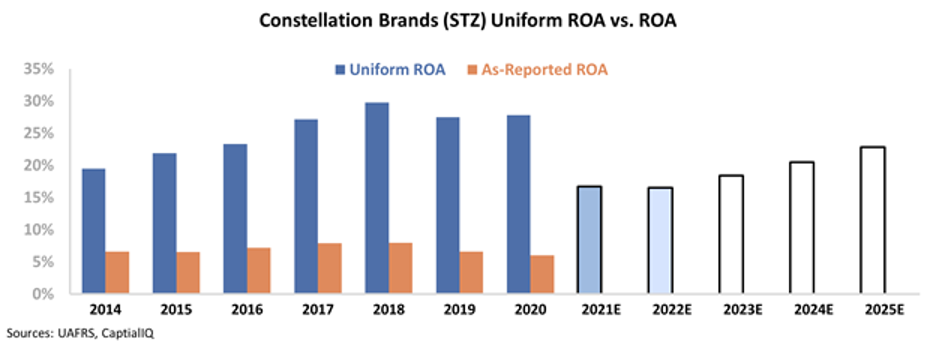

The chart below shows Constellation's historical performance as represented by Uniform ROA (dark blue bars) compared to analyst expectations for the next two years (light blue bars) and market expectations at current stock prices (white bars).

As you can see, both analysts and investors expect to see a massive, permanent drop-off in profitability – with Constellation's Uniform ROA falling from 28% to 17% in 2021... and only recovering to 23% five years from now.

Much like medical-devices firm Integra LifeSciences (IART) – which we discussed on Wednesday – Constellation is likely to have short-term business headwinds at worst, with the potential for little interruption considering the initial results of its top brands.

As such, market expectations for sustained weakness appear far too bearish... and Constellation may be a company to watch going forward.

'ESG' is a popular topic in the investment community...

'ESG' is a popular topic in the investment community...

For years, we've seen a growing trend towards investing in companies that score high in environmental, social, and governance ("ESG") practices.

For many businesses, the movement stems from the fact that it's the morally "right" thing to do... and that all else being equal, there's no reason not to support companies that support the environment and their communities.

That said, the movement was initially met with a lot of criticism. Early indications showed that ESG companies and portfolios tended to underperform the market... meaning the time, money, and resources those companies were devoting to the environment weren't actually helping investors.

This led "ESG" to become a dirty term in some circles, and the movement treaded water for many years. As an investor, why would you sacrifice stock returns for some opaque concept like an "environmental impact score"?

But recently, more investors have started to come around to the movement, and are seeing the potential value of buying sustainable companies.

Last fall, the International Monetary Fund ("IMF") published a report claiming that more than 1,500 global equity funds have "sustainability mandates" as part of their investment strategy. A study of those funds came to a different conclusion than earlier studies – these funds perform in line with non-ESG oriented ones.

For some investors, that changes the algebra. If you can get the same returns supporting ESG and not, there's an argument to be made that investing in firms with improving ESG practices could be worthwhile.

A great example is a business you might not expect to focus on the environment – Stanley Black & Decker (SWK).

While you probably know the company for its power tools and related products, behind the scenes, Stanley Black & Decker has been pushing hard to support the environment.

In 2018, the company implemented a corporate social responsibility ("CSR") initiative to reduce its various emissions by between 35% and 100% by 2030.

Though it unveiled the plan in 2017, Stanley Black & Decker has been working hard since 2015 to start down the right path. For five consecutive years, the company has improved its scores in factors like energy intensity, waste intensity, carbon intensity, and water intensity.

By no means are these improvements without tangible costs – the company has spent significant cash to improve its business for the long term.

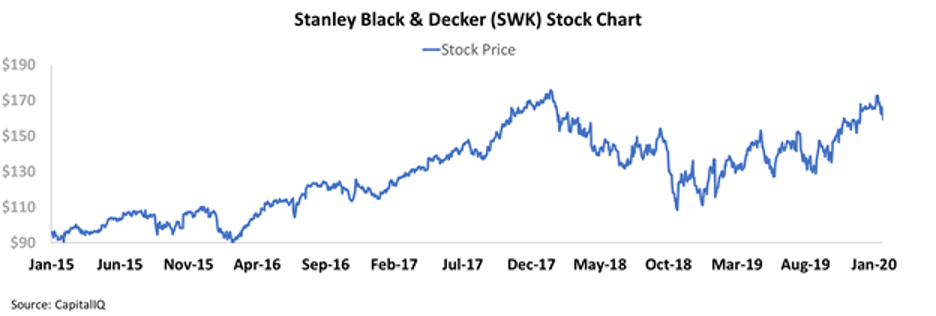

Despite the potential loss of short-term profit, Stanley Black & Decker performed fairly well towards the end of the recent bull market. Prior to the escalation of the coronavirus pandemic, SWK shares had returned more than 65% over the past five years...

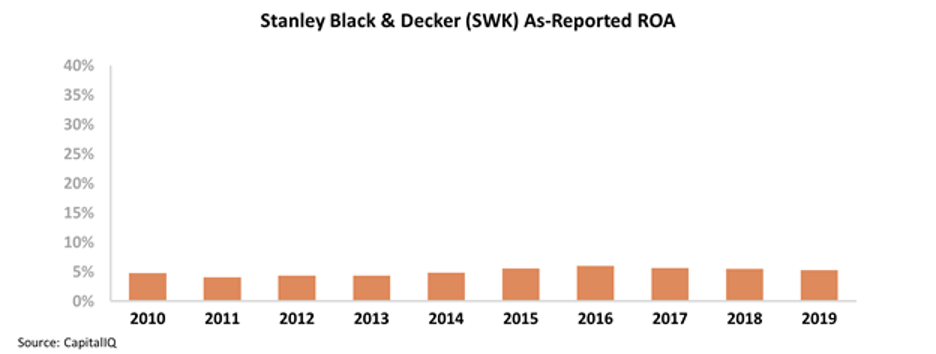

But looking at Stanley Black & Decker's as-reported profitability, it's tough to see why the stock was up so much.

For the past five years – and even as far back as a decade – the company's profitability has been stable but weak. Maybe its ESG initiatives were holding it back more than investors realized?

The company's ROA has ranged between 4% and 6%, which is at or below long-term corporate averages.

At these levels, it's puzzling why investors would be willing to reward this stock.

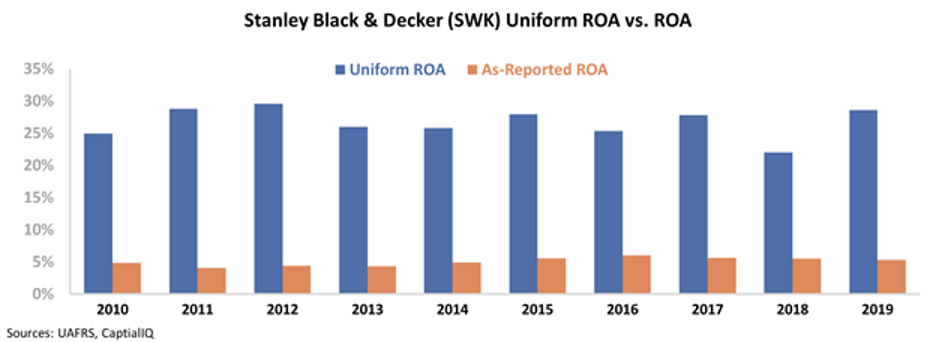

But Uniform Accounting metrics help us understand why investors like Stanley Black & Decker...

After making the proper adjustments to the company's as-reported financial statements – adjusting for misleading line items like operating leases, research and development, and goodwill – we can see that Stanley Black & Decker's profitability is both robust and stable despite its ESG investments. Take a look...

This is a great example of how ESG investments can reward investors considering all else stays equal.

Stanley Black & Decker's commitment to reducing its environmental impact hasn't hurt returns, but it has prepared the company for any potential changes in environmental regulations and made its stock more popular among ESG investors – thus supporting valuation levels.

Despite the fact that investments into ESG initiatives might not directly add value to shareholders, as long as companies can do so without destroying economic value like Stanley Black & Decker has managed to do, that might be a benefit by itself.

Regards,

Rob Spivey

June 5, 2020

How is the alcohol industry holding up?

How is the alcohol industry holding up?