Teck Resources (TECK) was dead set on spinning off its coal business...

Teck Resources (TECK) was dead set on spinning off its coal business...

Canada's largest miner announced the plan back in February. It intended to get rid of coal and focus entirely on metals used in the transition to clean energy.

But commodity giant Glencore (GLEN.L) had other plans. Two months later, it sent Teck a bid to cancel the split. Glencore wanted to buy the whole company for nearly $23 billion.

At first, Teck's management said no way. Teck has been actively trying to get out of the fossil-fuel business on behalf of its shareholders. Management feared a Glencore takeover could undermine that plan.

But in the past few weeks, the conversation has gotten more intense. Glencore promised Teck's shareholders that it would still split up the two businesses and would buy shareholders out of their exposure to coal. It could spend as much as $8.2 billion doing so.

It's clear Glencore means business. And it's puzzling considering that most merger and acquisition activity has dried up this year.

Glencore is clearly keen on buying Teck. Today, we'll look at why that might be... and whether Teck would be smart to take the current deal.

Commodities are hot... unlike the rest of the market.

Commodities are hot... unlike the rest of the market.

Prices have stayed high thanks to trends like the transition to clean energy and

the supply-chain supercycle. Some folks are even using commodities like gold to hedge against inflation. So the sector has held strong, even when other industries have faltered.

Teck is the biggest Canadian player in a lot of these trends... especially with metals used in the transition to clean energy. Glencore knows this, and it knows that these commodity prices are likely to keep rising as demand grows.

Teck clearly knows what it has, too. That's why it's not so willing to sell at any price.

As we go to press, Teck hasn't said yes or no. But it's weighing its options and thinking about ways to demand more money.

At a $23 billion valuation, Glencore would be getting Teck for a steal...

At a $23 billion valuation, Glencore would be getting Teck for a steal...

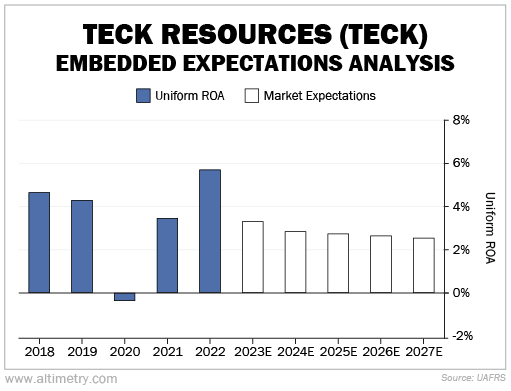

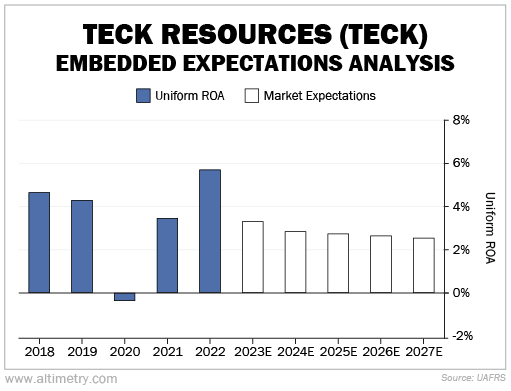

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today... or in this case, a prospective bidder.

In the past five years, Teck's median Uniform return on assets ("ROA") was about 4%. But take a look at the white bars in the chart below. They show what investors expect from the company through 2027.

Since Glencore's bid, Teck's market cap has hovered around $23 billion. To justify that $23 billion valuation, Teck only needs to return 3% per year in the future.

That means if the deal goes through and Teck keeps returning 4% per year, it will be more productive than what Glencore paid for it. Said another way, Teck should be worth more than $23 million to Glencore.

Glencore clearly understands this. It's trying to consolidate its position as a commodity giant at a good discount.

Teck shareholders better hope management fights for a higher bid... or that it goes through with its original spinoff of the coal business.

Today's commodity boom will likely last for a while. Teck shareholders have every right to push for more money. If they succeed, this sale negotiation could pay off for investors.

Regards,

Rob Spivey

May 3, 2023

Teck Resources (TECK) was dead set on spinning off its coal business...

Teck Resources (TECK) was dead set on spinning off its coal business...