GameStop (GME) wasn't the only company whose stock exploded in January...

GameStop (GME) wasn't the only company whose stock exploded in January...

Last week, we covered the excitement about the GameStop short squeeze. Of course, it was the biggest headline, but it wasn't the only stock in focus in the last two weeks. AMC Entertainment's (AMC) stock also participated in a big way.

Shares of the movie-theater chain rocketed more than 200% in the last week of January as the company announced it was successfully able to raise more than $900 million. This new debt issuance is serving as a cash "cushion."

Before that news, investors were questioning the company's solvency. Now, AMC has bought itself more time, and those issues are off the table for the near term. That caused the stock to take off.

This surge is yet another example that shows how equity and credit markets are trading "wide open" at the moment. With the ability to easily refinance and borrow money to reduce the risk of default, companies' bankruptcy potential can change virtually overnight. This was the catalyst for AMC's short squeeze.

To understand the equity markets, investors must have a solid grasp of what is occurring in the credit markets.

Historically, recessions have happened due to a lack of available credit. When companies or individuals can no longer finance their debt, they go into bankruptcy.

When waves of companies are going bankrupt, they have to focus on cleaning up their balance sheets as opposed to growing. This causes demand to collapse and leads to a spiral of declining economic activity.

This is why understanding these markets is critical for investors.

This echoes what we've said in the past about when the next recession comes. The risk of a bear market is lower when companies aren't at risk of being able to pay off their debts.

One part of understanding the credit risk comes from the credit default swap ("CDS") markets...

One part of understanding the credit risk comes from the credit default swap ("CDS") markets...

Back in 2008, CDSs were bought and sold as insurance on underlying bonds. The recession occurred partly because mortgage bonds failed, leaving insurance giant AIG (AIG) on the hook. CDSs are a good indicator of credit health.

Like a higher insurance premium, a higher CDS signals the borrower has a higher credit risk and is more likely to default.

Using as-reported CDSs prices, it appears individuals were panicked at the onset of the pandemic, as some credit markets were flashing warning signs.

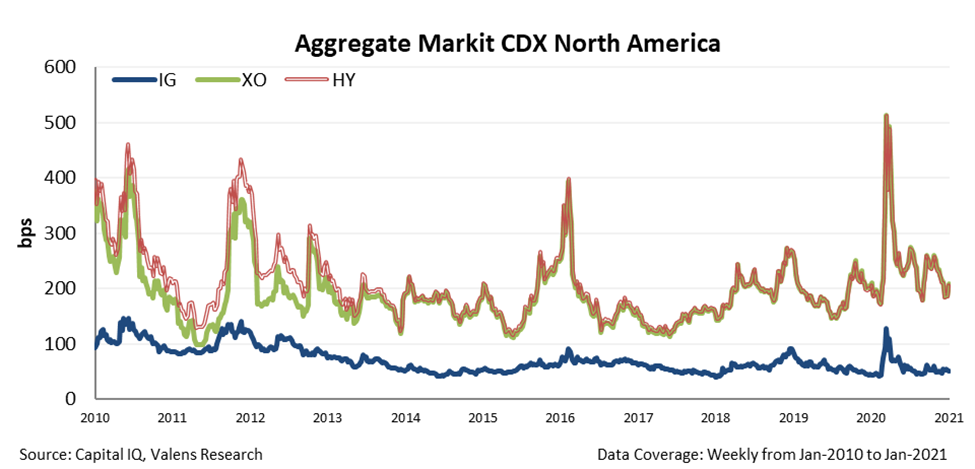

Markit CDX is a popular index that tracks CDSs prices.

In March, its high-yield index rose to its highest levels since the Great Recession. With these scary signals, people panicked, assuming that a flood of companies would be going bankrupt...

However, this spike in default risk was only a mirage...

These indexes are incomplete because they use a tiny sample size and only represent a small subset of the market. The Markit CDX only covers 100 entities that don't all have high-yield credit ratings.

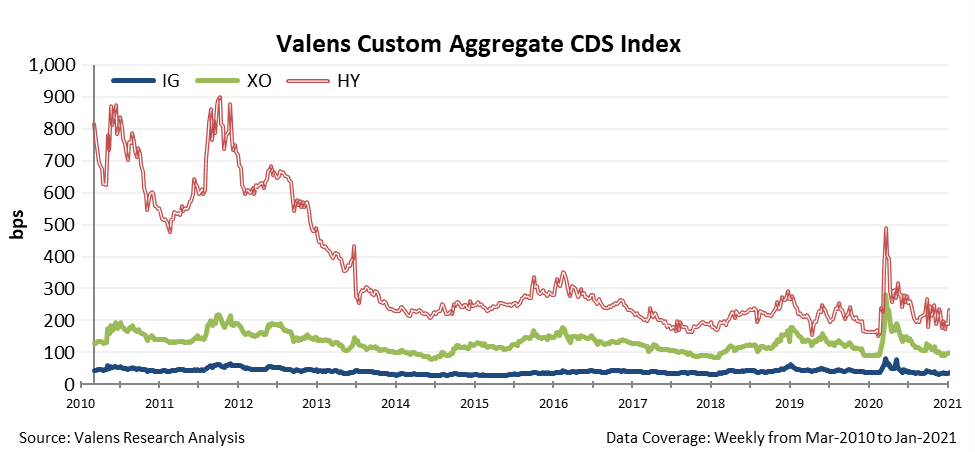

Part of the reason we at Altimetry told credit investors to hold tight on their investments was because we had better data. We used our own aggregate CDS indexes.

We gather this data from a universe of hundreds of thousands of credits and thousands of companies with liquid debt.

Through our CDS indexes, we are able to analyze and base our decisions off of real data.

Plus, the indexes we use are much more complete in the signals they offer. They attempt to capture all U.S. companies with liquid CDSs.

Our indexes showed that while the CDSs spiked wider in March, they never reached the levels we saw back in 2010 and 2013. Furthermore, these levels were far from the ones we saw during the panic of 2008.

As you can see in the chart below, the tick higher in March was much less severe than the ones represented in Markit CDX...

Because we could identify this discrepancy in the market, we knew a full-blown recession was unlikely, especially after the government injected its stimulus.

With the wrong data, it's no wonder investors panicked.

Right now, the same data show we are at historically low levels of credit risk.

With low cost to borrow, companies can refinance their debt and kick the can down the road. This means that the risk of default for firms like AMC is low.

Under these market conditions – and using the right data – it's clear that the next Great Recession isn't looming around the corner.

Regards,

Joel Litman

February 8, 2020

GameStop (GME) wasn't the only company whose stock exploded in January...

GameStop (GME) wasn't the only company whose stock exploded in January...