The grand work-from-home experiment has led to some preliminary results...

The grand work-from-home experiment has led to some preliminary results...

As we've mentioned before here at Altimetry Daily Authority, the coronavirus pandemic has forced corporate America into an experiment around the structure of the working environment. Back in March, in order to keep business functioning, employers were forced to allow folks to work from home.

Before the pandemic, companies were hesitant to allow remote work. The primary concern was that employees, out of sight from their bosses, would slack off and become unproductive. Now that the early challenges of working from home have been dealt with, The Economist recently analyzed a study by Harvard Business School to determine how much working from home has changed productivity.

That initial concern by upper management has proven to be completely unfounded. Professionals no longer need to be concerned about the commute, rigid working hours, or office distractions. Instead, many important metrics are up. Worker stress has been reduced by 10%. Furthermore, working hours have increased by 10% to 20% due to the time saved from a lack of commuting.

Many businesses have been taking the long view of this new workplace change. Social media giant Facebook (FB) recently announced the earliest its employees will return to the office is July 2021. However, the current equilibrium won't hold forever...

Some folks do feel more productive in the office, and are seeking to return as soon as possible. Furthermore, new employees will be much easier to train in-person than remotely, making some type of office space a necessity.

Now, companies are looking to the future to evaluate how much office space they truly need, to take advantage of the benefits of working from home and mitigating the drawbacks. Some form of a "hybrid" plan will be the most likely path for large companies going forward in the U.S. workforce.

It's what employees want... and employers are starting to see the benefit. This also means that while folks may not be spending as much time at home in the future as they are now, they'll be there much more than they used to – thus continuing to fuel the "At-Home Revolution."

Are you looking forward to heading back into the office full-time, thinking more of a hybrid model, or want to continue staying at home? We've talked a lot about the At-Home Revolution, but we'd love to feature some thoughts from readers next week. Send an e-mail to [email protected].

For most companies, the primary goal is to create shareholder value...

For most companies, the primary goal is to create shareholder value...

However, some firms don't seem to care as much about making money. Instead, they focus on satisfying their consumers.

One example of this is the Public Broadcasting Service ("PBS"). Founded in 1969, the organization strives to make educational and informative content for all Americans.

Because of this, PBS "only exists thanks to the generous donations of viewers like you." The not-for-profit firm relies heavily on federal funding and grants for a sizeable portion of its revenue stream.

Similarly, the BBC and NPR are other examples of "public access" firms, run out of the U.K. and the U.S., respectively. These companies create content for people, and profit is only an ancillary goal.

Many other examples of public access firms exist across the globe. Each one has a similar goal of creating content for the masses.

Twitter (TWTR) isn't a company that aims to solely make reachable content for consumers... However, many investors have concluded that Twitter is akin to a PBS – acting as a public utility and news aggregation service. Analysts have given up hope on the company's profitability and believe Twitter will never actually be able to make any returns greater than its cost of capital.

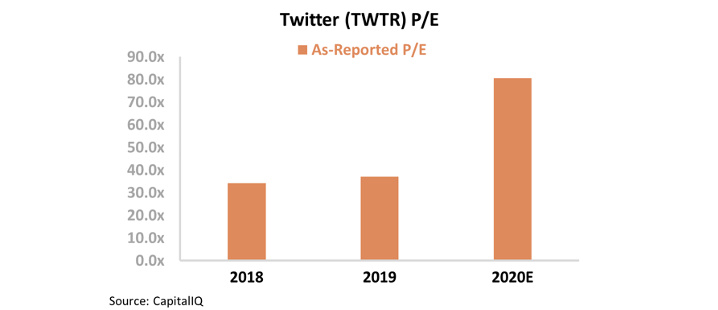

Even with muted profitability levels, Twitter's price-to-earnings (P/E) ratio is well above corporate averages. Right now, this metric stands at 80 times...

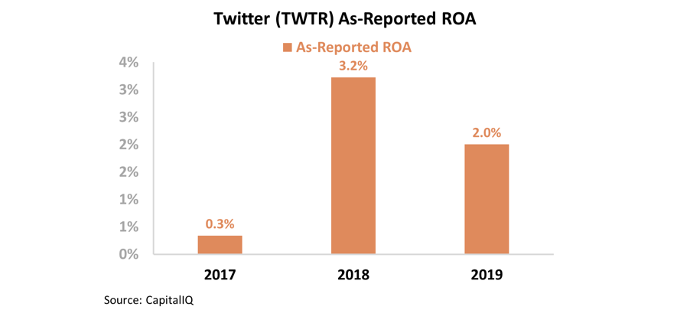

In order to justify high P/E ratios, companies usually need to be growing rapidly and have robust profitability. However, Twitter's as-reported return on assets ("ROA") can't justify the current market valuation.

This metric has been below cost-of-capital levels since the company went public in 2013. Returns have been increasing slightly over the previous years, yet still only sit at 2%. Take a look...

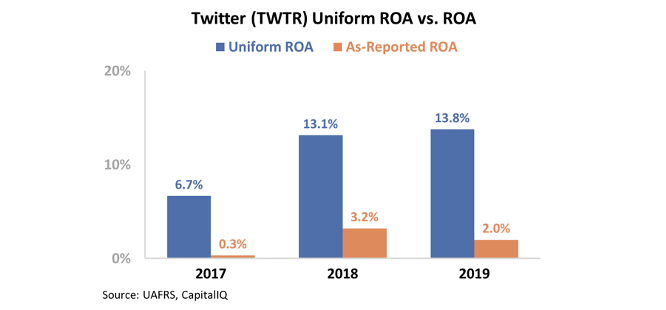

However, GAAP accounting has been unable to show Twitter's true profitability levels... The company's asset base has been significantly overstated by misrepresentations of excess cash, among other distortions. This in turn has artificially decreased Twitter's as-reported ROA.

Uniform Accounting shows Twitter's ROA has actually been positive every year since its initial public offering ("IPO"). Furthermore, the company's returns have been improving over the past three years to 14% – consistently above the firm's cost-of-capital.

These healthy returns don't begin to rival its social media peers like Facebook (FB), which have much higher returns. Yet they at least show that Twitter can generate a profit... and help to explain why investors might optimistically hope it could become as profitable as Facebook. This in turn helps explain the premium valuations.

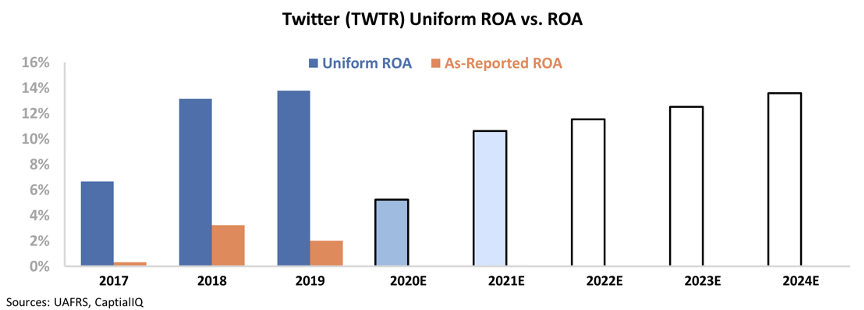

Using our Embedded Expectation Analysis, we can also measure whether the market is pricing in this trend to continue.

The chart below explains the company's historical corporate performance levels, in terms of ROA (dark blue bars) versus what sell-side analysts think the company is going to do in the next two years (light blue bars) and what the market is pricing in at current valuations (white bars).

As you can see, this year isn't going to be a strong one for Twitter. Advertising revenue has dried up since the pandemic began... but the drop should only be a short-term headwind.

Sell-side analysts also believe this is a temporary setback, as they assume Twitter's Uniform ROA will return to 10% next year. Beyond 2021, the market expects the company's Uniform ROA to rise to 15% in 2024 – only 1% greater than where this metric was last year. Twitter doesn't have to swing for the moon to justify these expectations, like its as-reported P/E implies.

Twitter's as-reported numbers are scaring investors – they show that the company can barely make a profit. On top of that, valuations are extremely high, and well above corporate averages.

However, the real numbers show that Twitter is actually a profitable company... though not impressively so. Without Uniform Accounting, investors see Twitter as being similar to a public utility, instead of a firm with growing profitability levels that can justify current valuations if it just executes successfully.

Regards,

Rob Spivey

August 20, 2020

The grand work-from-home experiment has led to some preliminary results...

The grand work-from-home experiment has led to some preliminary results...