The 'impossible trinity' is one of the widely held beliefs in macroeconomic theory...

The 'impossible trinity' is one of the widely held beliefs in macroeconomic theory...

Also known as the "trilemma," the logic is that an economy can't have all three of the following:

- A fixed foreign exchange rate

- Free capital movement

- Independent monetary policy

If you want two of these, you need to give up on the third. For example, to fix its currency to the U.S. dollar, Hong Kong basically gave up independent monetary policy and instead embraced America's monetary policy.

For most developed economies, a desire to have both free capital movement and to control their own monetary policies has led to floating exchange rates. Since a majority of commerce occurs inside large economies' borders, it's better to let foreign exchange ("forex") rates float, and have more control over monetary policy in other the other ways.

By controlling monetary policy and interest rates, countries can generally control their forex rates anyway. If one wants a stronger currency, it just needs to raise interest rates. Capital would flow in, which would drive forex rates higher. In weaker economic conditions, when a country wanted to boost exports, it could weaken its currency by reducing interest rates.

But today, many countries don't have this option. As The Economist highlighted recently, with most countries at (or near) 0% interest rates and unlikely to break materially from those levels, governments can't use the most classic tools to manage forex rates.

And that could lead to more forex volatility than we've seen historically. When a country's outlook starts to get worse, the currency slide won't be mitigated by reducing interest rates, and vice versa.

This likely means larger-than-normal swings in the forex markets... and the swings will be more sustained. That could mean significant issues for companies with big international exposure... and also it's likely to affect investors and governments.

This sleepy part of the market might become much more volatile in the near term than it normally is.

The 'At-Home Revolution' is leading to a lot of winners and losers, but even obvious winners may not be stocks that you want to own...

The 'At-Home Revolution' is leading to a lot of winners and losers, but even obvious winners may not be stocks that you want to own...

Over the past few months, we've talked about the power of the "At-Home Revolution" in the stock market. Some of our earlier Altimetry Daily Authority issues have explained how the stay-at-home orders have affected the golfing market, freelance contracting, or elective surgeries.

While many companies are indirectly profiting from this market change, one industry has seen a significantly direct benefit. The home-improvement field has been a major beneficiary of consumers' renewed interest in investing in their homes.

With employees working from home, sales of computer monitors and desks have skyrocketed. Home gym sales have been through the roof. Even products such as toys have seen a spike in sales as parents look to entertain young children at home.

Therefore, it makes sense for investors to look to the companies that empower home improvement. As we said in the December 10 Daily Authority, it's often profitable to look for the original supplier of an industry when pursuing a thesis on market shifts.

This is why many investors have been eyeing Home Depot (HD) and Lowe's (LOW). Both companies stock the supplies needed for any home-improvement project. However, each firm fits a different market niche. Home Depot has spent some time to tailor its stores to contractors, Lowe's has focused more on "do it yourself" home improvement.

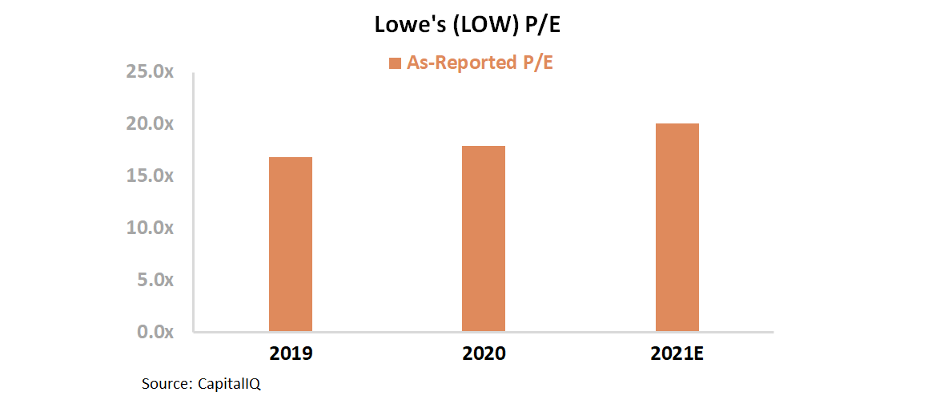

While these companies have seen surging demand, based on the as-reported metrics, valuations for Lowe's haven't risen too excessively. Over the past three years, the company's price-to-earnings (P/E) ratio has steadily improved – only now reaching market-average levels of 20 times.

Considering the strong fundamental demand that Lowe's is seeing from a surge in home improvement – and a P/E ratio that's in line with the market – the stock looks like a no-brainer to buy.

Not only is the market focused on home improvement, but customers are more inclined to try a "DIY" solution instead of hiring a contractor – many folks are hesitant about other people entering their homes. This favors Lowe's over Home Depot, and means that Lowe's should trade at valuations above the market average, thanks to its growth.

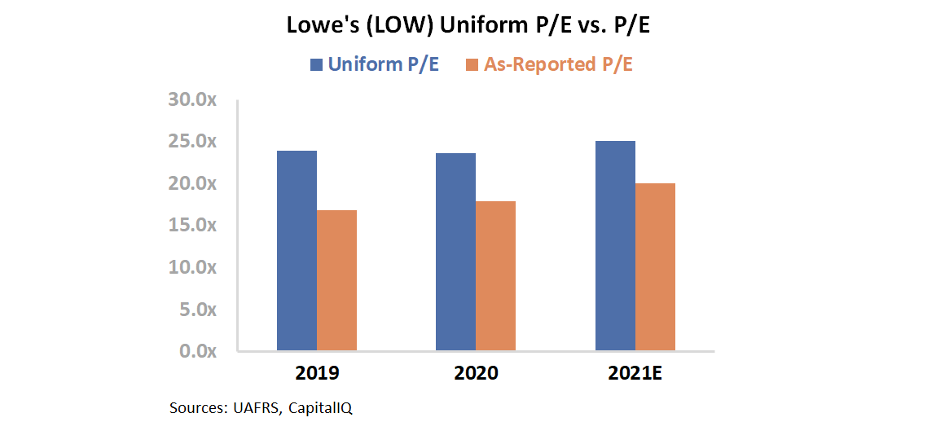

However, it is impossible to understand what variables are already priced into the market without using Uniform Accounting...

After making adjustments around income taxes and operating leases – among other adjustments – valuations for Lowe's look completely different. Instead of hovering at market-average valuations, the company is trading at a significant premium.

In reality, the Uniform P/E for Lowe's in 2020 is 25 – higher than market averages. Furthermore, Lowe's has been trading at a premium for the past three years already. Take a look...

The market has already priced Lowe's at a premium, but it's impossible for the average investor to see it.

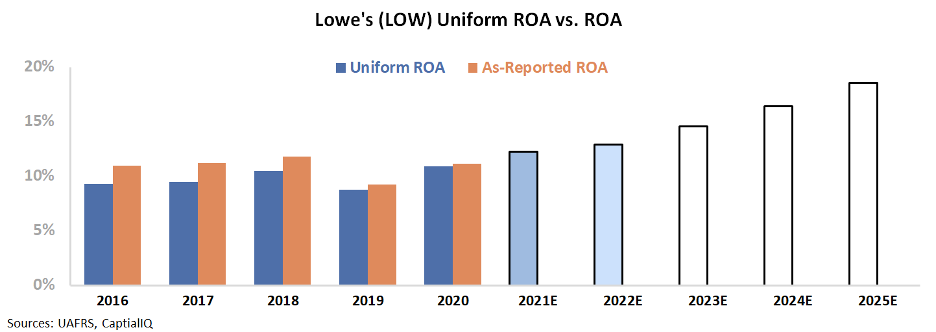

The chart below shows Lowe's historical profitability in terms of Uniform ROA (dark blue bars) compared to what analysts expect in the next two years (light blue bars), and what the market is pricing in at current valuations (white bars).

As a Uniform P/E ratio of 25 implies, investors have high expectations for the firm – anticipating returns to double from 10% to 20% over the next five years.

While it's possible for Lowe's to improve its profitability in the current market conditions, the expectations baked in at current valuations price Lowe's at close to perfection. This appears to be a target that Lowe's could struggle to hit.

This shows how essential it is to understand market expectations before rushing in to buy shares. While the conditions for Lowe's are favorable, the company's as-reported P/E ratio has lulled investors into an investment idea where any potential gains in the stock have already likely happened.

Regards,

Joel Litman

July 10, 2020

The 'impossible trinity' is one of the widely held beliefs in macroeconomic theory...

The 'impossible trinity' is one of the widely held beliefs in macroeconomic theory...