Tech companies can't build cloud infrastructure fast enough...

Tech companies can't build cloud infrastructure fast enough...

In the third quarter alone, Amazon (AMZN), Microsoft (MSFT), and Alphabet (GOOGL) spent a combined $32 billion investing in cloud-computing infrastructure.

For comparison, that's nearly 50% more than they spent in the same period three years ago... And it's only the beginning.

You see, cloud infrastructure is critical to artificial intelligence ("AI").

AI relies on huge datasets to make calculations. And all of that data needs to be accessible around the world, which means it needs to be stored on the cloud.

However, with the recent ramp-up in folks using AI, the world's existing cloud infrastructure is under stress... So to satisfy growing demand, the top three cloud companies are investing hand over fist.

This year, their investments are projected to hit $95 billion. By 2025, they're expected to exceed $125 billion.

Numbers like these tend to get investors excited. After all, this sounds like a huge buying opportunity in the AI space. Yet as we'll explain today, these investments won't make a huge difference by themselves...

These AI investments won't boost profits...

These AI investments won't boost profits...

Amazon, Microsoft, and Alphabet are building cloud infrastructure specifically for use in AI.

The issue is that cloud storage is basically a commodity. And cloud-computing offerings don't vary much between these three companies... So customers are going to shop based on price.

We saw the same thing happen over the past few years in the 5G space.

The first 5G-enabled device launched in 2019. And the big broadband providers were quick to start building out 5G infrastructure to support those devices.

Telecom giants like AT&T (T), Verizon Communications (VZ), and T-Mobile (TMUS) have spent nearly $50 billion per year building towers to support 5G broadband.

Yet, despite their investments, these companies aren't able to charge more for their 5G services... because they all compete with one another.

Ultimately, these companies are spending billions on investments that won't help improve profitability.

Building a commodity business just to satisfy demand doesn't generate much value for shareholders, either...

Building a commodity business just to satisfy demand doesn't generate much value for shareholders, either...

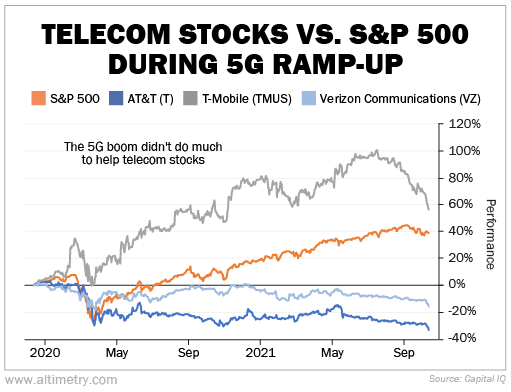

Even though 5G investments ramped up between 2019 and 2021, most telecom stocks performed poorly...

For example, both Verizon and AT&T shares lost value over this period. And while T-Mobile actually beat the market, it really only did so because of its merger with Sprint.

Combined, these three telecom giants averaged a mere 2% return compared with the S&P 500's 38% gain.

Take a look...

On average, this group of telecom stocks remained relatively flat. Their 5G investments didn't actually help win more business... they just helped the companies tread water.

A similar story is playing out for cloud-storage companies today. The three biggest names in this space are all spending billions just to stay competitive. And that spending won't come with better prices.

Microsoft, Alphabet, and Amazon are better positioned than the telecom giants...

Microsoft, Alphabet, and Amazon are better positioned than the telecom giants...

While their investments may not make them more profitable, they should help them grow revenue at the very least.

New AI companies are popping up daily. In fact, the AI market is expected to grow more than 17% per year through 2030. That means there will be more customers looking to use these cloud companies' services.

Broadband, on the other hand, was already a mature industry... so very few new customers came out of the 5G transition.

That being said, investors should keep in mind that investing in cloud infrastructure alone won't help any of these businesses win the AI arms race...

The companies that are building the most unique tools – at the very heart of the AI industry – will be the big winners.

The tech giants we mentioned today all have potential... Microsoft invested in ChatGPT. Alphabet owns Bard. Amazon is investing in a rival tool called Anthropic. And many other companies are building tools on top of these ones.

Savvy investors should focus on the companies with the most to gain from supplying the AI boom – especially those with ample industry experience to stand on.

Regards,

Joel Litman

November 28, 2023

Tech companies can't build cloud infrastructure fast enough...

Tech companies can't build cloud infrastructure fast enough...