For equity investors and the biggest corporations, the past few years have been a dream...

For equity investors and the biggest corporations, the past few years have been a dream...

The stock market keeps hitting new highs. Corporate profits are still growing. It doesn't get much better than that.

Smaller businesses, on the other hand, aren't doing nearly as well... especially financially.

You see, this market rally is concentrated. Both the ups and last week's painful down have been driven by a handful of massive corporations. And a lot of other companies are getting left in the dust.

Last year saw 686 corporate bankruptcies. That's a 14-year record... the highest number since the aftermath of the Great Recession in 2010.

Popular businesses like Party City, Tupperware, and Spirit Airlines struggled under rising interest rates, higher costs, and weaker consumer demand.

In short, it has been a tough time for everyone but the biggest companies. But two important metrics are showing promising signs... and small businesses might finally be getting a lifeline.

Banks are feeling more confident about lending...

Banks are feeling more confident about lending...

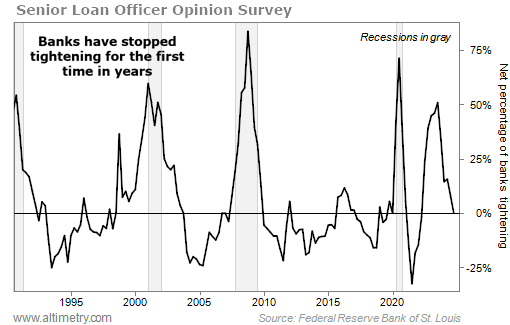

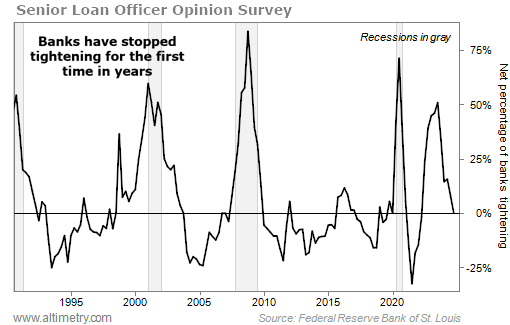

If you've been following our work, you know we covered this story back in December. The Senior Loan Officer Opinion Survey ("SLOOS") – one of our favorite metrics for tracking the economy – started to ease toward the end of the year.

The SLOOS is a quarterly survey conducted by Federal Reserve regulators. It asks loan officers whether their lending standards have tightened, loosened, or stayed the same over the past three months.

Put simply, it measures how eager banks are to extend loans... and how accessible credit is to both businesses and consumers.

In the most recent SLOOS survey, banks stopped tightening standards. As we wrote on December 3...

The chart below shows the percentage of domestic banks that tightened standards for C&I loans to large- and middle-market firms.

For the first time in 10 quarters, banks didn't tighten their lending standards. Take a look...

Now, we warned you at the time that it's still tough to get a loan. You don't bounce back immediately from 10 straight quarters of tightening standards.

But if the trend continues, banks are on track to ease their standards in the next quarter. That's when these companies' fortunes can start changing for the better.

Of course, one metric alone isn't enough to predict the economy's next move...

Of course, one metric alone isn't enough to predict the economy's next move...

That's why it was such a big deal when, a short time later, the 10-year/three-month Treasury spread "uninverted."

The yield curve normalized because the 10-year Treasury yield is rising. Said another way, the market is regaining confidence in the economy's long-term prospects.

Like the SLOOS, this is another big reason for banks to start lending more. That should give smaller companies a much-needed boost.

As borrowing conditions improve, the companies that have struggled under high interest rates could finally catch a break. We expect a slowdown in defaults and an overall healthier credit environment in 2025.

Instead of just a few big names carrying the market, we could see more companies contributing to the gains... meaning a broader and more sustainable rally for investors.

Regards,

Joel Litman

February 3, 2025

For equity investors and the biggest corporations, the past few years have been a dream...

For equity investors and the biggest corporations, the past few years have been a dream...