The media spent the past two years predicting a doomsday that hasn't materialized...

The media spent the past two years predicting a doomsday that hasn't materialized...

In late 2022, the U.S. economy was still struggling with rampant inflation and an intense interest-rate hiking cycle. Economists forecast recession risk at 100%. It was all the talking heads could talk about.

As inflation cooled off in 2023, interest rates and the slow rise of layoffs and bankruptcies took over the headlines. Once again, the "pros" were convinced a downturn was on the way.

And now that we're actually on the cusp of a recession, many of those same folks seem to think the worst is already behind us. They're preparing for a huge rate-cut cycle and new highs in the stock market.

In short, investors believe we beat inflation – and avoided a recession altogether. But not everyone agrees with them...

We've spent the past two days covering the market's misguided expectations for AI and warning bells in venture capital ("VC") via the SoftBank Vision Fund's latest survey.

Today, we'll delve deeper into what's really going on with VC... and why most investors aren't worried enough.

VC-backed companies in particular feel the pain of high interest rates...

VC-backed companies in particular feel the pain of high interest rates...

It means they don't have easy access to capital like they did when rates were near-zero. If money is that expensive and no one wants to lend, the VC space can't keep up with the cost of operations.

That's why last year was so tough for VC following a great 2021 and a mixed 2022.

And while the general market seems to think the worst is behind us, venture-backed executives don't seem so sure... at least, if the Vision Fund's latest survey is anything to go by.

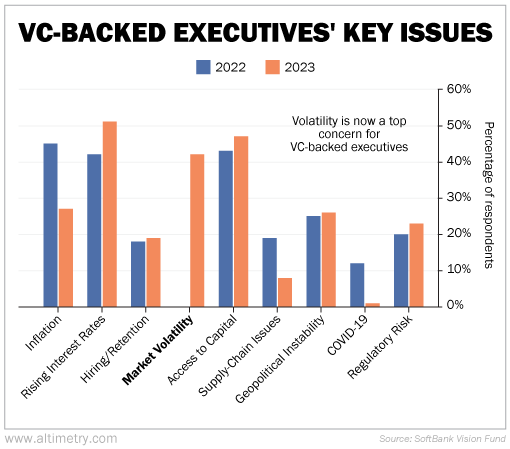

A lot has changed between the end of 2022 and the end of 2023. Inflation and rising interest rates were at the forefront of VC-backed executives' minds two years ago.

By the end of 2023, interest rates were far and away the biggest concern. Executives seem to understand that the Federal Reserve won't let inflation start rising again.

However, the biggest difference heading into 2024 isn't inflation or interest rates... It's volatility.

Two years ago, volatility wasn't even included in SoftBank's survey (probably because nobody was worried about it). Yet in 2023, 42% of those surveyed said it was one of their top concerns.

Take a look...

Market volatility is now a top-three concern among VC-backed companies.

The Vision Fund survey results tell us the general market is missing something big...

The Vision Fund survey results tell us the general market is missing something big...

VC-backed companies are on the leading edge of the economy. They have tremendous growth prospects. And as a result, they're most concerned about anything that stands to hamper that growth.

These executives were right not to worry about market volatility at the end of 2022. Despite recession fears, the stock market was in a relatively steady rally last year.

Yet after the rally, it seems most investors have been lulled into a false sense of security.

VC-backed companies' livelihoods are at stake if the market is too volatile... because volatility is connected to other important factors, like bank lending and employment levels. So you can bet they're paying close attention.

You can't say the same for many other investors. The consensus isn't factoring in enough risk for this market.

Regards,

Joel Litman

February 8, 2024

The media spent the past two years predicting a doomsday that hasn't materialized...

The media spent the past two years predicting a doomsday that hasn't materialized...