When investing legends talk, we listen...

When investing legends talk, we listen...

One of the benefits of having our Altimetry team of 100 employees in Manila is the ability to direct those folks to gather and catalogue all the amazing content that some of the great investors generate.

We keep entire lists of quotes and presentations from investing legends so we can learn from them.

And one of these folks who has gone under the radar after a phenomenal run is Bill Miller.

Formerly of Legg Mason, Miller is the only fund manager to ever beat the S&P 500 Index for 15 years in a row – from 1991 to 2005 when he ran the Legg Mason Capital Management Value Trust. Afterwards, his performance struggled for a bit... and some people were quick to write him off.

But it's almost impossible for someone to have that sustained success without having unique skills or methods for how they invest. And when you start to listen to Miller, it's apparent that he does...

When I teach students about "How to Beat the Market" – one of the most popular lessons I give in my MBA classes – I focus on Miller's advice. His mantra of understanding what the market is pricing a company to do is one of the core concepts here at Altimetry – what we call "Embedded Expectations."

Recently, we came across an interview with Miller on financial network WealthTrack from 2017 and had our team in Manila gather the highlights.

In 1999, while still at Legg Mason, he started up his own company: Miller Value Partners. And since he left Legg Mason full time, he's back to his old tricks... In the five years leading up to the interview, Miller boasted 23% annualized returns. His returns have continued to be impressive since then.

During the interview, Miller had interesting advice for investors looking for funds to invest in. He said to focus on two incredibly important things when finding funds that will outperform the market as a whole. Otherwise, why not just buy an index fund?

The first is to determine if a fund has high "active share." That's an industry term that means the fund is making bets that aren't in its benchmark. If a fund isn't making these type of divergent bets, it's not likely to generate returns that are significantly different from the market.

And second, investors should look for funds that have low turnover. As Miller pointed out, funds that have lots of "churn" – meaning they turn over their portfolio a lot – tend to underperform, because of transaction costs and other issues.

Based on the research highlighted in the interview, as of 2017, funds with high active share and long holding periods outperformed the market as a whole by 2% after fees. And high active-share funds that had higher churn?

They underperformed the market.

So if you're looking for mutual funds to put money to work in, remember to pay attention to those two variables. And in your own investing, remember that if you want to beat the market sustainably, be a "buy and hold" investor.

At least that's what the investment greats tell us... and when they talk, we listen.

Oligopolies are powerful...

Oligopolies are powerful...

In yesterday's Altimetry Daily Authority, we discussed the economic value of being part of an oligopoly.

For global organizations like OPEC or public companies like S&P Global (SPGI), having a dominant market share has led to sustainable profits.

Specifically, OPEC profits by controlling the global oil supply. Oil is a limited resource, and OPEC members own enough of it to influence pricing based on how much the cartel decides to supply at any time.

Meanwhile, S&P Global is able to generate profit by being one of only a few suppliers of financial data, credit ratings, and market indices. Technically, anybody could join the market... but the collective share and entrenched power of the oligopoly acts as a barrier to entry for smaller competitors.

Furthermore, with limited threat of competition, companies like S&P Global and its peer MSCI (MSCI) have pricing power – they can charge whatever they want, well in excess of what they need to charge to be profitable.

But oligopolies only work like this when there's either an implicit (legal) or explicit (illegal) understanding from the top players that they shouldn't compete on price.

Just having enough market share concentration doesn't guarantee that a company or industry can be dominated by an oligopoly.

Plenty of industries have a group of powerful businesses that hold most of the market share without supply constraints or pricing power.

For example, the wireless telecom industry is incredibly concentrated... and is becoming more so every day.

Despite companies like AT&T (T), Verizon (VZ), and the newly merged T-Mobile (TMUS) and Sprint representing almost the whole wireless telecom industry in the U.S., there's no pricing power there.

That's because even though the three major players dominate on market share, they're still competing for share based on price.

All of these firms need to invest massively in infrastructure to dominate the market... but because they're so focused on growing, they can't charge premium prices to generate higher returns.

The two largest competitors, AT&T and Verizon, have realized that wireless telecom is somewhat of a zero-sum game, so both have invested in other differentiators to grow their profitability.

For example, Verizon moved into ad solutions through its acquisition of Yahoo... while AT&T entered the media business by acquiring Time Warner. Both companies have also invested heavily in the cable TV space.

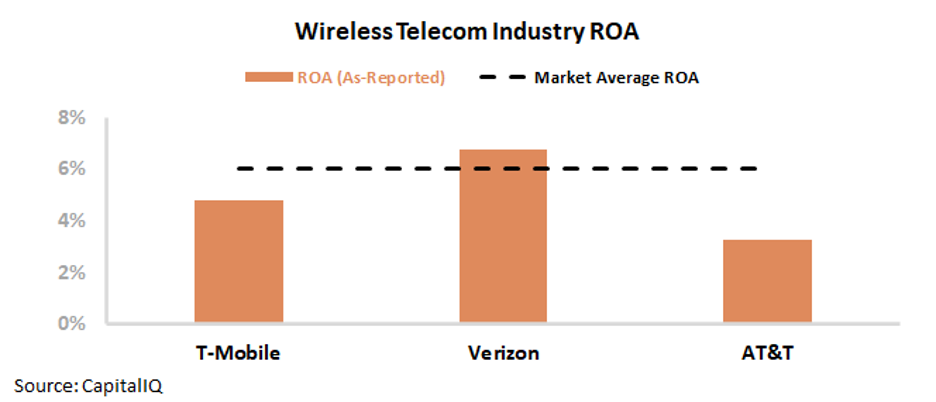

That said, the acquisitions don't seem like they've done much to differentiate their businesses. Compared to T-Mobile – the most "pure play" wireless provider – last year, all three firms had returns on assets ("ROAs") near long-term averages of 6%. Take a look...

In fact, looking at the as-reported metrics, it looks like Verizon's differentiation efforts slightly helped the business based on the company's 7% ROA in 2019... while AT&T's actually hurt the business – the company's ROA was only 3% last year.

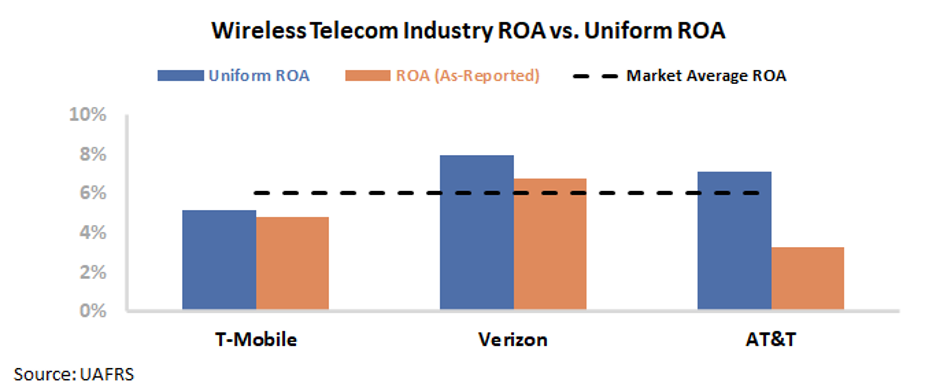

That said, once we clean up the accounting for all three companies and apply our Uniform Accounting metrics, we can see that the businesses were smart to differentiate.

The Uniform metrics adjust out the effects of distortions like operating leases, non-cash pension adjustments, and goodwill to give a more accurate representation of corporate earnings.

On this view, the only pure-play wireless firm ends up in last place – T-Mobile's Uniform ROA was just 5% in 2019, compared to 7% for AT&T and 8% for Verizon.

This might not seem like a big difference... but considering how much these firms have invested, that variation in returns is massive. One percentage point in Uniform ROA translates to billions of dollars of earnings.

Looking at the as-reported metrics, investors and management teams may think that T-Mobile's focus on pure-play telecom and Verizon's focus on ads is the right strategy for these businesses' respective management teams. It's only when looking through the accounting "noise" that we can see that T-Mobile's investments remain value destructive... while Verizon and AT&T are starting to create real profits for investors.

Regards,

Joel Litman

June 10, 2020

When investing legends talk, we listen...

When investing legends talk, we listen...