President Joe Biden's recent interview with ABC News' George Stephanopoulos drew lots of attention...

President Joe Biden's recent interview with ABC News' George Stephanopoulos drew lots of attention...

The president talked about immigration, Russia, Saudi Arabia, and coronavirus vaccinations. But investors are focused on one talking point, where Biden reaffirmed his tax plan to raise rates on folks making more than $400,000 per year.

The original tax policy he ran on also called for raising capital gains taxes and the corporate tax rate.

Biden sought to treat capital gains as common income for tax purposes for those making more than $1 million per year, raise the maximum rate to 39%, increase real estate taxes to 45%, and raise corporate taxes to 28%.

This is a wide swath of rate changes for different areas of the economy, but they have a common target. In general, Biden's goal to pay for the stimulus is to tax capital first and foremost.

The market hasn't yet panicked over this news, and neither should you...

The market hasn't yet panicked over this news, and neither should you...

On November 2, right before the election, we said if Biden's tax proposals were put into place, the market could drop somewhere between 8% and 32%. However, we urged restraint... and the market is up nearly 20% since the election. Today, our advice still hasn't changed.

You shouldn't be rushing to sell your portfolio in anticipation of tax changes.

Back in November, we explained how even with a potential "blue wave," Democrats were unlikely to see a strong majority to push forward any radical tax plan. With only 50 left-leaning senators and Vice President Kamala Harris required to break any ties, the Democratic Party needs to work in lockstep to pass any legislation.

This means more moderate senators need to give their support to any possible bill. That kills the chances of a truly progressive tax plan being passed by the Senate, no matter Biden's messaging.

Additionally, as any financial advisor would tell you, taxes can get complicated really fast.

Even if a new tax plan got through moderate Democratic Senators like Joe Manchin and Kyrsten Sinema, it likely wouldn't resemble Biden's current proposal. The devil is in the details with tax reform. Any number of loopholes or clauses could take the teeth out of tax changes.

This means no financial advisor would tell a client to dump stocks in expectation of a tax change, as the client could realize gains and incur unwanted taxes for potentially no reason.

This is why the market hasn't yet reacted, even if a potential tax plan is in the works.

Of course, many investors still want to know the potential damage...

Of course, many investors still want to know the potential damage...

If tax reform resembling Biden's plan made it through the House and then the Senate, it could still have an effect on the market... and your portfolio.

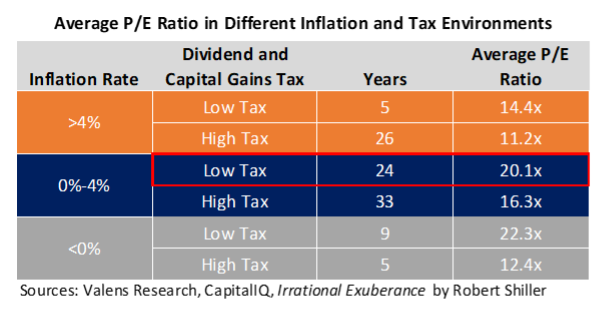

Right now, the market's price-to-earnings (P/E) ratio is supported by the low-tax and low-inflation environment. As we said in the March 15 Altimetry Daily Authority, low inflation is supporting high P/E ratios for the market. Low inflation means investors keep more money from their investments and are therefore willing to pay higher prices for the same earnings.

Taxes have the same effect. With lower taxes, companies and investors can keep more of their investments after paying Uncle Sam, which allows the market to trade at higher P/E multiples. As you can see in the table below, a low-tax, low-inflation environment allows for a P/E ratio of around 20 times or greater.

However, a change in taxes would push down these multiples. Moderates like Manchin have expressed loose support for a corporate tax rate hike from 21% to 28%.

This tax hike could be a 9% headwind to the market. Real earnings would fall from higher taxes on pre-tax profits, forcing down the "E" (earnings) in the P/E ratio.

And if average capital gains taxes jumped to 39%, with dividend tax rates remaining the same, the aggregate tax rate moves closer to 30%. (Note that this 30% isn't only for income or capital gains themselves, but an average tax based on the assets investors generate returns on, excluding tax-advantaged investment vehicles.)

This would mean the market P/E would drop to nearly 19 times. On a lower net income and a lower P/E ratio, the market could potentially fall 22%.

Of course, this would be a one-time drop before the market started moving higher again. And as the rally since the election has showed, corporate earnings growth wins the day when it comes to longer-term stock market trends.

Furthermore, this is a worst-case scenario for valuations. It's difficult to get elected officials to raise taxes, since they know a hike will hurt their election chances next time at the ballot box.

In The Altimeter Weekly, we recently discussed the implications of tax increases and how this fits in for the rest of our macro framework...

In The Altimeter Weekly, we recently discussed the implications of tax increases and how this fits in for the rest of our macro framework...

It's part of our new Timetable Investor feature for The Altimeter Weekly. Using a gauge – similar to the grades we issue for companies in The Altimeter – we discuss the big-picture signals we're seeing for the entire market. We also highlight how this should influence the construction of your portfolio.

Altimeter subscribers can read the March Timetable Investor feature by clicking here.

If you aren't an Altimeter subscriber yet, you're missing out on the real, Uniform Accounting data for more than 4,000 publicly traded companies. Furthermore, every month in the Timetable Investor, we highlight the relevant economic data you need to know to protect and grow your portfolio.

Learn more about The Altimeter right here.

Regards,

Joel Litman

April 5, 2021

President Joe Biden's recent interview with ABC News' George Stephanopoulos drew lots of attention...

President Joe Biden's recent interview with ABC News' George Stephanopoulos drew lots of attention...