Looking back on a year of economic analysis...

Looking back on a year of economic analysis...

As we find ourselves at the end of 2021, we want to highlight some of our favorite articles and see how they have held up over the past few months.

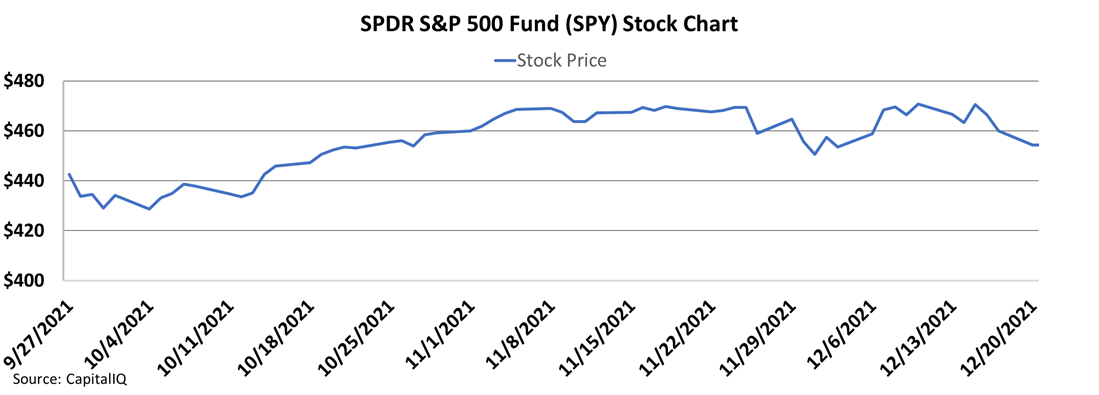

In late September, the omicron variant of the coronavirus was yet to be discovered, and inflation still seemed like a blip... and analysts and pundits were concerned that after such a large run in the first half of 2021, the market might see a downturn.

But as we talked about in our September 27 issue, "The Economy Is Hot and Stocks Are Flying High But That Doesn't Mean to Brace for a Crash," the stock market over the past 20 years has continued to appreciate. That's thanks in part to real Uniform returns consistently trending upwards. As average returns reached all-time highs in 2021, this run looks justified.

Furthermore, without a large credit crash, there is never the possibility of a protracted downturn. With access to easy capital, businesses could borrow to stay afloat.

That's why in late September, we said while there might be some shorter-term volatility after such a run.

There's no reason to believe that cash stashed on the sidelines will perform better than stocks.

As you can see below, despite short-term volatility, the market continued to appreciate by more than 5% since late September, even with inflation and omicron-related headwinds.

With Uniform Accounting, it's possible to cut through the economic noise and get to the true economic performance of stocks or markets. We look forward to highlighting some of our other favorite theses this week. Here are some highlights from our September 27 issue...

Market watchdogs' predictions are only as good as their data...

Market watchdogs' predictions are only as good as their data...

Some financial media pundits would have you believe the market is about to crater. The reason why? As-reported profit margin forecasts aren't rising anymore.

According to this school of thought, investors should brace themselves for severe market drops when analyst estimates for as-reported profit margins stop rising.

Since margins are already sitting at all-time highs and analyst estimates aren't rising, the market must have nowhere to go but down. The bears are saying to take your money and run, folks!

If the buck stopped with as-reported metrics, the concern would be understandable. But as regular readers know, here at Altimetry, we have better data to examine.

Uniform Accounting shows a much more accurate representation of actual economic conditions for companies and the economy as a whole.

So let's figure out what exactly is going on, and if you should be concerned...

So let's figure out what exactly is going on, and if you should be concerned...

In our August 9 issue, "What the Real Numbers Tell Us About the World's Superpowers," we examined how real corporate profits show that the current market isn't some aberration... nonetheless, it's not sustainable.

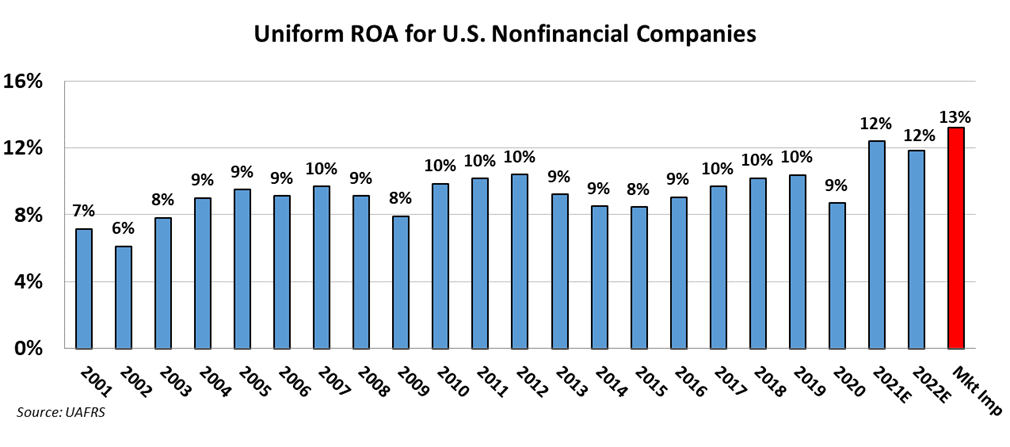

Companies are indeed performing at the top of their historical range, but this is part of a long-term, secular trend in corporate profitability.

We've seen a steady secular move upward in Uniform returns on assets ("ROAs"). Corporate profitability has consistently reached higher highs and higher lows through cycles.

As U.S. corporations have moved away from lower-return manufacturing business and into higher-return intellectual property-based businesses, firms have become more focused on operating efficiencies. Quality and efficiency regimes like "lean" and "six sigma" have permeated the entire corporate world – boosting aggregate ROAs.

Companies have also gotten smarter about limiting investments when they can't find growth opportunities. That has come with significant new modeling and forecasting capabilities made available by easily accessible big data.

With the right data, the movement of the benchmark S&P 500 Index over the past 20 years makes more sense.

After dropping in 2001 and 2002, Uniform ROA levels reached 10% in 2006 and 2007. These levels exceeded 1999 and 2000, just as the market made new highs.

Then after dropping in 2008 and 2009, Uniform ROA again reached new peaks in 2011 and 2012. By early 2013, the market was making new all-time highs.

After falling due to energy market headwinds from 2013 to 2015, markets were on the way to new highs before the coronavirus pandemic threw a wrench in the supply chain. This is part of why the stock market recovery was so robust.

Companies aren't teetering at the top of a business cycle. Take a look...

Although negative cycles cropped up in 2001, 2008, 2015, and 2020, they weren't driven by cyclical profitability trends but by credit crunches interrupting the profit cycle.

That's why in 2020, when the trough was driven by forced economic closures to fight the pandemic and credit was open. The stock market rebounded so quickly.

This understanding of the credit cycle gives context to our position in the profit cycle.

As long as capital remains free-flowing, companies maintain plentiful cash buffers to service their obligations, and interest rates remain stable, a hot economy alone is no reason to panic. It can signify that the economy is strong and will remain so for the foreseeable future.

And although analysts predict a minor contraction in 2022 Uniform ROA, there's no need to worry so long as credit markets stay healthy. Corporate productivity will still be higher than it was pre-pandemic.

Even when looking at market expectations, we see a reasonable picture.

Based on current valuations, the market expects Uniform ROAs to expand to 13% in 2024.

While this may prevent investors from reliving the surprise big gains of 2020 and the first half of 2021, there's no reason to believe that cash stashed on the sidelines will perform better than stocks.

Do you want to start the new year out on the right foot with a strong portfolio?

Do you want to start the new year out on the right foot with a strong portfolio?

Before the clock strikes 12 o'clock on New Year's Eve, you have an opportunity to become a partner in our Altimetry business. This is a chance to make strides in your financial success for 2022 and beyond...

As a VIP member, you'll have access to all of Altimetry's services: Microcap Confidential, High Alpha, Hidden Alpha and The Altimeter for just one lifetime price. That means just one payment unlocks all this value with no future subscription fees...

Our portfolios at Altimetry are delivering an average return of at least 30% and higher – beating the average return of the market substantially!

Regardless of whether you're already subscribed to one of our paid services, you can learn about upgrading to the lifetime partnership by clicking here.

Regards,

Joel Litman

December 28, 2021

Looking back on a year of economic analysis...

Looking back on a year of economic analysis...