As companies push for short-term work-from-home strategies to mitigate risks, the line between employees and contractors is blurring...

As companies push for short-term work-from-home strategies to mitigate risks, the line between employees and contractors is blurring...

One of our business partners is a talent acquisition company called MBO. It focuses on helping large companies and independent contractors match with each other based on their respective needs and skills.

Just last week, CEO Miles Everson explained to clients and prospects that with the move to remote work due to the coronavirus outbreak – and the potential need for more flexible hours – short-term demand uncertainty means that more and more, knowledge-based independent contractors and employees are looking increasingly alike.

Many people have expressed fears about the "gig economy" and the independent contractor world, since platforms like Uber (UBER) and others are viewed by some as not having their workers' best interests at heart. But the world of independent contractors is just as relevant for high-skilled workers...

These types of platforms pull people with significant knowledge and skills back into the workforce by giving them the ability to name their own hours and projects. Some of these people may be work-from-home parents, caregivers, or others who need flexible work.

Considering current corporate uncertainty, there may also be concerns about the outlook for the staffing industry. But companies that offer a platform that gives employers more ability to match variable needs with variable labor are likely to see continued demand. It's a sector worth watching.

Emotions and investing don't mix well...

Emotions and investing don't mix well...

Our macro-based articles usually focus on one of two major themes:

- Uniform Accounting data for better big-picture signals.

- Making sense of existing macro signals – in particular, credit signals – by interpreting them in a straightforward way.

These themes aren't mutually exclusive, but they can operate independently.

Obviously, we consider Uniform Accounting to be a critical component to proper macro analysis, but we would argue that understanding the signals around you can also make you a more "rational" investor.

In this case, given today's market environment, "rational" is in direct contrast with "emotional."

We've written previously about the downfalls of emotional investing, including in the January 27 Altimetry Daily Authority on "animal spirits."

We tend to see a huge surge of investment into the market just before a crash – these are the "animal spirits" that push investors to buy so as not to be left out of the market's success.

The cause ties back to legendary investor Warren Buffett's quote: "Be fearful when others are greedy and greedy when others are fearful."

Investors tend to get greedy by buying stocks right when they should be getting fearful – namely, at market peaks.

Conversely, investors become fearful by selling their portfolios as soon as they have lost 30%, 40%, or even 50% of their value. To Buffett's point, this is exactly when investors should be greedy – they should buy the market at its lows.

People get the market wrong because of emotion – not because the signals aren't there (think back to Friday's Daily Authority).

However, it's possible to use the adage about fear and greed as its own type of "signal"...

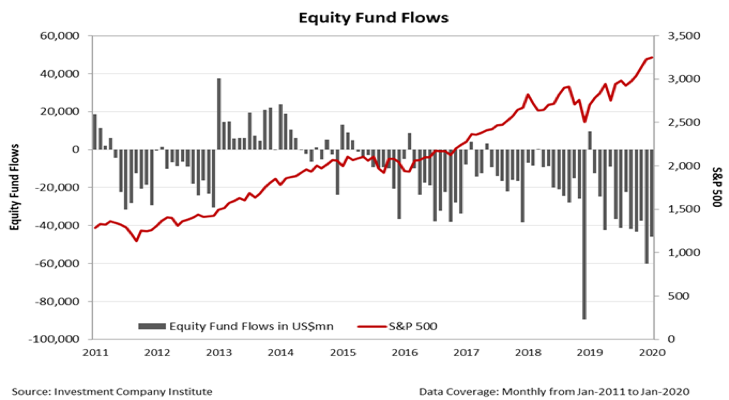

The majority of investors will continue to act emotionally – as they always have – so we can monitor this through "equity fund flows." Tracking the net of inflows and outflows from equity funds helps us understand how investors overall feel about the market.

Since investors as a whole tend to be buyers when the market is nearing a top and sellers when the market still has room to grow, we can watch the trends of monthly inflows and outflows to see how investors are feeling.

Over the past decade, investors have remained fearful – this is a good sign for the health of the market.

Despite recent volatility due to the coronavirus outbreak, we can see that investors have been pulling money out of equity funds consistently for the past several years.

Since 2016, investors have only been net "buyers" in four months. In the remaining months, they've pulled billions of dollars out of the market. The most excessively bullish investors have been over the past 10 years was back in 2013 and 2014, before the oil crisis.

Conversely, December 2018 saw the single largest equity outflow – nearly $90 billion. Investors were selling just when they should have been buying.

Since then, equity outflows returned towards the average levels that we'd seen for several years during this historic bull market until recently – when investors appeared to be getting too bearish again. Take a look...

Tying this back to Buffett's old adage, investors are fearful today. This is the time for the "smart" money to remain greedy so long as the other macro signals we monitor continue to be positive.

Regards,

Joel Litman

March 16, 2020

As companies push for short-term work-from-home strategies to mitigate risks, the line between employees and contractors is blurring...

As companies push for short-term work-from-home strategies to mitigate risks, the line between employees and contractors is blurring...