Joel's Note: From time to time, when there's uncertainty in the market, we like to touch base with our readers to let you know what we're seeing. We sent this note out to our paid subscribers yesterday after the market entered correction territory and wanted to expand on it and share it with all our readers today.

The Nasdaq composite clocked its 66th correction since 1971...

The Nasdaq composite clocked its 66th correction since 1971...

Over the last few days, investors have been reaching out to us with questions about the current market volatility. Since recent all-time highs, the S&P 500 Index fell by almost 6% by Wednesday's close, and the Nasdaq composite dropped by 11.5%, officially entering correction territory.

Naturally, even with the market bouncing back a bit yesterday, the biggest question we've been getting from clients is, "Should I be worried?"

The short answer is a definitive "no," or as the British would say, "Keep calm and carry on."

We talked about how this kind of market choppiness would happen as we turned the calendar to 2022.

In the January 3 Altimetry Daily Authority, we laid out what would happen in the market.

In this article, we said...

History offers us some powerful lessons about past Fed rate-hiking cycles. The market will likely sell off when the first rate hike is formally announced. This is because traders are prone to overreact, and they unduly panic that the central bank is taking away the punch bowl and ending the party.

And today, nothing has changed.

There is a common misconception that the Federal Reserve will ruin the economic recovery by raising rates.

This concern is not unique to this cycle, as it's a refrain that happens heading into the beginning of every Fed raising cycle of the last 40-plus years.

In each of the last four times the Fed has raised rates, the market has sold off, each time more than 6%, and at times in double digits.

And each time, within two years, the market rallied double digits, often significantly in double digits, after the sell-off.

After each dip, the market has rallied as the Fed started raising rates because it is actually a great sign for equity investors.

It means the Fed is saying the economy is healthy enough to no longer support it with low rates. The economy (and market) can run on its own.

The Fed is discussing raising rates to rein in inflation because the Fed thinks the economy is on firm enough footing that economic growth won't be scuttled by acting. Again, that is a good thing.

Rising rates do not end an economic cycle...

Rising rates do not end an economic cycle...

We've been highlighting this since very early on here at Altimetry. We've been highlighting it to our institutional clients for over a decade, and it is one of the subjects our institutional clients most regularly tune in on when we talk. This work is built atop our analyses of more than 150 years of financial cycles.

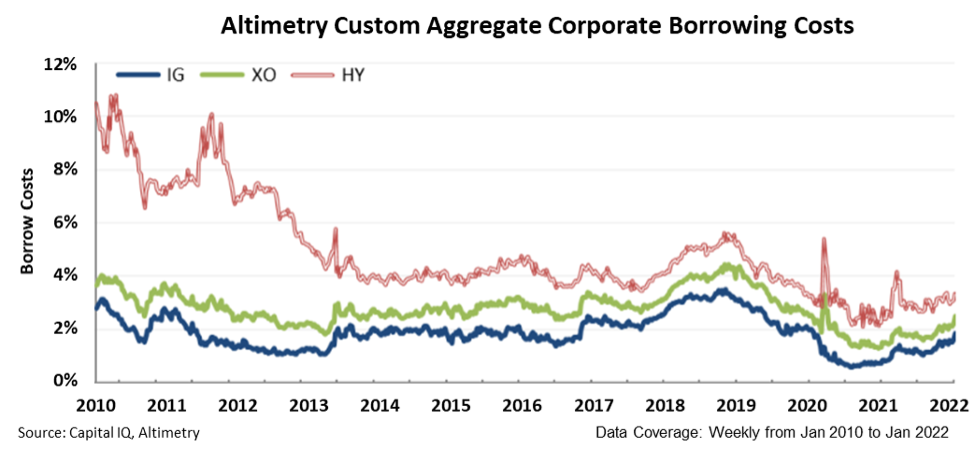

Included below is an updated version of the chart we have been showing since 2019, with data up to 2022 included.

The chart below highlights the total cost for U.S. corporations to borrow. We break it down into three buckets: investment grade ("IG"), crossover ("XO"), and high yield ("HY").

IG companies are among the largest, safest, and most stable public companies, while HY companies are the smallest and riskiest. So, it makes sense that HY cost to borrow is always more expensive than IG, and XO charts toward the middle.

After the brief spike in the pandemic, the cost to borrow has been remarkably low thanks to wide-open credit markets.

Right now, the cost to borrow for high-yield credits is 100 to 200 base points less than its lows during the last bull market, which spanned from 2014 to 2019. IG and XO levels are similarly sitting at historically low levels.

For every class of corporate credit, borrowing costs are sitting at all-time lows outside of late 2020, when central banks had the spigots of liquidity fully open to keep the economy open.

Because rates are so low, even if we added 1% to the cost to borrow for U.S. companies, it would only put borrowing costs in line with normal levels from the last decade, where we had strongly positive economic growth.

We didn't arbitrarily pick a 1% rise in cost to borrow. We chose that level because that's how much it looks like the Fed might raise rates in the next 12 months or so.

The point is, even if the Fed did raise rates quickly, as is expected, it is not going to send borrowing costs into a tailspin that could freeze borrowers out of the market. That's what you must worry about for a sell-off becoming a bear market and the economy going into a recession.

Rising rates don't kill a bull market...

Rising rates don't kill a bull market...

If anything, as the market sell-off and rally data above shows, with borrowing costs still low, it's an "all clear" signal for the next phase of a bull market run.

Overall, we think the market is primed to continue to shoot higher in 2022 because of a major theme we see developing: a long-term trend in "spending."

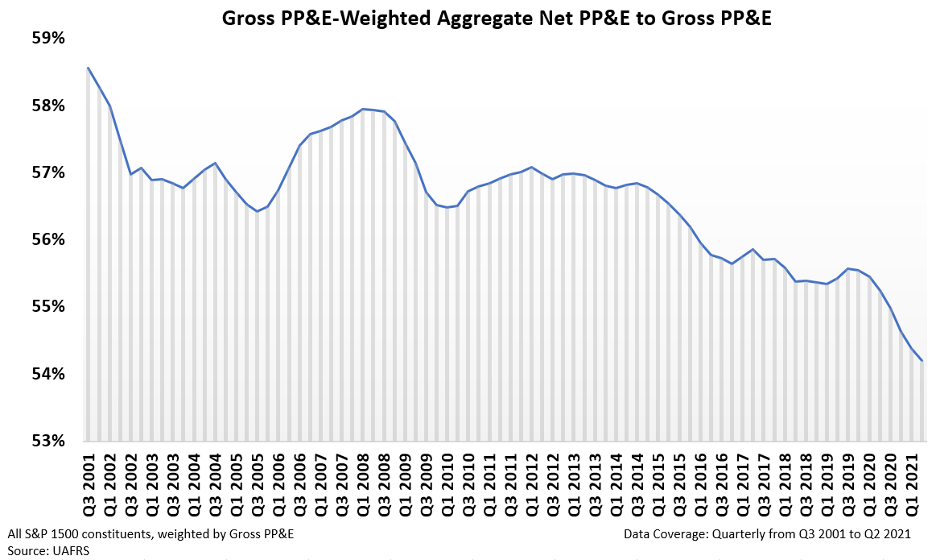

Over the past decade, U.S. companies have underinvested in their property, plant, and equipment (PP&E) to grow old to maximize their cash flows. These older assets, along with higher demand, are a root cause of the supply chain and inflation issues we have seen, where supply can't ramp up fast enough to meet demand.

This chart shows how old assets are: A lower net-to-gross-PP&E ratio means assets are more heavily depreciated on U.S. corporate balance sheets. This is the accountants' way of saying that the physical stuff that companies own is older, and right now, it is as old as ever.

Once U.S. corporates finally start to embrace that they need to invest in fixing this issue, that will kick off a virtuous cycle that can take the earnings across the economy significantly higher and the market with it. And it looks like it's primed to happen in 2022.

On November 22, we talked about how raw materials will benefit from the coming capex supercycle...

With merger and acquisition (M&A) activity hitting all-time highs in 2021 and increased corporate spending, acquisitions and organic growth are poised to stay strong into 2022.

The power of the capex supercycle on the horizon isn't just that it will improve supply chains or leave us with new infrastructure.

As companies invest more, their suppliers will need to invest more to keep up, and their equipment makers will need to build more capacity to supply them, which keeps on flowing down the value chain.

Don't just take our word for it. Over the past few months, management teams and corporate insiders have been buying shares more than they have been selling, they're voting with their wallets.

Those on the inside have been growing more confident that the market will see a 2022 run. And we're seeing it come through in earnest with our earnings call analysis, and investment analysis, too.

So while we know the last couple of weeks have been a wild ride, we want to let you know with confidence that anyone who buys the dip will be richly rewarded...

Now is not the time to panic and go to cash...

Now is not the time to panic and go to cash...

Instead, it's time to position your portfolio for solid returns in 2022.

Over the last two years, we've given our readers five chances in our High Alpha service to make up to triple-digit gains on small, unheard-of stocks.

And we recently identified one single stock that is set to become an outright winner in our High Alpha portfolio... and it's destined to be a multibagger.

Learn more about this opportunity by clicking here.

Regards,

Joel Litman and Rob Spivey

January 21, 2022

The Nasdaq composite clocked its 66th correction since 1971...

The Nasdaq composite clocked its 66th correction since 1971...