Airlines are finally getting a win... from an unlikely place.

Airlines are finally getting a win... from an unlikely place.

For the past few decades, investors have repeatedly overreacted to market shocks by calling for the total death of business travel.

It makes sense in theory. Business travel is very expensive for corporations. These companies had to seriously lower spending after the dot-com bubble burst in the early 2000s... and again during the 2008 financial crisis.

The logical first expense to cut was business travel.

It looked like business travel would finally lose its edge once and for all in 2020. Mass flight cancellations made traveling for work all but impossible. And the emergence of Zoom Video Communications (ZM) for remote meetings made people question if it was even necessary.

We highlighted this pandemic-induced shift away from business travel last November. At the time, we predicted that the shift to remote work would mean less casual business travel. But we still believed travel was vital to businesses... and that video calls couldn't totally replace it.

Today, business travel has recovered even better than we expected. And thanks to limited seating and higher fuel costs, the prices of those tickets have increased substantially. A return business-class trip between New York and Sydney now costs as much as $20,000 – double the pre-pandemic cost.

Even membership miles are worth less than before. A business-class seat that used to cost 150,000 miles now costs around 300,000 miles.

And this is if you can find a business-class seat at all. Most airlines are still flying at lower capacity than before the pandemic. So there are fewer options to begin with.

This trend is frustrating for businesses – but the timing couldn't be more perfect for airlines...

This trend is frustrating for businesses – but the timing couldn't be more perfect for airlines...

Legacy air carriers like American Airlines (AAL), United Airlines (UAL), and Delta Air Lines (DAL) make most of their revenues from the front of the cabin. So when the prices of business-class seats rise, margins will expand.

These companies desperately needed a boost to their bottom lines after a tough past few years. And Delta was no exception...

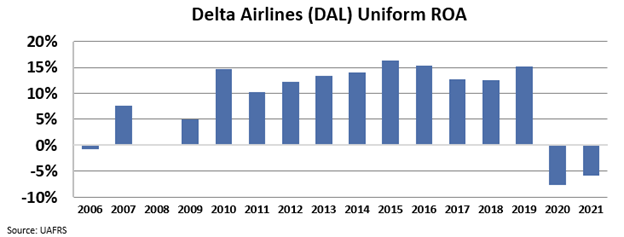

Delta's pre-pandemic Uniform return on assets ("ROA") averaged about 14%. That's slightly above the 12% corporate average.

But COVID-19 hit Delta hard. Its Uniform returns plummeted to negative 8% in 2020. And they only improved slightly to negative 6% in 2021 as travel began recovering. Take a look...

Delta struggled in the wake of the pandemic. And for a while, there didn't seem to be any end in sight. But recent improvements to business-class seats should help. Analysts expect its Uniform ROA to improve to 6% this year.

The market doesn't seem to get it, though.

Investors think Delta has a long road back to profitability...

Investors think Delta has a long road back to profitability...

These folks understand how much the pandemic hurt the travel industry. Airlines are trading for cheap, and investors have low expectations for the future.

That could mean big opportunity...

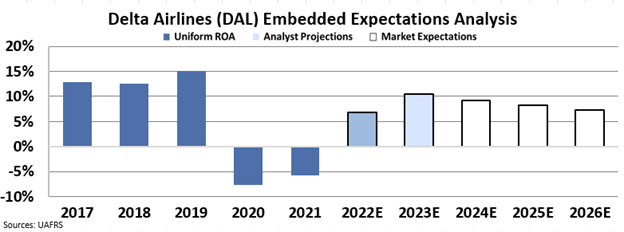

To understand how the market values Delta, we can check out its Embedded Expectations Analysis ("EEA").

Our EEA framework uses Uniform Accounting to show us exactly what the market expects from a company based on its current stock price. Here's how it looks for Delta...

Regular readers might recall that we discussed expectations for Delta back in July. As we explained at the time, Wall Street analysts predict Delta's Uniform ROA will spike to 11% by 2023.

But here's where things get interesting. Investors believe Uniform ROA will then fall to 7% by 2026. That's still higher than the past two years, but it's well below the company's long-term average.

Not counting 2020 and 2021, Delta's returns haven't dropped below 10% since 2009. And remember, that was right after the Great Recession. Corporations were still in cost-cutting mode and limiting business travel. That's no longer the case today.

Yet the market doesn't think Delta's returns can surpass those levels.

If Delta can continue to capitalize on positive business-class trends as travel returns to pre-pandemic levels, it could do much better than investors expect. We believe returns could easily reach the 14% levels of the past.

Investors were right to be pessimistic toward airlines for the past two years. But things have changed. Their continued doubts could make for a promising opportunity in Delta.

Regards,

Rob Spivey

October 5, 2022

Airlines are finally getting a win... from an unlikely place.

Airlines are finally getting a win... from an unlikely place.