Astronomers aren't the only ones who should be worried about start-up satellite initiatives...

Astronomers aren't the only ones who should be worried about start-up satellite initiatives...

The New York Times ran an interesting article last Thursday on the concerns astronomers have about OneWeb, SpaceX's Starlink, and other satellite initiatives from the likes of Facebook (FB) and Amazon (AMZN).

More and more companies are building competing offerings to canvas the Earth's orbit with satellites that will provide Internet access across the globe. But astronomers are worried that with so many of these new satellites planned, it will impact scientists' ability to study the night sky.

Investors should also consider the consequences...

As we've discussed here in Altimetry Daily Authority in our essays on Grubhub (GRUB) and Uber (UBER), "platform" businesses are all well and good... but in a massively competitive environment, even creating a popular platform can't save you from a lack of pricing power – and therefore low returns for investors.

If we see four or five (or even more) global satellite Internet plays available for customers to choose from, none will have pricing power. And if the businesses don't have pricing power, then it's unlikely that they can earn the returns that their parent companies – and highly optimistic investors – are hoping for.

SpaceX alone is valued at more than $33 billion, and much of investors' perception of value could be attributed to the company's Starlink initiative.

Much like how Iridium and other satellite phone companies ended up struggling to generate the returns needed to justify their invested capital in the late 1990s, expectations for the returns on these initiatives today are likely to disappoint.

Companies like Facebook and Amazon might be planning on building their services out and then giving these away. They might view the infrastructure as an investment to generate revenue for their other businesses, like advertising for Facebook and selling products for Amazon.

But for companies like OneWeb and SpaceX, this business is where they're looking to make money. If these firms are trying to charge a premium for a product that users could get from other competitors – some of which aren't motivated to make money from this business – then they're likely to struggle.

It could end up that in a few years, astronomers' view of the stars in the sky is distorted from an overload of new satellites... with no added benefit for the investors who backed all these initiatives.

Yesterday, we highlighted a dominant advertising conglomerate...

Yesterday, we highlighted a dominant advertising conglomerate...

Omnicom (OMC) has become one of the leaders in the industry through its aggressive growth strategy.

It's the second-largest advertising firm in the world, only behind WPP (WPP). With more than 75,000 employees and more than 1,500 agencies under its control, Omnicom has solidified its spot in its industry through consolidation.

Consolidation has been a common theme across many sectors over the past several decades. The two biggest advertising firms achieved dominance by acquiring many smaller companies. This is also true for the leaders in other industries – ranging from telecom, to media, supermarkets, tobacco, and airlines.

With consolidation being such a popular and powerful strategy, many smaller businesses end up struggling to stay afloat until they either get bought out or fail completely.

However, not every company can become a category-dominating behemoth. Whether there's already a major player with most of the market share, or the company in question is just too small... sometimes aiming to be the largest firm isn't always the best strategy.

In some cases, it can be more strategic to pursue a niche... and dominate that instead.

For example, many small pharmaceutical companies don't bother to grow to be as big as Pfizer (PFE) or AbbVie (ABBV).

Rather, they focus on one particular disease or type of therapy. For instance, Global Blood Therapeutics (GBT) solely develops treatments for blood disorders like sickle cell disease, and Sage Therapeutics (SAGE) only researches central nervous system disorders.

For medical upstarts, this is a more viable approach than trying to consolidate such a diverse sector.

While the rail industry seems like a better candidate for mass consolidation, we've actually seen some niche players survive to this day.

Of course, the big rail players make up the majority of the sector. Companies like Union Pacific (UNP), Norfolk Southern (NSC), CSX (CSX), and BNSF Railway make up more than 75% of the industry.

This clearly looks like an oligopoly, with a few major players dominating the industry.

That said, as we mentioned, some companies have carved out niches to protect themselves from larger competitors. For instance, much like how airlines have specific routes, different railroads cover different geographies.

Despite holding less than 10% of the total market share, Kansas City Southern (KSU) is a market leader in "shortline" rail, as well as transit between Mexico and the U.S.

The company serves just 10 states in the U.S., but it's also a major player in Mexico... and as far south as Panama.

Due to its presence near a number of major North American ports, Kansas City Southern owns some critical routes for importing goods to the rest of the continent. Controlling these key assets means that even without a massive footprint, Kansas City Southern stays relevant.

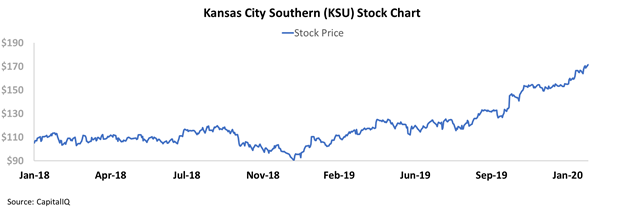

While the company's stock struggled in 2018, it has since exploded... Shares are up nearly 80% since the beginning of 2019.

In addition to operating some key routes, Kansas City Southern is one of the major shortline railroad operators in the U.S. As opposed to many of the transcontinental routes that are dominated by the big players, Kansas City Southern operates a number of smaller, more local lines.

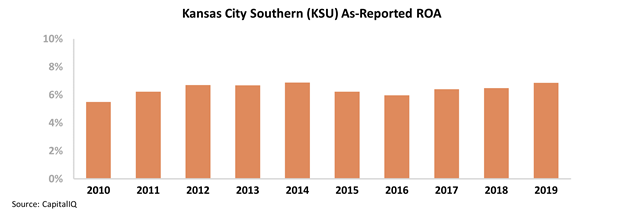

When analyzing the rail industry, small changes in performance can make a big difference. Given how asset-intensive railroads can be, a 1% difference in return on assets ("ROA") can be the difference between large gains and losses.

With that in mind, let's take a look at Kansas City Southern's as-reported profitability. Over the past decade, the company has maintained ROA in line with long-term averages, ranging between 6% and 7%...

While these are decent returns – especially for such a low-margin industry – this doesn't seem to explain why Kansas City Southern's stock has performed so well over the past year.

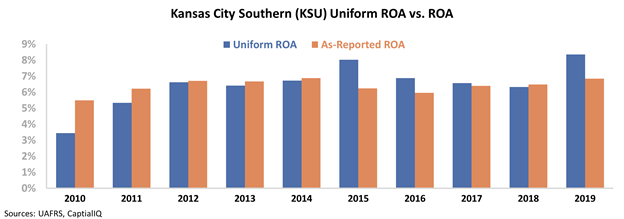

That said, once we look at the company's returns through Uniform Accounting metrics, we can easily see what the market has reacted to...

Using Uniform Accounting – which adjusts for inconsistencies including stock option expense, operating leases, and depreciation – Kansas City Southern actually saw a large profitability inflection in 2019. Take a look...

While most years track the company's performance fairly well, as-reported metrics have failed to highlight when Kansas City Southern has outperformed historical averages. In 2019, the company had a historically high ROA of 8%, which is a huge difference for a rail company.

It seems clear that investors were reacting to Kansas City Southern's outperformance... but you likely wouldn't be able to see why if you relied on as-reported accounting alone.

Regards,

Joel Litman

February 13, 2020

Astronomers aren't the only ones who should be worried about start-up satellite initiatives...

Astronomers aren't the only ones who should be worried about start-up satellite initiatives...