M&As dominated 2021...

M&As dominated 2021...

Altimetry did a few "best of 2021" articles, highlighting our prescient economic calls and stocks that crashed after we said to avoid.

Now that the new year is officially here, let's review 2021 holistically. In mid-December, DealBook published its year in review for the largest deals of 2021.

The New York Times newsletter highlights the largest deal that fell through, a $30 billion acquisition of Willis Towers Watson by Aon, which went up in smoke after the U.S. Justice Department blocked the deal.

It also features Citadel founder Ken Griffin winning an auction for a rare original of the U.S. Constitution, with a whopping $43.2 million bid, beating out a clique of cryptocurrency traders pooling their assets.

The list also underscores Linda Khan and Gary Gensler as the deal breakers of the year. Khan and Gensler are President Joe Biden's nominations for the Federal Trade Commission ("FTC") and the Securities and Exchange Commission ("SEC"), respectively. These recent appointees take an aggressive position on curbing corporate excess.

Khan and Gensler appear to be following European regulator Margrethe Vestager's playbook, who holds a reputation for aggressive trust busting.

But it seems that even between the three of them, a huge amount of ink has been spilled in remaking the corporate landscape through mergers and acquisitions (M&As).

In this back-and-forth battle between deal makers and deal breakers, there is a clear winner...

In this back-and-forth battle between deal makers and deal breakers, there is a clear winner...

Despite these two regulatory heads being hard at work to stymie any noncompetitive or noncompliant deals, 2021 was a record year for deals going through in the U.S. and the world.

As the worst fears of the pandemic have abated, boards have been urging their executives to open the pandemic war chests and start growing their businesses. Thanks to the Fed's stimulus activities, with rates still at record lows, management teams have secured attractive funding to support aggressive purchases for competitors or upstream suppliers.

Meanwhile, many large conglomerates are going through their final death throes, as the pandemic has firsthand revealed the weakest members of the business world. In the span of days, General Electric (GE), Johnson & Johnson (JNJ), and Toshiba (TOSYY) all announced they were splitting their businesses.

Finally, thanks to the special purpose acquisition company ("SPAC") boom of 2020, where investors give their money to an investor who will take a private company public, a plethora of new investable names have entered the public markets.

All of this means that this was the first year in decades that more companies were taken public than were either taken private or merged with another large corporation.

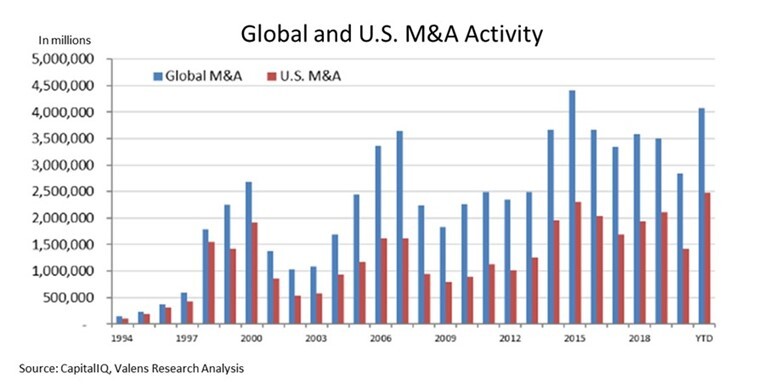

As you can see in the chart below, despite the actions of Biden's new regulators, this was a record year for M&A activity in the U.S., reaching almost $2.5 trillion. Furthermore, this past year was the second highest for global M&A activity, valued at more than $4 trillion. Take a look...

This huge M&A spree has mainly been driven in the financial, technology, health care, and real estate sectors, all key parts of the 21st-century economy.

We see this huge boom in M&A deals after the pandemic as a healthy sign of the strong recovery that has swept the U.S. and the world after the doldrums of 2020. As we have often talked about here at Altimetry, both corporate and national assets are historically old and in need of replacing, as can be seen in the bottlenecked supply chain.

As management teams become more comfortable with spending on M&A deals, they will also continue to invest in their businesses through capital expenditures ("capex"), kicking off a spending supercycle that will continue over the next few years.

This spending supercycle will act as a kick-starter for the economy, as companies start buying from each other in earnest. As spending goes up, it will further the pandemic recovery.

You can keep tabs on the economy and research your favorite stocks all in one place...

You can keep tabs on the economy and research your favorite stocks all in one place...

Once a month, we publish the Timetable Investor feature as part of our proprietary database service, The Altimeter. The Timetable Investor is a one-stop shop to understand where the economy is heading, powered by Uniform Accounting. There, we talk more about how long the capex supercycle will last and how to allocate the funds in your portfolio effectively.

And our research and use of Uniform Accounting extends beyond reviewing the economy...

We also use Uniform Accounting in the Altimeter database – applying our methodology to grade nearly 5,000 companies. It's a great way to see which stocks are over- and undervalued in today's markets... and it's a must-have for anyone who has money in the markets.

For the next few days, you can access The Altimeter for free... Click here to learn more.

Regards,

Joel Litman

January 10, 2022

M&As dominated 2021...

M&As dominated 2021...