As I said last Friday, Altimetry and the entire 'Powered by Valens Research' team hops on a weekly call to foster collaboration...

As I said last Friday, Altimetry and the entire 'Powered by Valens Research' team hops on a weekly call to foster collaboration...

At the end of the call, I provide a coaching comment to help the troops in whatever way a few choice words could make a difference in their work and personal lives.

We thought we'd also share that commentary with Altimetry Daily Authority readers on Fridays. And this week's coaching comments were about some wisdom from Peter Drucker...

He's widely known as "the founder of modern management." We've written about Drucker's wisdom in the past... and one of his key pieces of advice is to "make sure your back room is their front room."

This advice was given to legendary General Electric (GE) CEO Jack Welch to rethink when to outsource. Businesses succeed when they focus only on their core competencies... That means outsourcing anything outside of those competencies.

Drucker advised against creating internal "back rooms" for jobs like security or catering when Welch and GE could outsource to companies that specialized in these areas.

Another one of Drucker's famous phrases was, "what gets measured gets managed." If you don't measure something with hard data, it's difficult to assess whether that something is heading in the right direction.

At the same time, once you start measuring, you must realize how it will cause people to manage to that measure... regardless of whether it's a good metric.

People will do what they perceive they are paid to do. Members of company management will tailor their work to meet the metrics they're being judged by.

Proper corporate governance requires that a board of directors and management identify key objectives and then use milestones and metrics to measure how the key results align with and achieve those objectives. Managers will focus on improving tasks that have quantifiable metrics for measuring results.

And that's not just an imperative for corporations... This concept is important for governments as well. One example is the fascination with gross domestic product ("GDP") as a measure of a country's economic health and well-being.

The increased reliance on GDP as a measuring stick has led governments to tailor their economic policies to improving this metric. However, GDP is limited... It doesn't consider factors like income inequality, quality of life, and many other value-adding activities.

Finally, the concept of "what gets measured gets managed" also applies to an individual's personal life.

Consider someone who's trying to lose weight... If he's focused on the metric of weight alone, it might cause him to lose muscle instead of (or in addition to) fat. Focusing simply on calorie counting can lead to lots of poor decisions for physical health.

Similarly, when travel begins again, we'll undoubtedly see people focused on maximizing their hotel or other affiliation points that allow for free hotel stays and other perks. People focusing on their points tend to change their spending and paying habits radically toward those programs.

Just one of a myriad of crazy activities I've seen was done by a friend of mine. He realized that he'd achieve the next level of his airline loyalty program if he simply took two days off at the end of the year and flew a round-trip, eight-connection flight from New York to Los Angeles and back.

It's impossible to say if the time and effort and missed work were worth the points and the perks. Regardless, his points managing app seemed to be on his phone or computer all the time.

It's true that what gets measured gets managed. Perverse incentives can be created when we're not being very careful about what's getting measured – or how.

Before beginning to measure, there needs to be correct data...

Before beginning to measure, there needs to be correct data...

Additionally, there needs to be a place to make sense of all the data.

One of the biggest issues that companies face in the modern era is an overabundance of information. Additionally, these large data sets can be in disparate systems that don't communicate with each other. This makes it difficult for management to sort through the information overload to see the direction the business is headed.

This is where unifying programs like an enterprise resource planning ("ERP") system come into play. ERPs are business process management software that allow a company to use a system of integrated applications to manage the business. These systems allow management to interpret and manage data from many different business activities and improve decision-making.

The two biggest ERP providers are Oracle (ORCL) and German giant SAP (SAP.DE). SAP is the largest company in Germany and the world's third-largest publicly traded software company.

Over the past decade, SAP's market cap has nearly tripled, as more businesses are utilizing ERP systems to manage data. In an effort to consolidate the industry, SAP has also "rolled up" many competitors – including Sybase, Concur, and Qualtrics.

Investors would likely expect that a company offering software that allows businesses to track operating performance in one place would be able to charge a premium. However, based on as-reported metrics, it looks like companies are viewing the data from SAP as a commodity.

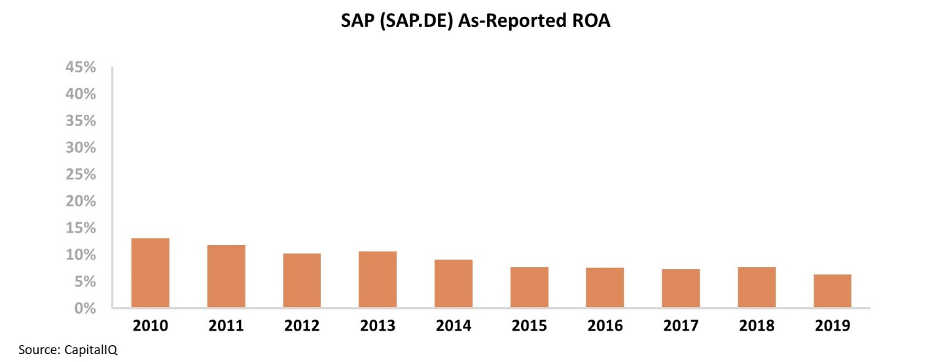

SAP's as-reported return on assets ("ROA") has fallen from 13% in 2010 to 6% in 2019. It appears that companies have devalued the use of enterprise systems to interpret data across the business...

However, this picture of SAP's performance isn't accurate.

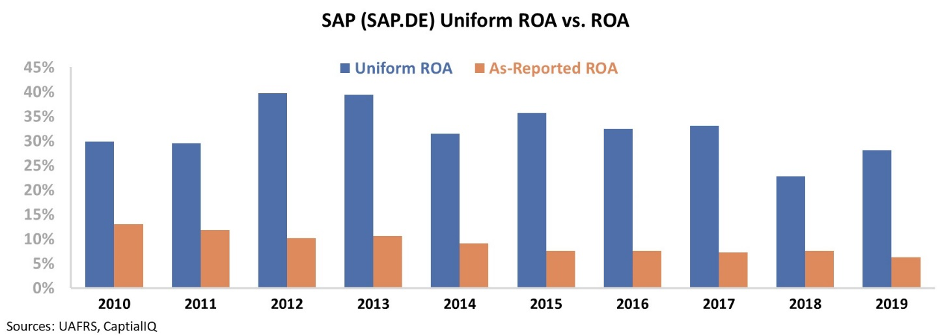

Due to distortions in as-reported accounting – including the treatment of goodwill – the market is missing the strength of SAP's returns.

SAP's Uniform ROA has been at least twice as high as as-reported metrics in each year since 2010. Its Uniform ROA was 28% in 2019, compared to the as-reported 6%.

SAP has been able to effectively capitalize on the increased demand for integrated data and has differentiated its offerings. In addition, the company's acquisitions over the past 10 years have improved its cloud-computing position in the market. SAP has reportedly spent more than $70 billion improving its cloud offerings to take advantage of the shift to the cloud.

However, to determine if SAP can continue to create value for shareholders, we need to look beyond the company's historical returns. For this, we'll turn to the Embedded Expectations Framework to easily understand market valuations.

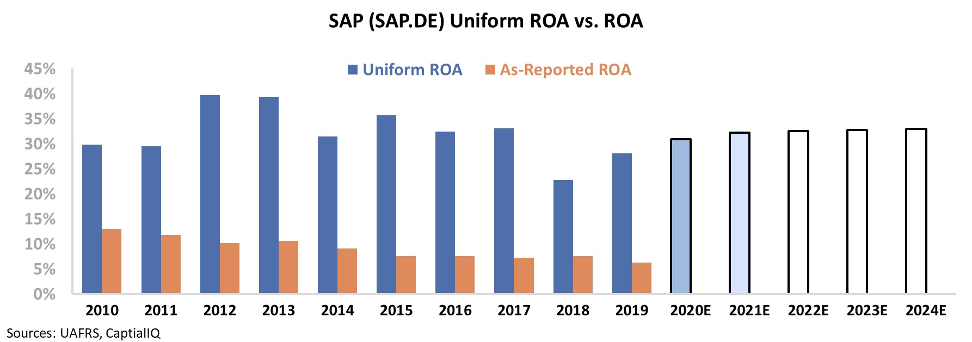

The next chart shows SAP's historical corporate performance levels, in terms of ROA (dark blue bars) versus what sell-side analysts think the company is going to do in the next two years (light blue bars) and what the market is pricing in at current valuations (white bars).

Analysts forecast SAP's returns to grow to 32%, with the market expecting returns to sustain this level.

If the company is able to take advantage of the increased demand for cloud offerings through its huge investments, these returns may be too pessimistic. SAP is also under pressure from famed activist hedge fund Elliott Management, which is pushing for improvements to the company that may result in higher returns.

Without Uniform Accounting, investors would likely see SAP as a company with average, declining returns rather than one with robust profitability.

The market is pricing in returns to plateau at analyst predictions. But if SAP can execute on its cloud offerings with the help of Elliott Management, these expectations may be too low – and that could mean a surprise to the upside for SAP's stock.

Regards,

Joel Litman

October 16, 2020

As I said

As I said