Editor's note: In lieu of a normal Altimetry Daily Authority today, we thought it was relevant, considering the election, to take a look at the markets from an asset allocation perspective.

As we go to press, the winner of the election is still unknown...

As we go to press, the winner of the election is still unknown...

We write the Altimetry Daily Authority and schedule it the evening before it publishes, so it can hit your inbox at 8 a.m. Eastern time each morning without a hitch.

In reality, even if we were writing this on Wednesday morning, we likely wouldn't know for sure who won the election yet.

Take Pennsylvania, for instance. The Keystone State doesn't count mail-in ballots until Election Day, and because of the massive volume, it may be days before the final count in Pennsylvania is clear.

Since this election is so unusual, the ability to use usual forecasting models from early votes is probably questionable, too.

As such, the market is faced with something investors hate even more than bad news: uncertainty.

Yesterday, Bloomberg published an article explaining what investors should and shouldn't do ahead of the election.

The article discusses making sure to not overreact, since those who reacted to the market dropping the morning after the Trump election were proven wrong.

It also talks about how you should watch your order types. Don't have market orders in if there's lots of volatility. Market orders can lead to bad execution prices as the market swings around in the short term.

The writers recommend not only paying attention to equities. In big macro events, price swings can occur across asset classes – including currencies, commodities, and bonds.

It's a thoughtful primer on how things can happen, and it's worth reading. But our advice is different...

Do nothing...

Do nothing...

The reason why you should do nothing is the same reason we also recommended you not panic in the midst of the coronavirus sell-off.

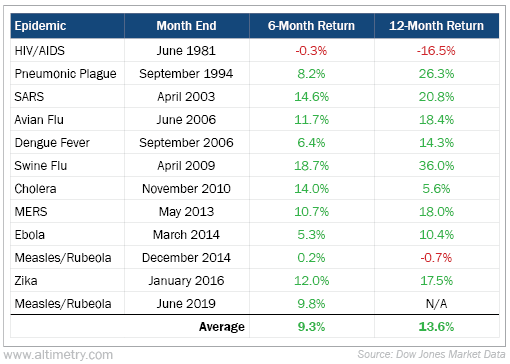

If you remember, on March 2, we shared the following graphic in the Daily Authority...

Our point, of course, was that the performance of the market after each epidemic in the past 30 years wasn't dictated by the severity of the epidemic. It depended on how healthy the economy was before the epidemic hit and how the central bank and governments reacted.

Of course, the coronavirus proved our point. The pandemic has taken more than 1 million lives around the world, including more than 200,000 in the U.S. The cost in human life has been staggering.

However, because of what the central banks and governments around the world did in March and April, the world economy hasn't collapsed. They made sure credit was accessible and prevented companies from going under, so the market has rocketed higher. The S&P 500 surpassed its February highs in August and has drifted sideways leading up to the election.

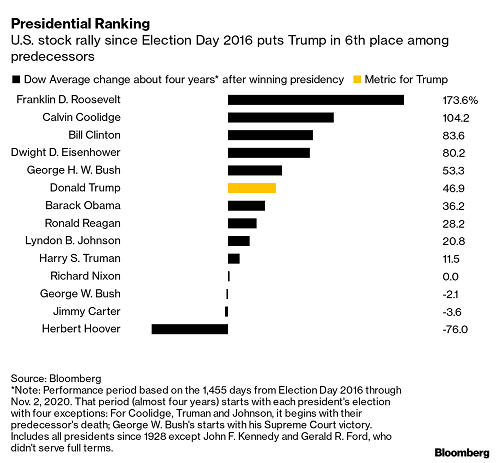

With that in mind, the following chart from a different Bloomberg piece was far more interesting and useful...

There hasn't really been any correlation between which party's president has been in office and the stock market's performance.

Franklin D. Roosevelt and Bill Clinton, both Democrats, had two of the three best stock market performance results for presidents going as far back as Calvin Coolidge.

Of the top six performances for the stock market, three have been under Democratic presidents and three have been under Republicans.

This isn't an opinion on what the market will do if Joe Biden or President Donald Trump wins.

It's the same point we were highlighting when talking about the pandemic back in March. And if you remember, our call in March ended up being the right one.

Our point is this: Pay attention to the other factors that have far more impact on the market than who is president, in terms of the macro indicators around credit, earnings growth, corporate profitability, and all the other drivers of economic growth and stock market valuations.

Those factors had much more to do with how the market performed for each of those presidents than the president's actions themselves did.

And as we talk about time and again each Monday at Altimetry, all of the most important indicators – and the credit signals in particular – aren't flashing "warning signs." That means no matter who wins the election, the market is unlikely to crash over the long term.

As we said on Monday, no matter who wins and what happens for taxes, it's better to ride through it than to try to time it yourself.

Any dip because of election panic should be viewed as a buying opportunity. The macro data we've been highlighting the past six months continue to say that staying long this market is the right bet.

That's why the right way to invest after an election is the same way you should invest any day: with a calm hand and data at your disposal – don't overreact and let emotions take over.

Regards,

Joel Litman and Rob Spivey

November 4, 2020

As we go to press, the winner of the election is still unknown...

As we go to press, the winner of the election is still unknown...