At Valens Research – the firm that powers Altimetry – we have a close relationship with MBO Partners...

At Valens Research – the firm that powers Altimetry – we have a close relationship with MBO Partners...

MBO is a consulting firm for independent professionals and companies looking to match up. Just recently, we had a conversation with the company's leadership about economist Ronald Coase's "Theory of the Firm." This theory states that companies exist to minimize transaction costs – it's cheaper to employ people for the long term, compared to staffing for each individual project.

Historically, if a company doesn't staff for a longer term (or work with suppliers and partners over a longer term), some of the costs for each project include:

- Discovering relevant prices

- Negotiating and writing enforceable contracts for each transaction

- Renewing contracts in an uncertain world

A company that hires its own employees and partners with long-term contracts could minimize some of these costs... and reduce the risk that someone (or something) isn't available when needed most. Incrementally, a business can save money by investing in its employees for the long term and reducing training costs.

However, modern technology is mitigating some of these risks. The growth of platforms that enable independent contractors has reshaped the way modern companies can be run.

The traditional need for the corporation diminishes with the ability to qualify people based on prior ratings and experience, identify contractors with reasonable rates who understand market pricing, and engage easily with a large workforce.

Community validation can act as a mechanism for price discovery and contracts. If customers are happy (or unhappy) with a service, they can let a whole community know about the experience. Community validation can also give prospective customers the opportunity to compare prices and quality for independent contractors easily, thus reducing the need for price discovery.

These trends toward independent contractors already appear to be accelerating in the wake of the coronavirus pandemic.

Companies are becoming accustomed to remote work, and the role of outsourcing tasks is continuing to grow. They're also getting used to outsourcing more of their work to specialists instead of doing it all in-house.

These trends are changing employment, supply chains, and the role of the corporation permanently... and they call into question Coase's Theory of the Firm.

And yet, the idea of 'unbundling' the corporation has grown in relevance over the past 10-plus years...

And yet, the idea of 'unbundling' the corporation has grown in relevance over the past 10-plus years...

The emergence of platform business such as Uber (UBER) and Lyft (LYFT) have upended traditional work norms. With these ride-hailing businesses, drivers are considered independent contractors and are able to set their own schedules and hours. They aren't considered employees of either company, but this distinction has come under fire in recent months.

Other industries have been disrupted by specialized contract labor companies like Upwork (UPWK) and MBO. Upwork is a freelancing platform that connects businesses and individual contractors. It has more than 12 million registered freelancers – disrupting the traditional notion of working for corporations.

This idea of outsourcing work has even been growing at some of the larger and more traditional corporations. Aerospace companies like Boeing (BA), Lockheed Martin (LMT), and Airbus have embraced the idea of outsourcing specialized product creation.

These giants take full ownership of product development, but look elsewhere to source the individual parts. This allows smaller companies – and sometimes even solo engineer shops – to focus on one part of production and develop specialized skills in that area.

Airbus outsources more than 80% of its parts – including engines – while the Boeing Dreamliner family has historically outsourced more than 90%.

Another industry where the traditional work arrangements and value chain are being disrupted is the pharmaceutical business.

Big Pharma has begun outsourcing much of the early-stage research and development (R&D) to small companies. The larger players will often come in and buy or license the drugs after the smaller firm's initial research is nearing completion.

On the other hand, while the semiconductor industry has seen a high degree of specialization over the past 20 years, the biggest players have often held out on outsourcing.

Historically, the large companies developing semiconductor chip designs have also produced the chips. Intel (INTC) has been a prominent example of a company that owns the entire semiconductor process.

However, the smaller companies in the industry have been outsourcing manufacturing to fabricators. Semiconductor fabricators produce chips in large volumes and often don't focus on building their own internal design capabilities. The largest of these companies is $380 billion giant Taiwan Semiconductor Manufacturing (TSM).

While Intel has been historically viewed as the market leader in semiconductors, a changing of the guard – and a breaking-up of the supply chain – appears to be happening...

Taiwan Semiconductor passed Intel in market capitalization in 2017, highlighting the integral role it plays within the industry. Its market position has led to remarkably stable returns over the past 10 years.

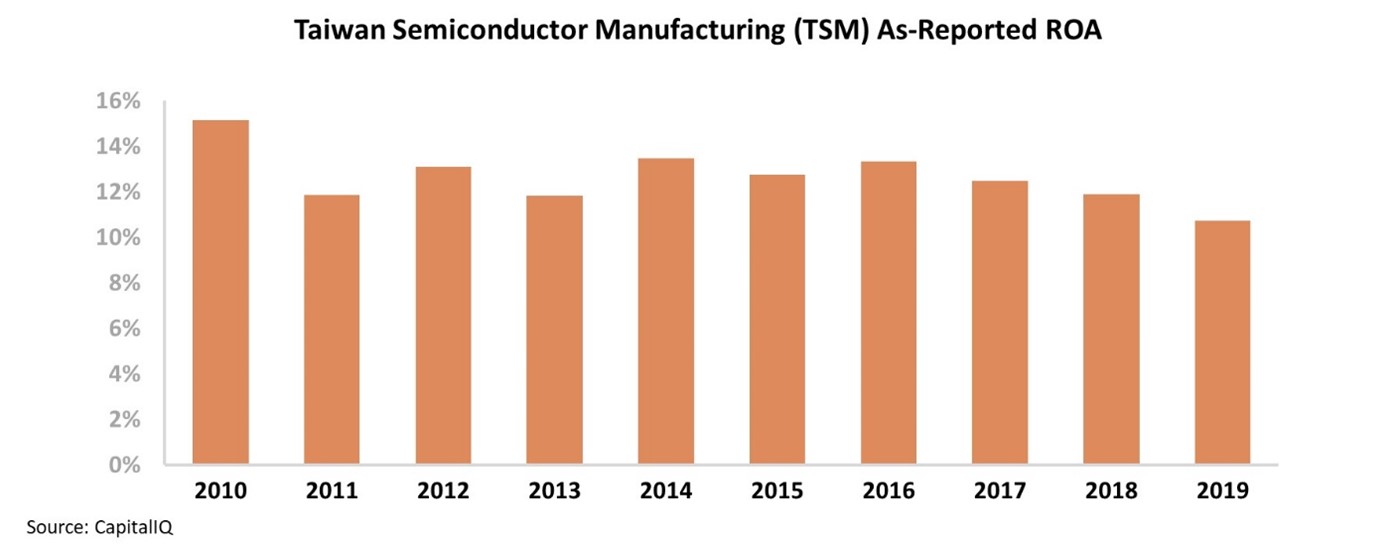

Looking at Taiwan Semiconductor's as-reported return on assets ("ROA"), this metric appears to have been relatively stable between 11% and 15% since 2010. Taiwan Semiconductor has managed to create an essential business for semiconductor companies to outsource production.

These firms have focused on their core competency of semiconductor design, while Taiwan Semiconductor specializes in mass production.

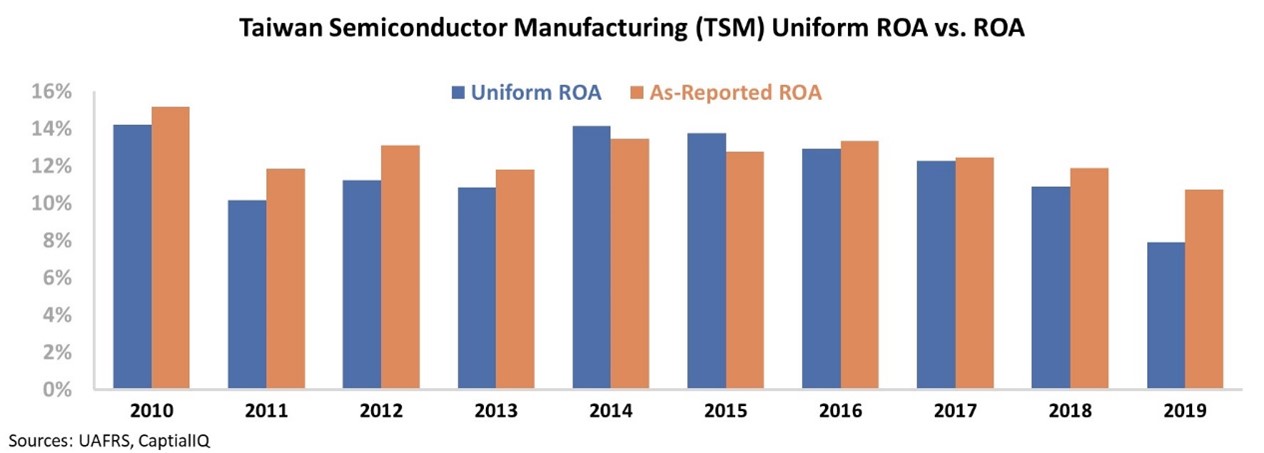

However, this picture of Taiwan Semiconductor's performance isn't accurate. Due to distortions in as-reported accounting – including the treatment of maintenance capital expenditures ("capex") – the market has missed the mark about the company's profitability.

Taiwan Semiconductor's Uniform returns were similar to as-reported metrics until recent declines in 2018 and 2019. The company's Uniform ROA fell to 8% in 2019, compared to 11% based on as-reported metrics. The market has been understating how much Taiwan Semiconductor's profitability has been hit over the last few years.

GAAP accounting understates Taiwan Semiconductor's investments in maintenance capex and the size of investment in physical assets necessary to continue operating.

The semiconductor industry is highly capital-intensive, and Taiwan Semiconductor must continue investing in its manufacturing ability to keep up with technological innovation. The company's performance isn't as impressive as it initially appears. Take a look...

However, just because returns have fallen in the past doesn't mean Taiwan Semiconductor is a bad stock. To understand this, we need to turn to future valuations by using our Embedded Expectations Framework to see if the company can continue to create value for shareholders...

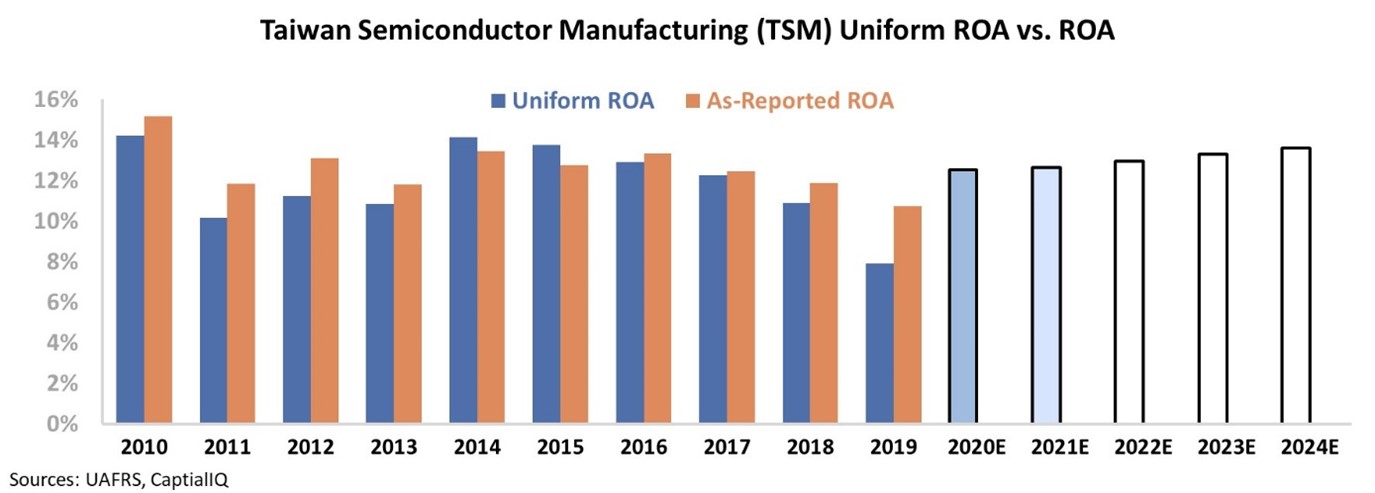

The chart below explains Taiwan Semiconductor's historical corporate performance levels, in terms of ROA (dark blue bars) versus what sell-side analysts think the company is going to do in the next two years (light blue bars) and what the market is pricing in at current valuations (white bars).

Right now, analysts and the market expect to see Taiwan Semiconductor's returns rise almost to historical highs over the next few years. The market is pricing in returns to rebound all the way to 13% by 2024...

This would imply the decline over the past two years was a temporary blip. However, if Taiwan Semiconductor is forced to continue investing huge sums into fixed assets as semiconductor firms try to squeeze the company's margins, these returns may be too optimistic.

Without Uniform Accounting, investors would miss this crucial semiconductor firm's recent downward inflection. They might see Taiwan Semiconductor as a company with only a small drop in profitability rather than a big decline.

Not only has Taiwan Semiconductor's ROA come under pressure, investors are wrongly predicting these returns will reverse strongly... thus making the name look expensive today.

Regards,

Joel Litman

September 30, 2020

At Valens Research – the firm that powers Altimetry – we have a close relationship with MBO Partners...

At Valens Research – the firm that powers Altimetry – we have a close relationship with MBO Partners...