Joel's note: The Altimetry offices are closed on Monday for Martin Luther King Jr. Day, so look for the next Altimetry Daily Authority on Tuesday, January 21.

Ride-hailing company Uber (UBER) is under assault from the skies...

Ride-hailing company Uber (UBER) is under assault from the skies...

The theme this week here at Altimetry Daily Authority can basically be summarized as "platform companies and all the problems with this fad business model."

On Tuesday, we highlighted how food-delivery service Grubhub (GRUB) has started to struggle with competition in a business with limited competitive moats.

On Wednesday, we talked about how Uber has struggled to ever make money in any of the various businesses it has launched – from its namesake platform, to Uber Eats, to Uber Copter.

And yesterday, we mentioned that even the scooter-sharing platforms that have taken many large cities by storm are starting to realize that their model is a challenging one to make money in.

Well, yet another company is getting closer to competing in the oversaturated transportation ecosystem. Startup Joby Aviation just received nearly $400 million in funding from automaker Toyota.

Joby is currently developing an electric passenger aircraft. The idea is to create a vertical takeoff and landing ("VTOL") aircraft that Toyota is exploring using in a flying taxi startup it's investing in.

Uber might have thought it was breaking into a more challenging market to replicate with its development of Uber Copter... but with Blade and others already in that market, even here Uber appears to be facing stiff competition that will limit its profitability.

If Joby is successful with its research and development (R&D), Toyota will be entering the flying taxi market... making things even more competitive for Uber.

As we move into the new year, it's a great opportunity to look for the key data and big investment themes that are likely to drive markets in 2020...

As we move into the new year, it's a great opportunity to look for the key data and big investment themes that are likely to drive markets in 2020...

One of the areas we're focusing on is retail.

Following the holidays, we've started monitoring a number of retail-related numbers – including sales and return figures.

Generally speaking, analysts expected this to be a strong holiday season. But while overall sales were generally positive, it was one of the most heavily discounted holiday seasons since the Great Recession.

The discount environment particularly hit department stores like J.C. Penney (JCP) and Macy's (M) and specialty retailers like L Brands (LB), who all saw comparable sales fall this holiday season.

As a result, many of these retailers plan to continue closing physical stores this year. 2019 was a record year for store closings, with more than 9,300 retail locations shutting down in the U.S. alone. For context, roughly 6,200 stores closed their doors for good at the height of the financial crisis in 2008.

Already, major retailers plan to close more than 1,300 locations in 2020, which puts this year on pace for the worst ever – with an estimated 12,000 total closures.

While physical stores struggled in 2008 due to financial disaster, the current slew of closures are due to the so-called "retail apocalypse" – the widespread, increasing competition from online retailers like Amazon (AMZN).

Many retailers have seen their stocks fall significantly as the retail apocalypse looms larger than ever. This is justified in many cases, as department stores like Barneys have recently gone bankrupt... and many others like J.C. Penney aren't far off.

When a trend as big as the retail apocalypse impacts an entire industry like this, it tends to lead to some companies being artificially punished. As the saying goes, these stocks are being thrown out like "the baby with the bathwater" – meaning they fall in sympathy even though they're less impacted by the overall trend.

Finding these stocks can lead to massive upside. For example, Williams-Sonoma (WSM) traded all the way down to $7 per share at the bottom of the Great Recession, but has rebounded to more than $75 per share today.

Right now, some analysts are wondering if Gap (GPS) fits that description...

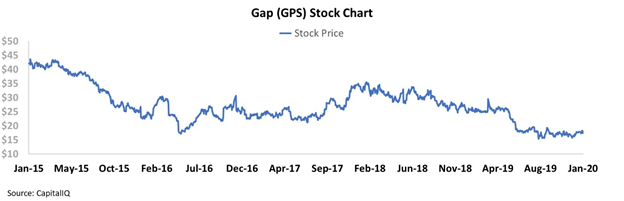

With its timeless designs and simple color schemes, Gap is a popular brand among many Americans. However, over the past five years, the company's stock has fallen by 60% amidst concerns about the retail apocalypse...

Given the fact that the broad market is up roughly 60% over that same time frame, this is a clear sign that investors are pessimistic about Gap today.

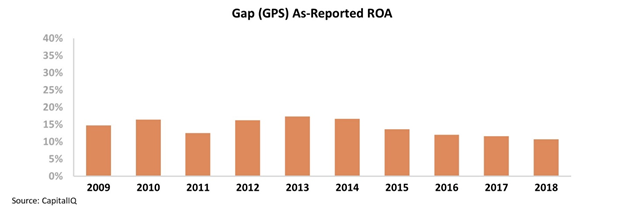

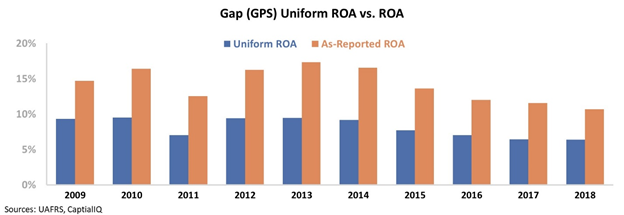

However, despite negative sentiment and the overall struggles in the retail landscape, the company has maintained decent returns. Gap's return on assets ("ROA") has certainly declined in recent years... but it's still 11% – slightly above corporate averages and much better than most peers.

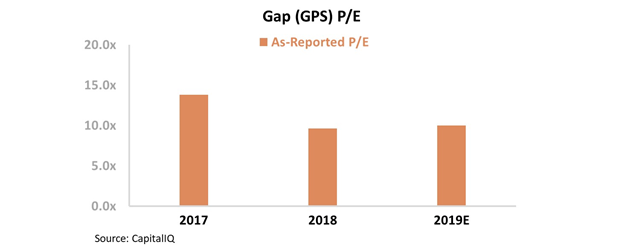

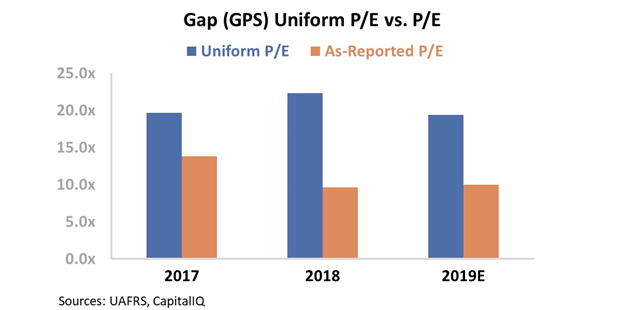

It looks like Gap has been unfairly punished. And at current stock prices, its valuations look interesting as well. Gap's price-to-earnings (P/E) ratio is 10, which is significantly below market averages. This is a potential sign that the company is undervalued.

However, once we apply our Uniform Accounting framework, we can see that Gap may not be as interesting as it seems. After adjusting for inconsistencies in as-reported financial statements – such as the treatment of operating leases and stock option expense – we can see why its stock has fallen 60% over the last five years. Take a look...

Gap's ROA has actually fallen to 6%, which is well below current corporate averages. This is also a 10-year low – weaker than it was coming out of the Great Recession.

On top of that, even after losing 60% of its market share over the past five years, Uniform Accounting reveals that Gap isn't undervalued at all. It's still trading at a market-average P/E ratio of roughly 20 times. Take a look...

As-reported accounting metrics make it seem as if Gap is poised to survive the retail apocalypse. Only with Uniform Accounting can we see that the company has reacted as it should.

Regards,

Joel Litman

January 17, 2020

Ride-hailing company Uber (UBER) is under assault from the skies...

Ride-hailing company Uber (UBER) is under assault from the skies...