Despite positive economic data, there's still a big red flag out there...

Despite positive economic data, there's still a big red flag out there...

Recent indicators are encouraging... Unemployment is incredibly low, at 4.1%, and inflation is largely cooling off.

The Consumer Price Index rose only 2.4% from September 2023 to September 2024. That's the smallest year-over-year increase since February 2021.

Additionally, the Federal Reserve's decision to cut interest rates last month – along with the likelihood of future cuts – could give the economy a much-needed boost.

Yet even with this positive momentum, one major issue remains unresolved – the student-loan crisis.

Right now, Americans owe a whopping $1.7 trillion in federal and private student loans. This represents about 9% of overall consumer debt in the U.S.

As we wrote back on September 5, the Biden administration restarted student-loan payments in October 2023, after a three-year pause.

However, loan providers haven't reported delinquencies and defaults to credit agencies due to the government's 12-month grace period. That ended on September 30, 2024.

When this reporting resumes, it could send shockwaves through the economy, revealing the true scale of the total debt burden. Today, we'll explain what those reports, plus other key data, could mean for both consumers and investors moving forward.

Official reports don't yet show a major spike in student-loan delinquencies and defaults...

Official reports don't yet show a major spike in student-loan delinquencies and defaults...

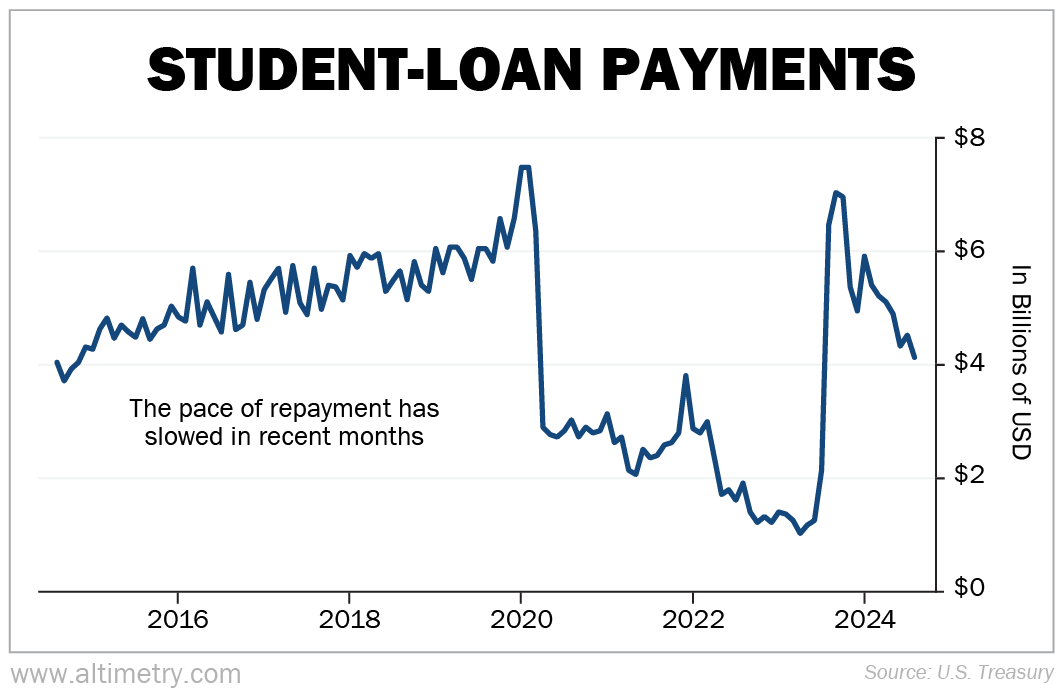

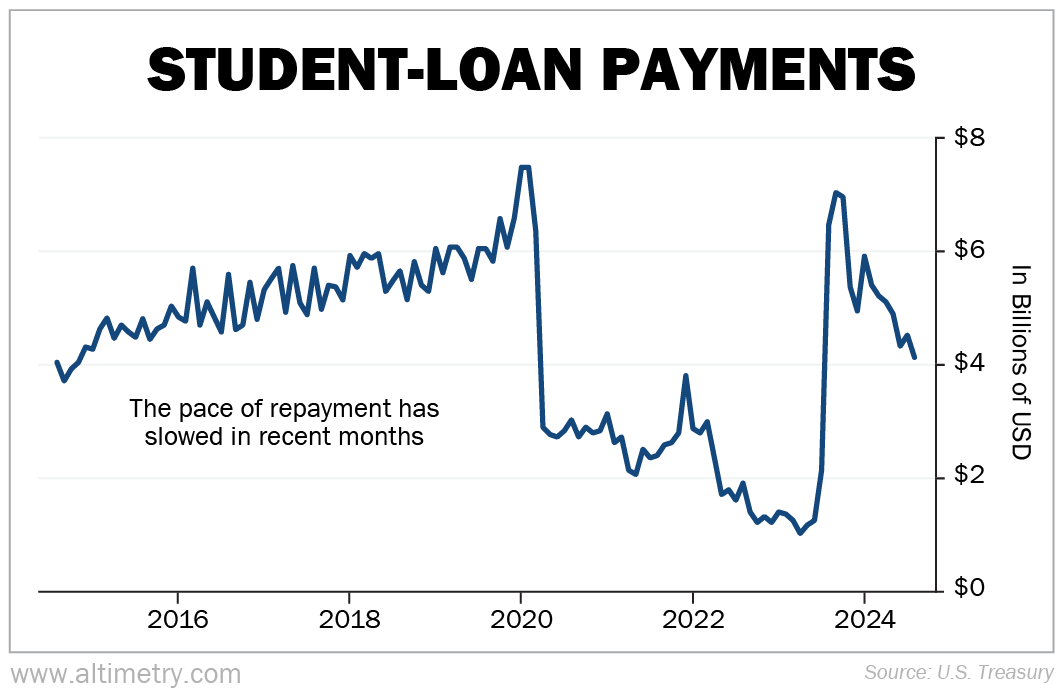

But we know that borrowers are still struggling to pay off those loans. We can see that in the data compiled by the U.S. Department of the Treasury...

This agency tracks payments to the U.S. Department of Education from borrowers who've taken out federal loans, like Stafford loans.

When student-loan payments officially restarted last fall, the U.S. Treasury reported a surge in repayment activity... Monthly payments jumped from a low of $1 billion to about $7 billion, similar to pre-pandemic levels.

For a brief moment, it seemed like things were getting back to normal. But that rebound didn't last long...

Loan payments have steadily declined over the past year, dropping to just $4 billion a month. Take a look...

This sharp decrease is likely due to the strain of factors like high costs and depleted savings.

As we wrote on August 19, nearly all pandemic-era savings were exhausted by the end of 2023. Yet that didn't stop people from spending.

Mounting consumer pressures could ripple across the economy...

Mounting consumer pressures could ripple across the economy...

Folks are still taking on huge amounts of debt to cover their expenses.

According to the Federal Reserve Bank of New York, total household debt rose to $17.8 trillion in the second quarter of 2024. That's a 4.3% increase from the previous year.

And many borrowers are falling behind on their payments... As we noted on September 5, credit-card, mortgage, and auto-loan delinquencies hit multiyear highs as of early 2024.

This trend ramped up shortly after student-loan repayments resumed last September, following the pandemic-era pause. That uptrend will likely continue as delinquency/default reporting ramps up.

Every type of loan delinquency (except for student loans) has risen in recent quarters. And student-loan delinquency will likely follow suit.

The bottom line is, many borrowers put their student loans on the back burner. And now that payments have resumed, they're having trouble balancing tighter budgets.

That's why the broad consumer-debt picture is likely to get very messy.

Right now, we're only seeing the tip of the iceberg...

Right now, we're only seeing the tip of the iceberg...

Despite some encouraging economic data, the sharp slowdown in student-loan payments is flashing a clear warning...

As the official loan reports begin to confirm delinquencies and defaults, the financial pressure on consumers will only increase. That could fuel a rise in debt levels across the board.

Simply put, consumers are facing much more pressure than the headlines suggest. And the mounting debt will continue dragging households down for the foreseeable future.

It's only a matter of time before that pressure spreads to the market... That means investors need to keep their eye on the latest reports and prepare for some troubling news in the months ahead.

Regards,

Joel Litman

October 21, 2024

Despite positive economic data, there's still a big red flag out there...

Despite positive economic data, there's still a big red flag out there...