Inflation rates aren't falling fast enough...

Inflation rates aren't falling fast enough...

After many months of rampant inflation, we're finally getting some relief.

The headline inflation rate, which is based on the consumer price index, dropped to 3% in June, marking a 16-month low.

The core inflation rate, which removes high-volatility categories like energy and food from the calculation, also tumbled... from the 6.6% peak in September 2022 to 4.8% in June.

This is great news for the economy... It means the Federal Reserve's interest-rate hikes are working.

However, the central bank isn't ready to take its foot off the gas pedal just yet...

Last week, the Fed signaled that it's willing to keep interest rates high, and possibly raise them further, in order to reach its 2% target core rate.

The Fed hasn't committed to more rate hikes beyond its recent 0.25% increase, though. And that brings up a few possible scenarios...

It could keep interest rates steady... It could continue raising rates... Or it could lower rates if unemployment and economic-growth metrics worsen.

The Fed may ultimately draw inspiration from a key period in U.S. history.

We'll explain why the central bank might use a post-World War II tightening policy even as inflation continues to fall...

History doesn't usually repeat itself, but it often 'rhymes'...

History doesn't usually repeat itself, but it often 'rhymes'...

As longtime readers know, history usually "rhymes," meaning that similar events tend to follow predictable patterns.

So while no two market cycles are identical, we can use historical examples to pinpoint future outcomes.

Today, we're detailing how the post-COVID-19 environment rhymes with the post-WWII period from 1945 to 1949...

In 2022, stimulus-backed consumer and corporate balance sheets, supply-chain issues, and increased consumer demand fueled the highest inflation rate in more than 40 years.

Similar conditions propelled the massive inflation rate that took hold after WWII ended...

Around 1947, inflation reached almost 20%. Two years after the COVID-19 pandemic began, inflation peaked above 9%.

In both cases, the Fed aggressively raised interest rates. And it worked...

Inflation dropped back to normal levels within two years of peaking post-WWII, and it's on track to do the same today.

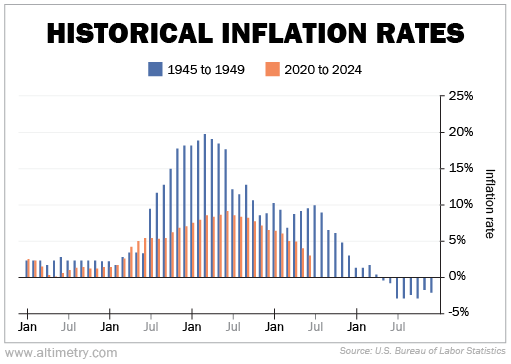

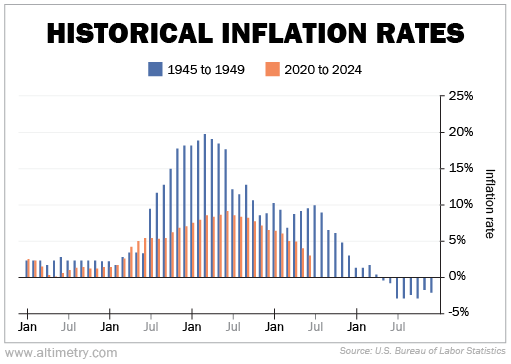

We can visualize these two inflation cycles in the chart below...

This graphic compares the inflation rates in two specific five-year periods – one following WWII and one following the start of the COVID-19 pandemic.

While the post-pandemic inflation rate never reached double digits, the overall pattern is similar...

We can see that the Fed is poised to repeat its post-WWII success in curbing inflation.

So it's no surprise that the Fed wants to maintain its aggressive monetary policy until it hits the 2% inflation target.

Although inflation is improving, we're not out of the woods yet...

Although inflation is improving, we're not out of the woods yet...

If today's inflation cycle continues to mimic what happened after 1945, the rate should keep falling.

But it may not be a smooth ride down...

Despite its successful tightening policy post-WWII, the Fed wasn't able to achieve a "soft landing."

In other words, it couldn't lower inflation without pushing the economy into a recession. Case in point... By 1949, the U.S. actually entered a period of deflation and a mild recession. (See the chart above.)

We could suffer a similar fate in the near future...

If the current cycle follows the post-WWII pattern, the Fed's rate hikes may lead to deflation in 2024, meaning a recession could be looming.

Today's mainstream media headlines suggest that we will avoid a recession, but we aren't so sure.

As inflation keeps dropping month after month, don't assume the worst is behind us.

We recommend you track a mix of economic indicators, along with the headline and core inflation rates... Credit and corporate earnings are at the top of our list, as they could spell trouble in the months ahead.

Regards,

Rob Spivey

August 2, 2023

Inflation rates aren't falling fast enough...

Inflation rates aren't falling fast enough...