Joel's note: Both the market and Altimetry are closed tomorrow for Good Friday, so look for the next Altimetry Daily Authority on Monday, April 5.

The post-pandemic world is emerging...

The post-pandemic world is emerging...

Ever since the start of the coronavirus pandemic, we've been highlighting how an economic recovery will be split between industries.

The businesses that service the home have been thriving. Meanwhile, industries like airlines, hotels, and restaurants have all struggled over the past year.

We've dubbed the big shift in consumer habits the "At-Home Revolution." And sadly, these service industries have been left behind during the pandemic.

However, our view was never that these entire industries were doomed. Rather, within these struggling sectors, certain winners would emerge from the wreckage. So, in the second half of 2020, we started talking about the second theme we noticed in the market...

Within the struggling industries, only the companies with rock-solid balance sheets and durable business models will be set to survive the pandemic. Then, with less competition, these names will be ready to win in a post-pandemic world as they take market share.

We've called this second theme 'Survive and Thrive'... and we're seeing it play out today.

We've called this second theme 'Survive and Thrive'... and we're seeing it play out today.

As Bloomberg recently explained, the gap between the haves and have-nots of the restaurant world is continuing to grow.

More than 91,000 restaurants and bars closed their doors for good during the pandemic. Meanwhile, burrito chain Chipotle Mexican Grill (CMG) is opening 200 new locations this year.

With more than two-thirds of U.S. restaurants being small players, this has left a large hole in the restaurant space. Landlords are willing to take reduced rents to fill the space.

This means the surviving players can take greater market share and operate for cheaper than ever.

Chipotle isn't the only restaurant looking to come back with a vengeance in 2021...

Chipotle isn't the only restaurant looking to come back with a vengeance in 2021...

Names like P.F. Chang's and Red Lobster are larger brands with strong credit that are seeking to expand.

However, some of the restaurant chains with the most exposure to the Survive-and-Thrive theme aren't publicly traded. This means investors have focused on a select number of chains set up for success.

Another potential name the market is starting to pick up on is Texas Roadhouse (TXRH). With a free bucket of peanuts at each table alongside honey cinnamon butter rolls, Texas Roadhouse has built brand loyalty across the U.S. – particularly in the South.

TXRH shares are already up more than 20% this year as investors have seen the potential for the company to survive and thrive in the post-pandemic world.

However, without the right metrics, it's impossible for investors to understand the real fundamentals of the business... and if the stock is a good buy as a Survive-and-Thrive name.

To see the real picture, we can turn to The Altimeter...

To see the real picture, we can turn to The Altimeter...

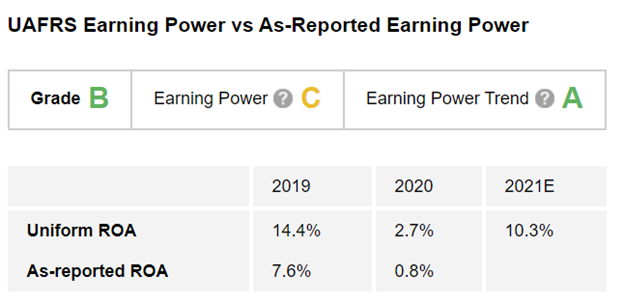

Using the power of Uniform Accounting – which eliminates the distortions in as-reported financial metrics – our Altimeter tool breaks down stocks using easily digestible grades and ranks them based on their real financials.

After making adjustments though Uniform Accounting, we can see Texas Roadhouse's return on assets ("ROA") has understandably fallen in 2020 due to demand collapsing during the pandemic.

However, based on Wall Street analysts' forecast for a reversal of this dip in 2021 and ROA recovering to average levels, the company earns a "C" rating for its Earnings Power in The Altimeter.

Analysts expectations for the big move higher this year – even as many restaurants are still forced to operate at limited capacity – also earns the firm an "A" for Earnings Power Trend.

Considering the pandemic's devastation to the industry, investors might be surprised to see a restaurant with such good Altimeter grades. So that must be a reason to run out and buy TXRH shares, right?

Not so fast...

Not so fast...

The market may already be banking on this recovery and more after the stock's recent run higher. If the market is overpaying for Texas Roadhouse, it may be a name to avoid instead of buy.

The Altimeter shows the real valuations based on Uniform Accounting. Subscribers can click here to see these for Texas Roadhouse... and learn if the trend is already priced in.

If you aren't yet an Altimeter subscriber, click here to find out how to gain immediate access Texas Roadhouse's full story based on Uniform Accounting.

Regards,

Rob Spivey

April 1, 2021

The post-pandemic world is emerging...

The post-pandemic world is emerging...