Cruise ships may never return to normal after the pandemic...

Cruise ships may never return to normal after the pandemic...

Concerns over the pandemic have been devastating for cruise ships. Major cruise line operators like Carnival (CCL) have seen their revenues collapse. With cruise ships idling, many people still think of them as floating petri dishes.

When the pandemic had just started to spread to the U.S., one of the first major outbreaks was on a cruise ship. The Diamond Princess ship had more than 700 passengers and crew members test positive for coronavirus. Crew and passengers were stuck on board for nearly a month and needed to quarantine before returning to their respective home countries.

Stories about the Diamond Princess and ships in Hong Kong were some of the first stories Americans read about the pandemic.

Naturally, with the headline risk and diminished demand, cruise ship companies have faced tough decisions. Many cruise lines are sending older vessels on a final voyage to a scrap yard.

As this Bloomberg article highlights, cruise ship operators are sending older ships to Turkey, where workers will begin the exhaustive and dangerous nine-month process of salvaging the ships' parts.

Everything from a ship must go, including artwork, kitchen equipment, and copper wires. Yet nothing is more valuable than the steel which makes up the hull of the vessel. The steel alone can be worth upward of $4 million.

This is part of the natural life cycle of any ship. However, the pandemic has ended some ships' lives earlier than expected.

While the process is not pretty, it is the only choice for struggling cruise lines. It costs money to store and maintain any large ship. With no demand for cruises, salvaging is the only income source for management. The cruise lines are hoping to stay solvent until spending returns to normal levels.

Slashing spending now can prime the pump for future growth...

Slashing spending now can prime the pump for future growth...

Lower consumer spending leads to the exact kind of reduced investment cruise lines are currently showing. In the short term, it can become a vicious cycle. Less spending leads to less investment, which means people are laid off, which leads to further reduced spending.

Then, eventually, things stabilize. It looks like that has already started to happen in the back half of the year, as people grew tired of lockdowns and hopes for the vaccine have emerged.

As demand finally starts to pick up, capacity will tighten and prices will rise, which will lead to bigger profits for businesses.

Those bigger profits then make it likely that companies will reinvest in themselves to grow further. This creates a virtuous cycle, the opposite of the one leading to cruise lines scrapping older boats. It is the fuel that leads the economy to sustain growth.

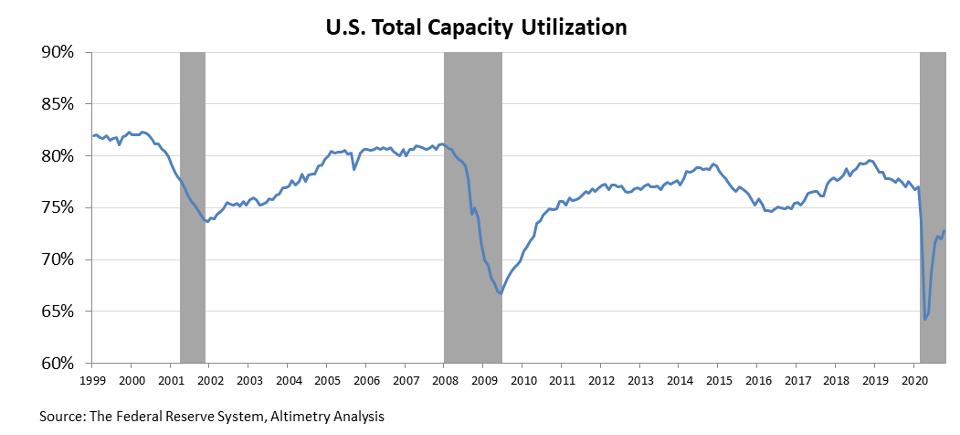

To understand where we are in this spending cycle, we can look at the "capacity utilization rate."

This measures how hard factories, forgeries, and even retail stores are working, relative to the maximum production rate they could reach. A higher rate means the economy is running near capacity, while a lower rate means more room for production to grow.

We last looked at this metric over the summer. At the time, the utilization rate had collapsed. Lockdowns and other measures to slow the spread of the coronavirus resulted in a lower total capacity utilization rate than during the Great Recession.

The rate bottomed out, briefly hitting 65%. However, as parts of the economy have reopened, the total capacity utilization has spiked back. Currently, it sits above 70% and has been improving since the summer...

This fast rise is a bullish signal for the economy, as the recovery in past recessions was far slower. After the dot-com bubble burst, it took three years for total capacity utilization to rise above 6%. After the Great Recession, the rebound was similarly a slow climb back to normal levels.

As has been the case with many economic norms, this pandemic-fueled downturn breaks the mold for standard patterns. Both the crash and recovery for the capacity utilization rate have happened quicker than in previous downturns.

The question for investors is whether the uptrend in the capacity utilization rate can continue. After all, it needs to, to justify the rally to all-time highs we've seen in the market since March.

And that's where old assets bring good news.

As we mentioned, without serious credit issues in the broad economy, utilization has been able to bounce back with little delay. However, utilization rates still remain low.

Until capacity utilization gets tighter, growth in capital expenditures ("capex"), which is the kick-start for the virtuous cycle that can cause sustained economic growth, will be absent. Companies can see sales growth without having to build new plants if they have idle ones.

The good news is that the vaccine is getting distributed. As the economy starts to open back up more completely, the total capacity utilization rate can bounce back even further. At that point, we'll have plenty of room for additional investment in capex.

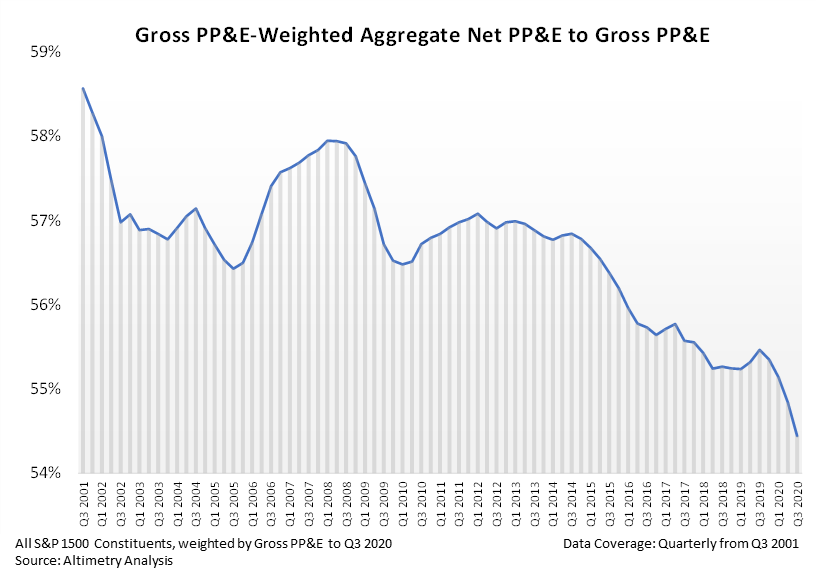

Further capex is needed because assets are old right now. Companies had been under-investing for a while, even before the pandemic.

We can see this in the ratio between gross property plant and equipment (PP&E) and net PP&E. This ratio tracks how old a company's assets are. When the ratio declines it means companies' assets are aging. Companies had already been holding off on investing the past five-plus years and put off necessary investments even further to update equipment due to the recession.

The current ratio is at its lowest level this century, making opportunities for capex ripe for the picking.

With assets so old, as capacity gets tighter, companies won't have the ability to milk their assets as much as they would have historically. They'll have to spend on capex to keep up with recovering demand.

The combination of strongly recovering capacity utilization and old assets should have investors excited as the recovery gains steam.

If the capacity utilization rate continues to rise, the virtuous cycle of business growth can continue. Management teams will begin investment in their businesses, which spurs spending in other parts of the economy.

While there is still a way to go before a full recovery, the path is becoming clearer. And as we look to 2021 in a few days, it's a good reason for investors to remain bullish.

Regards,

Joel Litman

December 28, 2020

Cruise ships may never return to normal after the pandemic...

Cruise ships may never return to normal after the pandemic...