Investors are panicking over last week's bank run – but that won't stop the Fed...

Investors are panicking over last week's bank run – but that won't stop the Fed...

On Monday, traders gave the central bank an 85% probability of raising interest rates at the next Federal Open Market Committee ("FOMC") meeting.

This may come as a surprise, considering higher rates were a key contributor to the second-largest bank collapse in U.S. history... as well as the two others that have investors panicking. But with much of the damage contained, the Federal Reserve still has plenty of work to do to combat inflation.

In February, the FOMC boosted rates by 25 basis points. That brought the federal-funds rate to 4.75%. And the Fed has made it clear that it'll keep raising interest rates as long as the economy stays hot.

This hurts a lot of industries outside of banking. And it leaves companies with large debt obligations particularly exposed, as rising rates means it costs more to pay down that debt.

Today, we'll look at an industry that actually does fine when the going gets tough... and one specific company that stands out from its peers.

Private equity and venture capital ('VC') got crushed by higher interest rates...

Private equity and venture capital ('VC') got crushed by higher interest rates...

That's one of the reasons Silicon Valley Bank ("SVB") collapsed. The bank was a favorite of VC firms. And when they all started worrying about paying their bills and withdrew from the bank, SVB needed more cash... quick.

But most of SVB's money was in supposedly "safe" assets like mortgage-backed securities and U.S. Treasurys. Their value had dropped due to rising rates. There was nowhere to go to raise enough money.

Likewise, private equity firms survive on mergers and acquisitions (M&A). They borrow money to buy other companies, develop them, and then sell them at a premium.

But when the cost to finance those acquisitions rises, it's harder to make the big returns investors have come to expect.

In today's environment, businesses need to focus on cutting costs and boosting efficiency to stay afloat. They can't rely on private-equity companies for capital like they have for the past decade-plus.

And few industries do cost-efficiency better than consulting...

And few industries do cost-efficiency better than consulting...

Consulting services are expensive. So many folks assume they might be the first to go when companies start slashing budgets. But contrary to that belief, consulting firms are impressively resistant to recessions. After all, that's when clients need them the most.

Instead of paying consultants to work on growth opportunities, clients hire them for outsourcing and cost efficiency. Overall, that means consulting firms tend to have stable revenue through economic cycles.

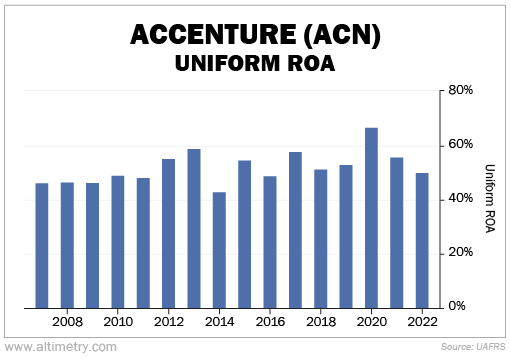

Just take a look at consulting giant Accenture's (ACN) performance. The company has consistently generated a Uniform return on assets ("ROA") above 40% over the past 15 years. That's more than three times the corporate average...

Accenture's Uniform ROA didn't budge during two crises... the 2008 Great Recession and the 2020 pandemic.

In fact, profitability jumped above 60% for the first time ever in 2020. The pandemic ended up helping Accenture.

In 2008, its stock fell less than 10% when the entire S&P 500 fell nearly 40%. And its stock rose 24% in 2020 when the S&P was only up about 16%.

And Accenture isn't alone. Other big firms like Boston Consulting Group, Deloitte, and EY all had record years in 2020, too. When companies feel they're on shaky ground, they turn to the businesses that can help them pull through.

The Fed's rate hikes are showing no signs of slowing down...

The Fed's rate hikes are showing no signs of slowing down...

Eventually, it will likely tip us into a recession. If and when that happens, it'll be another great time for consulting firms. History has shown us that these stocks hold up well in a downturn. We see no reason to believe this time will be different.

That's a big reason we currently hold consulting stocks in all three of our monthly advisories.

In short, the bank-stock rout is an overreaction... But it's also a reminder that you should always be holding some form of "recession protection" in your portfolio.

Plenty of industries are going to suffer when the next recession hits. Having exposure to consulting firms could help soften the blow.

Regards,

Rob Spivey

March 15, 2023

P.S. We just published our latest recommendation for Microcap Confidential subscribers. It's a tiny, "traditional" consulting firm that's following in Accenture's footsteps... through a huge business shift that could unlock triple-digit upside potential.

Investors are completely oblivious to how powerful this shift could be. They're treating the company as if it will fall back to pre-pandemic levels. But we don't think they'll stay in the dark for much longer. If you want to learn more about this transformative opportunity – and claim a free bonus year of Microcap Confidential – click here to get started.

Investors are panicking over last week's bank run – but that won't stop the Fed...

Investors are panicking over last week's bank run – but that won't stop the Fed...