The pandemic-induced recession was the shortest ever...

The pandemic-induced recession was the shortest ever...

The private nonprofit organization National Bureau of Economic Research ("NBER") officially defines a recession as a "significant decline in economic activity spreading across the economy, lasting more than a few months."

When the NBER's Business Cycle Dating Committee drafted this definition in 2009, it could never have foreseen the economic "black swan" event that brought the world to a standstill in 2020.

As you probably remember, during the first week of February 2020, the economy was roaring along. The unemployment rate was low. The credit picture looked good, and companies were posting record earnings.

Toward the end of the month, the coronavirus pandemic sent everything to a grinding halt. According to the NBER, by the end of April 2020, the recession was over. By June 2020, the U.S. GDP was already back to its pre-pandemic peak, and the stock market was blasting into space.

As we think about where the economy is headed, we need to understand where it's coming from and the structural factors that allowed it to weather the storm quickly.

Like we always say, the answer lies with debt...

Like we always say, the answer lies with debt...

Recessions typically occur as the economy becomes more unstable, thanks to corporations taking on more debt. A one-time shock creates a credit crunch, making it difficult for firms to refinance, leading to market panic. In turn, that same lack of credit often draws out the recovery as businesses are strapped for cash and cannot grow.

In September 2019, we outlined how only a credit crisis can create a long-term recession. This is why when people were running for the hills in March and April 2020, we could say this downturn wouldn't be a protracted credit crunch.

The reality is that corporate and personal balance sheets didn't just look fine, but they looked great. The U.S. debt universe was much healthier than it typically would be at the start of a recession. Even the companies in the worst shape received loads of federal cash to allow them to refinance their debt.

As discussed in our Aug. 10 piece on Fair Isaac (FICO), our economy runs on debt. Healthy debt is the most important sign of a healthy economy.

Without a wave of defaults crashing the financial system (as it did during the Great Recession), the economy regained its footing quickly after hitting March lows last year. All it needed was a quick realignment of priorities and an understanding of how to function under social-distancing rules, which took about two months.

The outcome would have been much different had a structural problem existed with our collective finances. But let's take a look at the macro-debt picture as it stood at the onset of the pandemic.

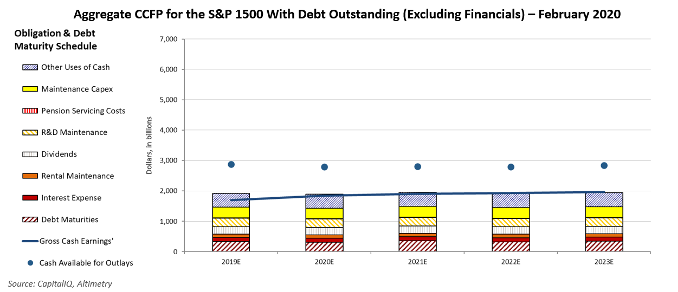

Using our Credit Cash Flow Prime ("CCFP") analysis tool, which leverages the full power of Uniform Accounting to diagnose the credit health of any company, or the entire market, we can see that not only did companies have enough cash to pay back their debts, but their annual Uniform gross cash earnings were sufficient to cover everything except buybacks.

Let's use our aggregate CCFP tool to gauge the quality of debt taken on by the S&P 1500 Composite Index, which encompasses 90% of the market capitalization of U.S. stocks.

Corporate America's debt buffer was instrumental in getting us to where we are now, coming off an impressively healthy economic recovery. While cash flows have barely matched obligations, from 2019 through 2023, cash on hand across the economy means the risk of widespread defaults remains low.

The learning curve for distanced productivity, and even the start-and-stop pandemic issues, are of little consequence for the stock market recovery, as equity prices are valued long-term.

Let's understand what shape we're in right now to prepare for the next few years...

Let's understand what shape we're in right now to prepare for the next few years...

Has the recovery shrouded us in looming clouds of credit bound to put corporate America in an awkward spot, or is the debt picture still healthy?

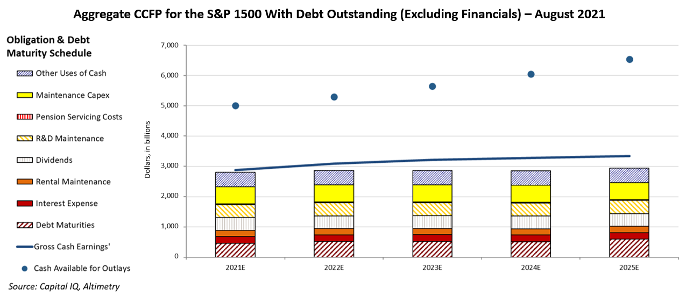

As you can see, the debt picture looks better than ever.

Although total corporate obligations among companies with debt outstanding have increased from about $1.9 trillion to about $2.8 trillion, the buffer between cash on hand and obligations has doubled from about $1 trillion to $2 trillion.

Uniform gross earnings are expected to cover not only operating obligations and debts but also buybacks. The corporate debt stack seems nearly bulletproof as it stands. That means we're still well-positioned for this staggeringly strong recovery to sustain going forward.

All this is to say that default risk and future recession risk is very low...

All this is to say that default risk and future recession risk is very low...

While the recovery has continued, the economy still has to contend with other issues.

- Corporations are now working on picking up the pieces of a fractured supply chain.

- Governments are working to reconcile the "K shaped" nature of the recovery. While it's lucrative for those with invested wealth, it can be highly damaging to those with fewer financial resources.

These issues will likely have little impact on the equity markets going forward.

We are monitoring default and recession risks closely to give you an accurate understanding of the economy...

If you're looking for insights pulling together the market facts and exactly how you should be adjusting your investment strategy, you're in the right place...

Here at Altimetry, we use the power of Uniform Accounting – which removes the distortions in as-reported financial metrics – to see stocks based on their real financials.

After we clean up the GAAP numbers, we can see whether a company is thriving.

Earlier this month, we identified an opportunity in a true innovator in the commercial real estate space. Right now, the market is completely oblivious to this stock's upside. But it won't be long until Wall Street catches on, and when it does, we think this stock could quickly take off...

To learn more about Hidden Alpha – and how to gain instant access to our top ideas – click here.

Regards,

Rob Spivey

August 23, 2021

The pandemic-induced recession was the shortest ever...

The pandemic-induced recession was the shortest ever...