Gilead Sciences (GILD) keeps on investing in a cure...

Gilead Sciences (GILD) keeps on investing in a cure...

On Friday, we explained how Gilead is unique in the biotechnology and pharmaceutical space. It focuses on treatments that can cure and mitigate diseases rather than just treating symptoms.

Over the past few weeks, GILD shares have rallied as investors speculated on how the company's formerly unsuccessful Ebola treatment remdesivir is showing promise for helping treat coronavirus. South Korea just recently approved Phase III trials of the drug for adult patients with the disease.

And earlier this week, Gilead announced that it's acquiring pharma firm Forty Seven. This is similar to Gilead's 2017 acquisition of Kite Pharma – Forty Seven is focused on immuno-oncology.

These are drugs that attempt to attack tumors using the body's immune system. Gilead has been heavily investing in this space, as immuno-oncology could revolutionize the treatment of cancer... just as Gilead's investment in liver drugs with its acquisition of Pharmasset in 2011 revolutionized the treatment of hepatitis and other liver diseases.

My father is an oncologist, and he just retired in December. Over the past few years, he and I would talk about the impact he saw from the first wave of these drugs.

All these treatments tend to vary in success on a case-by-case basis. But my father often told me how amazed he was by the potential of these immuno-oncology drugs to massively change the prognosis for a patient's cancer.

If Gilead is successful with these investments, it could mean the same type of surge in the company's Uniform return on assets ("ROA") – and increased benefit to people diagnosed with these diseases – that it saw once its liver drugs came to the market in the mid-2010s. Gilead is one company to keep an eye on...

We've spoken before about the importance of management alignment...

We've spoken before about the importance of management alignment...

In the February 24 Altimetry Daily Authority, we discussed our "Earnings Call Forensics" system and the importance of monitoring company management. These executives are ultimately the ones who are held accountable for their business' actions.

In addition to analyzing earnings calls to understand if management is confident about its company's goals and accomplishments, we can measure management alignment in other ways...

We also wrote about the importance of looking at management compensation and the concept of "incentives dictate behavior" by looking at tech company IBM (IBM).

If executives are compensated on earnings per share ("EPS") basis, they're likely to buy back shares and do what they can to boost earnings – potentially at the expense of other important activities, like spending on research and development (R&D).

For CEOs in particular, we also want to make sure that they're fully focused on their businesses. We've seen plenty of examples where health or other distractions have gotten in the way of a CEO's ability to perform his functions.

Just last year, Accenture's (ACN) CEO stepped down due to his ongoing fight with colon cancer. In 2016, Visa's (V) former CEO decided to step back in order to spend more time with his family.

It's important to know if a CEO is committed to the company, both in terms of time and mission. It's a demanding job, and it's difficult to balance those responsibilities with a normal life... let alone another CEO position.

This feat has been rarely attempted – especially for two public companies. Back in 2005, Carlos Ghosn became CEO of two automakers. The companies were part of the same alliance, but that didn't turn out well for anyone involved... he was arrested twice in Japan over allegations of financial misconduct, but subsequently escaped after his second arrest last year and fled to Lebanon.

However, one tech executive is currently ambitious enough to try to make it work...

Right now, Jack Dorsey is serving CEO for both social media company Twitter (TWTR) and digital-payments firm Square (SQ).

This should be somewhat of a concern for investors. The pressure and time commitment of one CEO role is difficult... but two should be nearly impossible.

In fact, activist investment firm Elliott Management has been targeting Dorsey's dual CEO title, claiming he isn't focused on operating Twitter. Elliott has a $1 billion stake in Twitter and believes Dorsey needs to choose one of his two roles and focus on it. The firm is skeptical of Dorsey's ability to operate both businesses and maximize their potential.

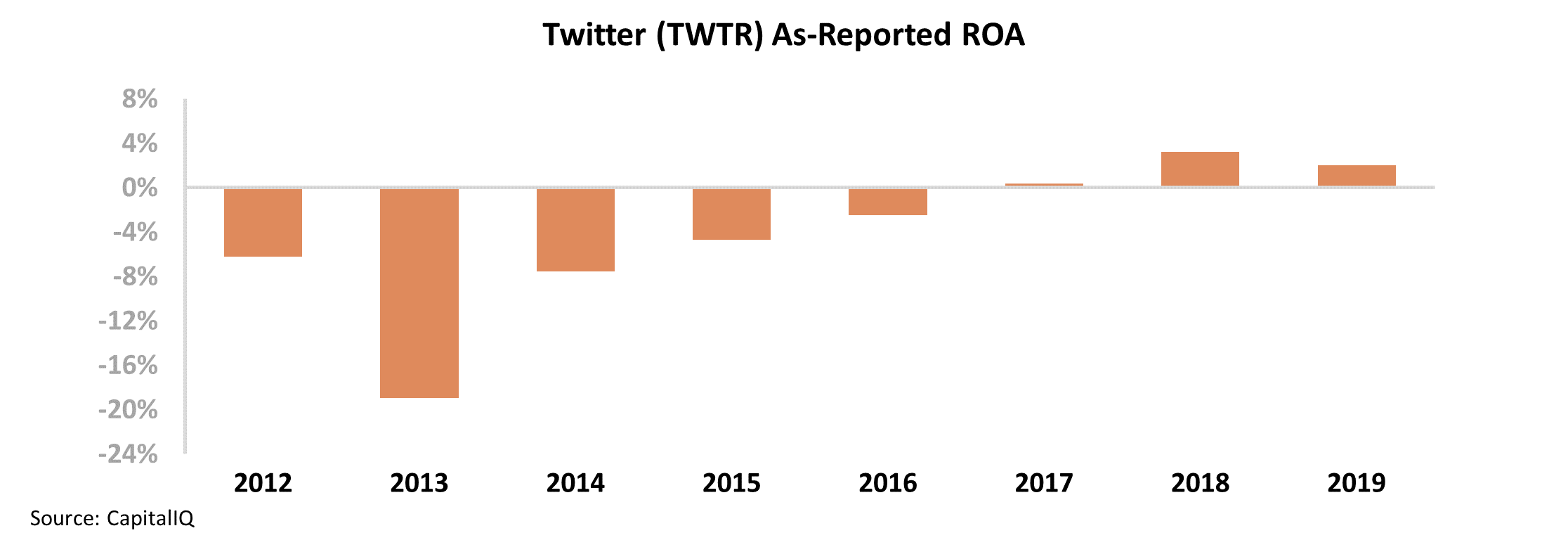

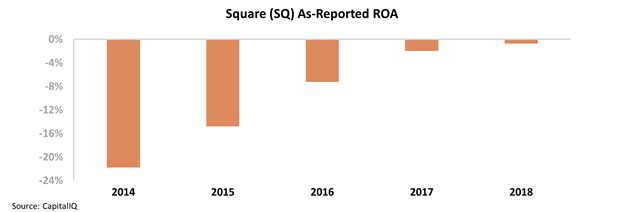

And based on each company's returns, this skepticism appears to be justified. Looking at the as-reported ROAs of Twitter and Square, we can see that both companies have profitability issues.

While Twitter was able to post positive earnings beginning in 2017, its ROA is still only 2% – well below long-term corporate averages. Furthermore, Square has yet to generate a positive ROA. Take a look...

While negative initial returns aren't unheard of for a tech startup, it begs the question whether Dorsey is equipped to lead both companies to profitability or if he would be better off focusing on one venture.

However, if we look deeper, we can see that Dorsey is doing a better job than most investors think...

First, we need to give him credit for his true alignment to each of his businesses. Dorsey is famous for his strange compensation structure. As CEO of two multibillion-dollar companies, he could demand massive cash compensation.

That said, in 2019, Dorsey's base salary from Twitter was just $1.40... And in his most recent disclosure from Square, he only received $2.75 in cash for his position.

Instead of cash, Dorsey receives his pay in the form of performance-based incentives and stock-based compensation. This shows that he's aligned with the best interest of shareholders.

Furthermore, he similarly rewards the employees of both companies. Twitter and Square offer massive amounts of stock options, which is a way to compensate employees without paying cash.

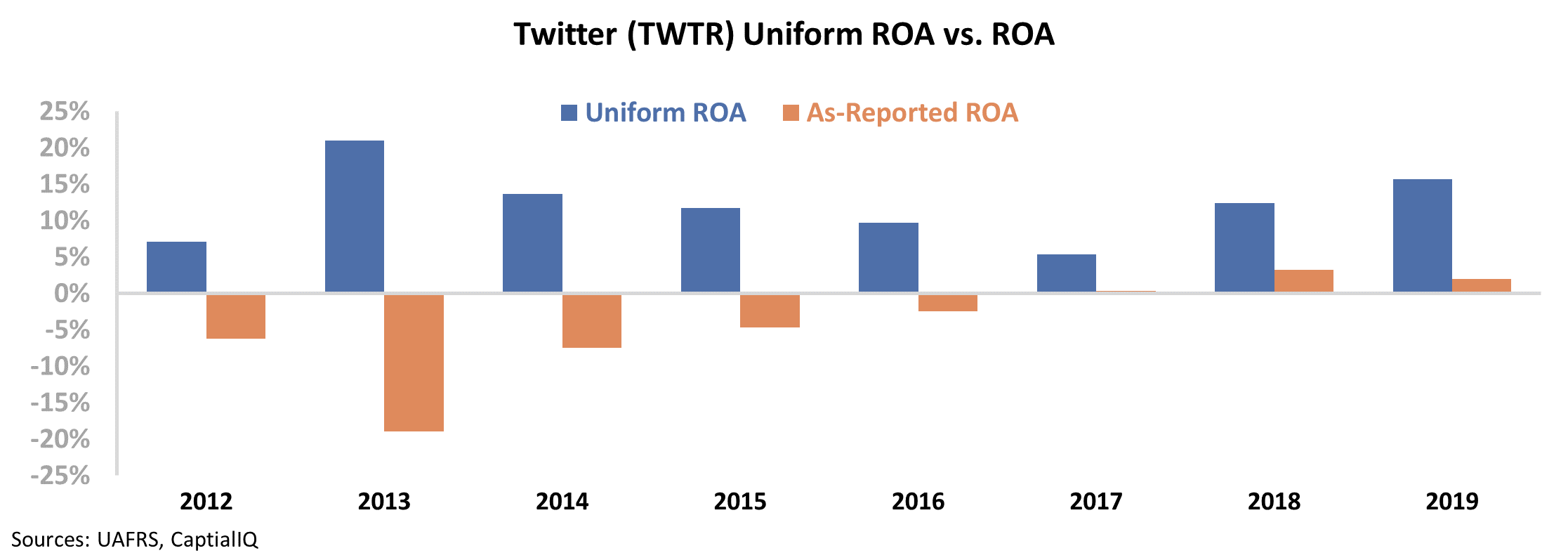

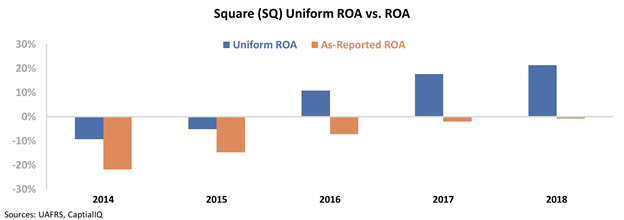

That said, as-reported accounting standards treat these non-cash stock options as expenses on the income statement – making returns look lower than they actually are.

Once we apply our Uniform Accounting metrics – adjusting for misleading treatment of stock options expenses, along with R&D accounting issues and other distortions – we can see that both companies are far more profitable than investors think.

Not only has Twitter been profitable in each year since 2012... but Square's returns turned positive as early as 2016, and its ROA has expanded to more than 20%.

In the modern era, it may be possible to run two companies at the same time with the right technologies, business partners, and time management practices in place.

Dorsey seems to have figured it out, and his shareholders can thank him as the market realizes this. This appears to be another example – similar to AT&T (T) – of how Elliott might be picking different targets if it was looking at the right numbers.

Regards,

Rob Spivey

March 5, 2020

Gilead Sciences (GILD) keeps on investing in a cure...

Gilead Sciences (GILD) keeps on investing in a cure...