Who is accounting for the accountants?

Who is accounting for the accountants?

In the July 21 Altimetry Daily Authority, we discussed a hidden danger for any portfolio: fraudulent companies. The U.S. Securities and Exchange Commission ("SEC") has limited capacity to investigate every publicly traded company, and one stock with a fraudulent business behind it can "torpedo" portfolio returns.

Fraud usually originates from the top, with bad actors in executive management exploiting their positions for short-term benefit. And yet, fraud is usually spotted during market corrections. In the words of legendary investor Warren Buffett, "Only when the tide goes out do you discover who's been swimming naked."

The latest naked swimmer to be discovered is accounting platform firm ScaleFactor. Back in 2014, founder and CEO Kurt Rathmann was looking to fill a vital market niche. For small businesses, accounting is a large hurdle to jump through – it requires hiring dedicated accountants to manage taxes and payroll.

Rathmann promised an inexpensive service where artificial intelligence tools could do the accounting for these firms instead. However, customers didn't quite get what they paid for...

Instead of a smart algorithm, ScaleFactor was actually having accountants manually complete the work from Texas or the Philippines. Funded by venture capital firms expecting big growth, ScaleFactor used aggressive sales tactics and sketchy marketing to push a product that was significantly different from the one being delivered.

Back in June, Rathmann announced in an interview with Forbes that ScaleFactor was closing shop due to the coronavirus pandemic. However, previous customers have come out to say the problems went deeper... One business reported it had lost $17,000 from a ScaleFactor error and would only get a partial refund if it didn't disclose the bad experience. A coffee shop owner needed to hire a team of accountants to clean the books after being a ScaleFactor subscriber.

Clearly, even some accountants aren't above fraudulent activity themselves. This highlights how important it is to always monitor the management team for the initial signs of corner-cutting... before the tide goes out.

However, the Harvard Business Review has estimated that between 70% and 90% of acquisitions ultimately fail.

It's a staggering number... and is often the result of a failure to integrate the combined companies. The famed 1998 merger failure of Daimler-Benz and Chrysler provides an interesting look at this...

On paper, the merger looked great. Executives expected cost synergies of $8 billion... and new international markets would be available for each brand while the companies' combined expertise would help the new entity dominate the market.

In reality, Daimler and Chrysler never fully integrated with one another. Cultural differences prevented synergies from being realized – from issues with marketing to sales to strategic direction.

Neither firm took advantage of the other's strengths, and cross-selling opportunities never materialized. The European Daimler and U.S.-based Chrysler waged cultural war on each other. Daimler's management team went as far as ripping out the smoke detectors at the non-smoking Chrysler headquarters so the executives could smoke cigars in the evening.

This was a situation where neither company considered the actual nuances of integration. And in 2007, Daimler ultimately sold Chrysler to a private-equity firm, ending the failed merger.

One way to find out whether a company is a good acquirer is to see if it has a system to integrate and adopt the target business. Companies should be focused not just on cost synergies, but on cross-selling opportunities as well.

Conglomerate Danaher (DHR) is one firm that has done this successfully. As we discussed in October, the company uses its Danaher Business System ("DBS") to help navigate mergers. More than 50% of Danaher's current revenue is derived from acquisitions over the past seven years.

Another company that has done a great job as a serial acquirer is Baxter (BAX) – a medical-devices firm that has made more than 55 different transactions over the past 10 years.

Baxter has sought to consolidate smaller companies in the industry. It utilizes a direct, targeted sales force to accelerate the effects of these acquisitions – acquired companies experience immediate integration benefits by reaching a much wider audience of prospective customers.

In the midst of the pandemic, demand and valuations for many of Baxter's potential targets have dropped. This presents an opportunity for a consolidator to take advantage of the "survive and thrive" strategy we talked about on Wednesday... Baxter can scoop up smaller companies that are treading water and thus improve its market position.

However, looking at the as-reported metrics, investors would think Baxter has been unable to create value through all these acquisitions.

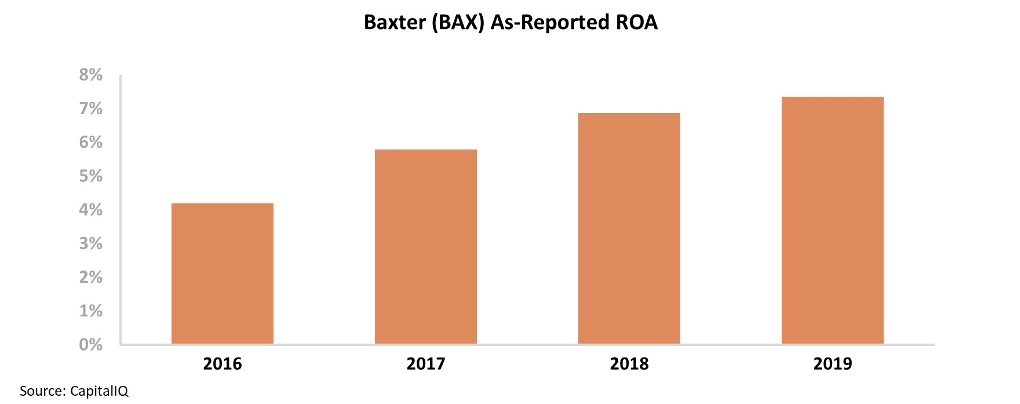

Baxter's as-reported return on assets ("ROA") has grown from 4% to a modest 7% from 2016 to 2019. Investors see Baxter as a business with returns below corporate averages, unable to efficiently take advantage of cost synergies and cross-selling opportunities.

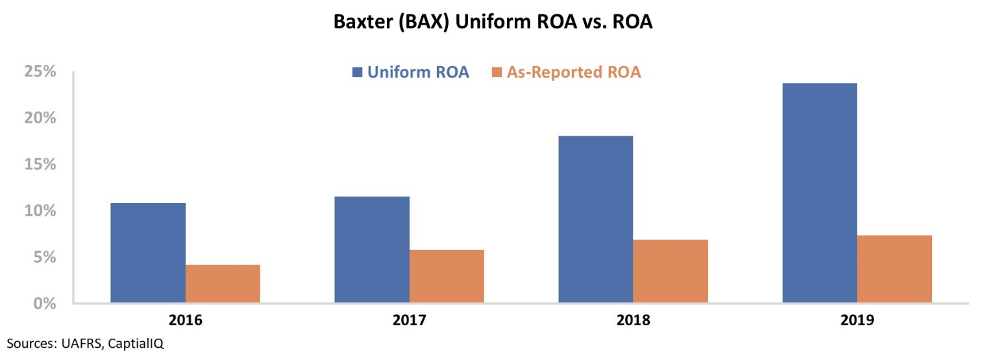

However, this picture of Baxter's performance is pulled down by distortions in as-reported accounting. Due to the GAAP treatment of goodwill and excess cash, among other distortions, the market is missing what's really going on here...

In reality, Baxter has been able to successfully pull off its serial acquirer strategy and drive high returns. The company's Uniform ROA was more than double the as-reported numbers from 2016 to 2019 – growing from 11% to 24% over that same time frame...

These strong returns indicate that Baxter is fully integrating each acquisition into its business strategy.

Baxter has an incredibly resilient business, with first-quarter revenue up 6% despite the toll of the pandemic. The company has multiple products in use for treating coronavirus complications.

Baxter's history of successful acquisitions and its resilient business positions the company well coming out of the pandemic. It has the opportunity to take advantage of depressed valuations for target firms... giving it the potential to grab these businesses on the cheap.

It looks like a classic "survive and thrive" business.

But without Uniform Accounting, investors would miss the success of this high-return serial acquirer... and not realize Baxter may be able to take advantage of industry consolidation and continue to get bigger.

Regards,

Joel Litman

August 21, 2020

Who is accounting for the accountants?

Who is accounting for the accountants?