Ralph Lauren is the latest to venture into the metaverse...

Ralph Lauren is the latest to venture into the metaverse...

While the "At-Home Revolution" theme continued to dominate 2021, with the strengthening of blockchain and e-commerce companies, another trend emerged: virtual reality ("VR") becoming mainstream.

One of the first signs of the "metaverse" was a massive concert hosted by rapper and record producer Travis Scott last year.

It wasn't a typical concert. It wasn't in-person due to lockdown restrictions... and it wasn't a livestream for online users either.

Instead, Scott's concert occurred inside the virtual world of the popular video game Fortnite.

The concert was a huge success, and ever since, many others have sought to dip their toes into the water of virtual reality, particularly this year.

Fashion giant Ralph Lauren (RL) made an unexpected leap into VR when it announced it would soon host a grand holiday party on video game platform Roblox (RBLX).

In our November 9 issue on "Is It 'Game Over' For This Video Game Stock?" we discussed how Roblox is now a company on the frontlines of the metaverse and gaming.

Roblox allows developers to customize games within its universe, which is why it's a great arena for corporate sponsors like Ralph Lauren. But there's also another company minting money by being even more developer-friendly in this space...

This name is an emerging leader in the gaming space...

This name is an emerging leader in the gaming space...

Roblox provides a platform that allows users to build and develop its own "mini video" games.

It feels almost like an evolution of the popular game Minecraft, a 3D-generated world where gamers can roam infinite lands of block-shaped structures and build whatever they wish.

This is where the metaverse comes in. Developers can flex their skills and creativity using Roblox's engine to create various combinations.

AppLovin (APP) does the same. Its engine provides solutions that are even more accessible to a wider audience.

The company's services allow developers to create gaming apps for mobile phones and then monetize and market them to the masses.

AppLovin has some of the best monetization software for in-app purchases, which has been massively profitable.

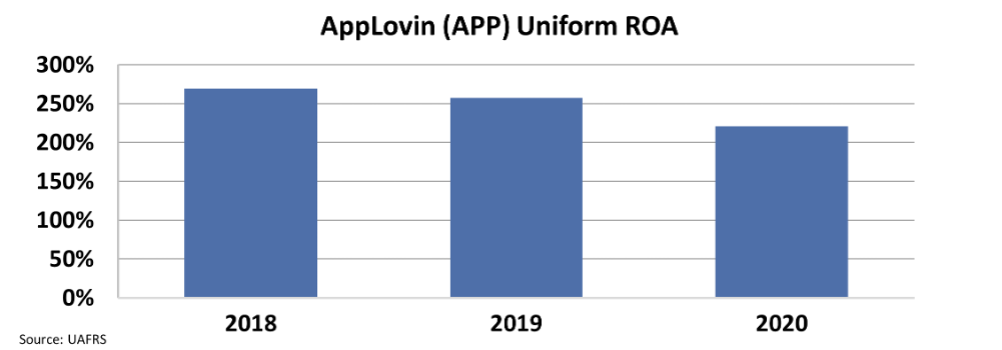

Uniform Accounting shows that unlike Roblox – which is still unprofitable on a Uniform basis – AppLovin is minting money by helping developers succeed.

Over the past three years, AppLovin has consistently generated an impressive Uniform return on assets ("ROA") of more than 200%. Wall Street even expects those returns to stay above 100% in 2021.

See for yourself below...

The company has shown itself to be a moneymaker in an industry often riddled with hype for companies in the red.

As more of our time is spent online in the post-pandemic world, the company stands to keep the profit train rolling.

AppLovin hasn't made public investors much money...

AppLovin hasn't made public investors much money...

AppLovin's impressive profitability is part of the reason why it was such a popular initial public offering ("IPO") earlier this year.

But while the name was a big focus for the market, public investors who bought at the company's IPO have only made a 10% return on their investment.

Most of the real wealth creation from AppLovin occurred well before the company went public at a valuation of around $25 billion.

Early backers like private equity shops KKR and Novator and venture capital funds like Nimble Ventures are the ones who made out with handsome profits.

Much like the other names – including Alibaba (BABA), Airbnb (ABNB), and Visa (V) – we've discussed the past few days, public investors missed out on AppLovin's best returns.

It almost seems like the opportunity to make 100 times return on investment is becoming exclusive to venture capitalists and private market investors.

How do you find venture capital-style returns in the stock market?

How do you find venture capital-style returns in the stock market?

At Altimetry, we've found a way for public investors to get the same returns as these high-roller private equity firms.

It involves focusing on a tiny corner of the public market that is tremendously underfollowed with names that can contain massive upside potential.

The area we're talking about is microcaps. It's a space where we specialize in picking stock for our Microcap Confidential service, and our portfolio of microcap stocks is producing staggering returns along the way.

We're so excited about the opportunities in microcap stocks that I held an investment summit webinar this month. In my special presentation, I highlight a few of my favorite stock picks for 2022 and beyond.

But this stock-pick giveaway is only available for a few more days...

To learn more about these exciting stock recommendations – you can replay my special presentation right here.

Regards,

Joel Litman

December 22, 2021

Ralph Lauren is the latest to venture into the metaverse...

Ralph Lauren is the latest to venture into the metaverse...