In the midst of the market collapse in March, misguided 'experts' discussed banning a popular investment strategy...

In the midst of the market collapse in March, misguided 'experts' discussed banning a popular investment strategy...

As often happens in a rout, short sellers became a popular target to blame for the decline.

European regulators scrambled to stop the practice last month as part of efforts to provide a floor for the market. On the surface, it's hard to blame them... Officials naturally wanted to protect investors and stem the losses.

In reality, short sellers help the market come into balance. Without them, the market might never find its true level. The U.S. Securities and Exchange Commission ("SEC") Chairman Jay Clayton recognizes this. And in late March, he stood behind short sellers.

While some may think short selling hurts markets by artificially driving prices lower, an important part of the market relies on short selling to work...

Even if you don't think that short sellers are good for the market, you likely want companies to be able to access credit markets, and as cheaply as possible. As we've said before, access to credit is the grease that keeps the wheels of the economy moving.

And without short selling, the convertible market – a key part of the credit markets – can't function. I saw this firsthand in 2008 at Credit Suisse.

During the 2008 meltdown, U.S. regulators halted the shorting of many financial stocks, and broader bans on shorting were enacted across the globe.

At the time, I happened to be sitting on the same desk as Credit Suisse's convertible-bond trading desk, which had basically shut down when shorting was banned.

Investors in convertible bonds want to be able to arbitrage mispricings between the equity and credit markets. That's why they're interested in buying the convertible bonds. These assets consist of both a debt instrument with a set maturity and a coupon rate, and an equity instrument – the warrant the buyer owns when he purchases the bond.

If the price between the convertible market and the equity and credit markets become out of whack, a trader can go short the equity component of the convertible bond by shorting the company's actual stock. If traders don't have access to do this, they're unlikely to want to take the risk of trading the bonds.

And when that happens, this source of liquidity for higher-risk companies dries up. It's what happened in 2008.

So remember... when you're against short sellers, you're actually against fully functioning, normal equity and credit markets.

Marketplace companies aren't our favorite stocks...

Marketplace companies aren't our favorite stocks...

The marketplace business is difficult, especially when there's no competitive moat to protect your platform. "Fake marketplace" industries are competitive, margins are thin, and switching costs are nearly zero.

Regular Altimetry Daily Authority readers will likely recall two essays we wrote in mid-January about marketplace businesses we thought were destined for difficult futures...

While we can't use the past three months as a guidepost, both food-delivery service Grubhub (GRUB) and ride-sharing company Uber (UBER) are in for trouble over the long term.

On one hand, Uber's trip volumes have fallen as much as 70% in some of its major markets due to the coronavirus pandemic.

Meanwhile, more people than ever before are ordering takeout and delivery from apps like Grubhub... but they're waiving most of their fees as a gesture of goodwill to new users and struggling restaurants.

When things eventually return to normal, we still think both companies will struggle because they failed to dominate their respective markets.

That's key to operating a successful marketplace – if you aren't a virtual monopoly, the competition will be able to cut into your margins until they're gone.

We've seen this time and again. But of course, there are exceptions...

If you're able to establish yourself as the "go to" marketplace and you have actual economic moats in your business, chances are you can make a sizable profit based on volumes alone.

Today, one platform company has successfully built itself into the marketplace in its industry... and it has done so through the "illusion of choice."

Match Group (MTCH) is the leading provider of dating websites and apps.

It might sound strange to refer to a dating site as a "marketplace"... but that's exactly what it is. Just like any other marketplace, Match Group facilitates connections between two parties. It "sells" these connections rather than products.

It's not the offering that makes Match Group compelling... The company has cornered the market by owning just about every dating site and app available.

Most folks might just assume the company owns Match.com based on the name. However, in reality, Match Group has consistently acquired popular dating sites and apps to bring into its portfolio over the past several years. It owns some of the biggest out there: OkCupid, Plenty of Fish, Tinder, and Hinge.

That said, as-reported financial metrics make Match Group look like many of the other problematic marketplace firms...

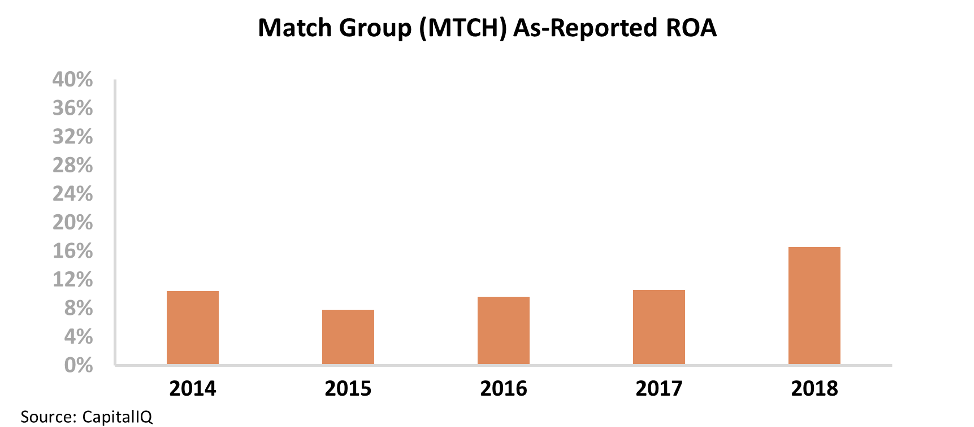

The company's return on assets ("ROA") is decent, but not particularly exciting. Since just prior to becoming a public company in 2015, Match Group's ROA has ranged from around 8% to 17% – only recently rising slightly above corporate averages.

That said, when we look at asset-light tech companies like this, we expect to see significantly stronger ROAs to justify strong stock returns.

And Uniform Accounting might give us the answer we're looking for...

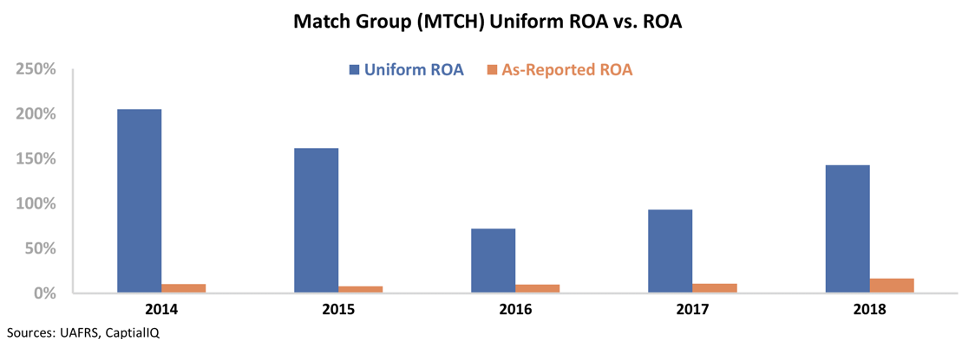

You see, traditional as-reported financials can make acquisitive tech companies like Match look much weaker than they actually are. GAAP and IFRS accounting statements punish businesses that make large acquisitions by forcing them to retain non-operating goodwill on their balance sheets, and they treat non-cash stock options as a cash expense to the income statement.

Once we've adjusted for these misleading practices, we can see that Match's ROA is far stronger than investors realize... and it's also growing faster than they think.

In reality, Match Group's Uniform ROA has expanded from a low of 72% in 2016 to a massive 143% in 2018. Take a look...

With this level of profitability, it's clear Match Group has used the "illusion of choice" to become the right kind of marketplace company – one that can earn sustainable returns. And when investors realize just how profitable this business model is, Match Group's stock price will need to adjust higher.

Regards,

Joel Litman

April 15, 2020

In the midst of the market collapse in March, misguided 'experts' discussed banning a popular investment strategy...

In the midst of the market collapse in March, misguided 'experts' discussed banning a popular investment strategy...