Deep into a two-year bull market, a second-term president gets up in front of Congress...

Deep into a two-year bull market, a second-term president gets up in front of Congress...

He talks up his victories across crime, education, and foreign policy. And he aggressively backs plans to cut the federal deficit and balance the budget.

At the same time, investors are excited about a new technology that's transforming the economy.

Yet these big ideas are starting to spook investors. Deep down, they're worried the market has run too far too fast... Many fear the Federal Reserve's next move, global trade, and even a recession.

All of this sends the market into a tailspin... The Nasdaq Composite drops more than 10%, and the S&P 500 falls hard, too.

We're talking about President Bill Clinton's 1997 State of the Union address... and presidency. Of course, there are clear parallels to President Donald Trump.

Today, we'll explain why investors should block out overblown fears in today's administration... and focus on the big tech trends.

The market headlines don't just sound like 1997... They're almost identical.

The market headlines don't just sound like 1997... They're almost identical.

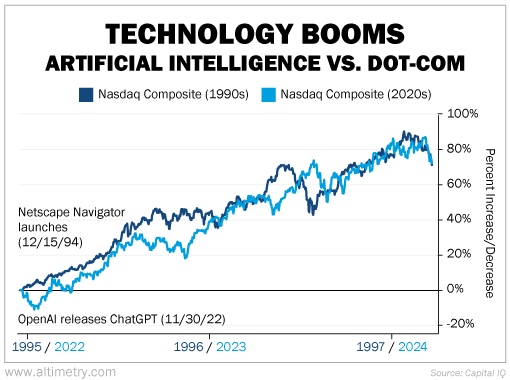

From late 1994 to early 1997, the Nasdaq rose 71%... That's when Netscape Navigator came on the scene and revolutionized web browsing.

From November 30, 2022 (the day OpenAI released ChatGPT) through March 4, 2025, the index rose 72%.

In both cases, the market had made its all-time high a few weeks prior... before pulling back. Take a look...

Clinton's State of the Union triggered a 13% pullback in the Nasdaq, which lasted three months. Trump's March 4 address to Congress has already led to a 5% drop.

And right now, investors are understandably worried.

The market is realizing that tariffs, for example, might be more than just negotiating tactics... Once implemented, they could inflate consumer prices and reduce corporate profits.

The government is also slashing programs and budgets at the fastest rate in more than a decade.

Yet, many investors felt the market would climb inexhaustibly higher...

Yet, many investors felt the market would climb inexhaustibly higher...

And that's largely because of the artificial-intelligence ("AI") boom...

This technology has touched everything from power companies to old-school tech firms, investing, software development, and customer service.

That, along with receding inflation, the Fed's monetary easing, and declining corporate credit risk powered the Nasdaq to near 100% gains.

Optimism about deregulation and tax cuts also perked up investors after Trump's reelection.

However, despite these developments...

It's clear that no bull market moves in only one direction...

It's clear that no bull market moves in only one direction...

Between 1994 and 2000, the Nasdaq rallied nearly 600%. Yet, there were also 10 pullbacks of 10% or more.

With the recent market pullback, it's good to step back, take a deep breath, and assess the broader trends in play...

The current market has rallied amid falling inflation. And while headlines focus on rising inflation, the data shows the panic is overblown.

Even tariffs are a one-time price reset, not a trigger for a wage-price spiral.

We also see improving credit conditions, as we wrote on Monday. And that's a key ingredient for economic prosperity.

The real force behind market surges, though, is tech adoption...

The real force behind market surges, though, is tech adoption...

The Internet craze of the 1990s forever changed how we access and share information. This created massive wealth, transforming the tech industry and the overall economy.

The AI boom has even more upside potential.

We last saw this kind of tech adoption under the Clinton administration. And at the time, it could have handed investors a 600% gain in six years... if they'd overlooked the 13% market pullback.

That's how generational wealth is built.

So don't overreact to market spikes and the Trump headlines... They're unlikely to disrupt the long-term picture.

Regards,

Rob Spivey

March 12, 2025

Deep into a two-year bull market, a second-term president gets up in front of Congress...

Deep into a two-year bull market, a second-term president gets up in front of Congress...