Last Monday, we warned readers to prepare for the market to roll back over at some point before a significant move higher...

Last Monday, we warned readers to prepare for the market to roll back over at some point before a significant move higher...

But a week later, that clearly hasn't panned out. Since May 18, the market has made new two-month highs and continues to be pushing for a move higher. So were we wrong?

When we highlighted the risk of a retest of the lows, we didn't say that it would happen the next day... That's the kind of prediction only charlatans and cranks can make. Rather, we said that at some point in the near-term future – potentially in the next month or so – we'd see that rollover.

And one of our most important macro indicators just gave us a signal that gives us confidence that we're in for more volatility in the near term, even if credit fundamentals don't give us reason to worry about a larger-term issue.

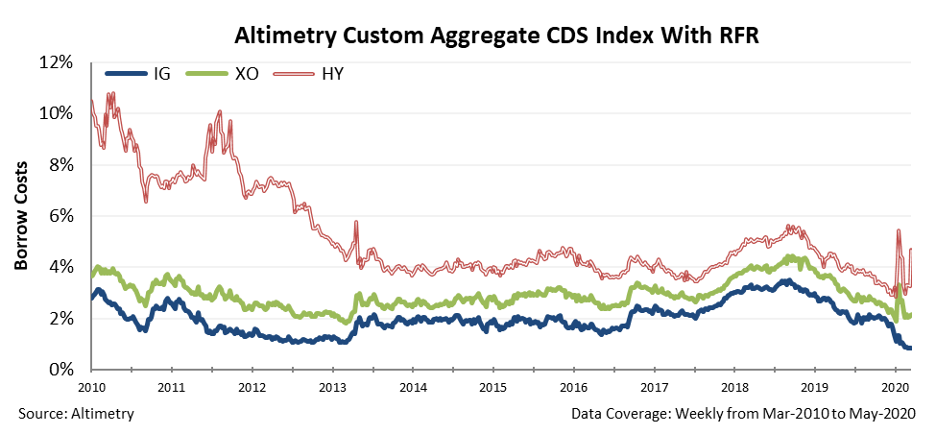

We diligently watch the cost for corporations to borrow. It gives a great window into what credit markets are thinking about the default risk of companies. And we saw an interesting signal from the high-yield credit markets over roughly the past week...

Normally in an equity market rally, you'd expect to see a confirmation signal from the high-yield credit market. If equities are going higher, default risk for corporate credit should fall.

High-yield credit spreads – along with all types of credit spreads – shot wider in mid-March. Investors were worried about defaults when companies weren't making any cash in the midst of the coronavirus shutdown...

But when the federal government and U.S. Federal Reserve stepped in to help provide monetary and fiscal support for the economy, the corporate cost to borrow pulled back massively (and) quickly in April – fueling the equity markets higher.

Since then, this month, equity markets have been sideways-to-up. And the investment-grade credit cost to borrow has remained incredibly low. But the canary in the coal mine, high-yield credit, has seen a spike higher. This means that the credit markets appear to be seeing something the equity markets don't.

Now, as we highlighted last week, overall credit fundamentals remain healthy, with significant liquidity. So we're not calling for a 2008-style environment of bankruptcies across sectors.

In fact, neither are the credit markets. Even though the high-yield cost to borrow has spiked higher, it's still only at levels seen in 2016 and in the first half of 2018. Those were periods where credit wasn't completely "all clear" for some areas, like oil and gas, but the economy wasn't teetering on the brink of collapse.

But clearly, credit markets are telling us that something is going on that the equity markets aren't paying attention to. Keep a watch for the eventual pullback... and remember the playbook we gave you to know whether it's a buying opportunity – which it likely will be – or if you should be concerned.

Late last year, we talked about a phenomenon in product marketing called the 'illusion of choice' with companies such as Whirlpool (WHR) and Booking Holdings (BKNG)...

Late last year, we talked about a phenomenon in product marketing called the 'illusion of choice' with companies such as Whirlpool (WHR) and Booking Holdings (BKNG)...

Consumers love to feel like they're buying a product tailor-made for them. But often, one company owns a large portfolio of services, and builds buyer goodwill and draws in customers... even if they don't realize the scope of the seller's suite of brands.

Meanwhile, we've also talked about the strategy of dominating a specific niche in a marketplace. By focusing on fulfilling a precise need, a business can unlock value by providing the perfect product that customers are willing to pay a premium for. In March, we showed the power of this in action in our essay about Barnes (B).

Finally, we love the rare business that can extract real value from an aggressive acquisition strategy. It's hard for companies to rapidly grow organically... but it's even harder for them to make their money back from buying another firm. Back in October, we applauded the strength of Larry Culp at Danaher (DHR). Culp was able to drive total shareholder return through smart acquisitions.

These are all wildly different methods for an enterprising CEO to bring wealth to his shareholders. Any company that can successfully act on any of these strategies should be followed with great interest.

And today, let's look at a company that has done all three...

AMETEK (AME) is a leading producer of electronic devices such as analytical and calibration instruments. The company has rolled up and effectively integrated multiple businesses in the electronics space to power shareholder return.

The businesses that AMETEK acquires provide a niche but vital service to their consumers. Customers can't get the products elsewhere at the same quality.

Finally, these businesses are maintained as separate portfolio companies, which allows customers to feel like they have a plethora of choices in the marketplace.

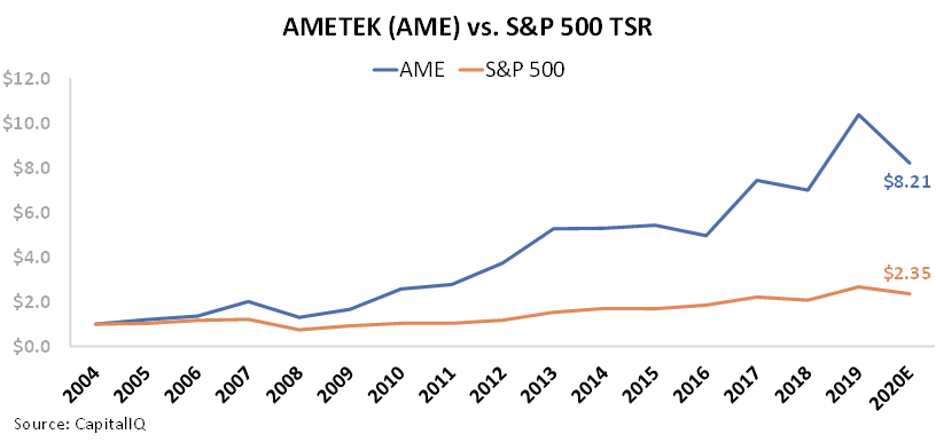

Clearly, investors have loved this three-pronged strategy. Over the past 15 years, AMETEK is up 721% – more than 5 times higher than the market's return over the same period. Take a look at the total shareholder return ("TSR") comparison below...

However, many Wall Street analysts think the party is over.

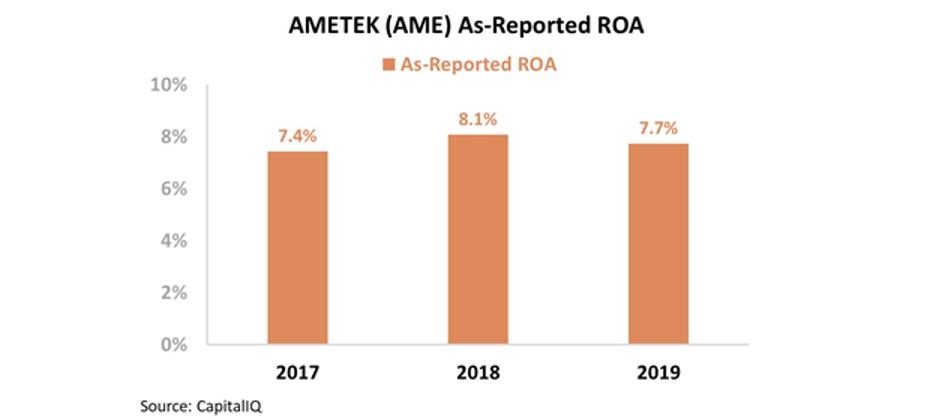

Over the past few years, AMETEK has seen a flat as-reported return on assets ("ROA") that's holding just above cost-of-capital levels, at 7% to 8%.

Even worse, with these middling returns, AMETEK is priced at a significant premium. It sports a price-to-earnings (P/E) ratio of 22 – above market averages.

It wouldn't be surprising for a seasoned Wall Street analyst to look at the numbers and write off AMETEK as a has-been. If a firm is still priced for growth but has recently plateaued, a correction must be coming soon. It looks like a prime company for investors to short.

But for AMETEK, this appears to be a misguided assumption. Skewed as-reported data misrepresent the company's performance.

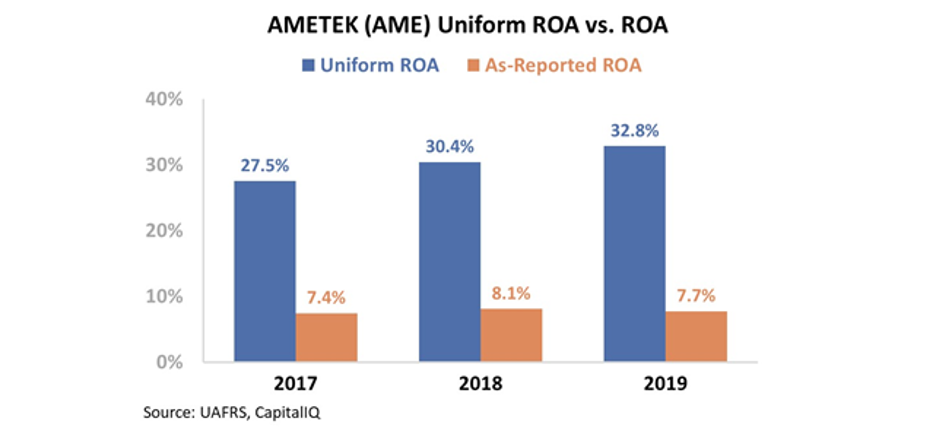

By throwing aside misleading GAAP metrics, we can drill down into AMETEK's true operating performance. By adjusting around goodwill, amortization, and other distortions, we can see a much different performance history.

Over the past three years, AMETEK's real returns have not only been strong, but improving. The company has continued to deliver on its masterful strategy by improving its ROA from 28% to 33%. Take a look...

AMETEK isn't a company that has lost sight of its strategy... It's a firm that's executing three powerful strategies that create impressively high returns. But this is being misunderstood by the accounting standards investors are using.

AMETEK's high valuation reflects its fundamentals. It should be trading at a premium Uniform ratio P/E of 22 thanks to its strong and improving returns... and its stock performance is tracking against its recent improvements in ROA. However, without Uniform Accounting, it would be easy for an investor to make a huge mistake with their money by thinking this stock is a potential short.

Regards,

Joel Litman

May 26, 2020